by betsharks0

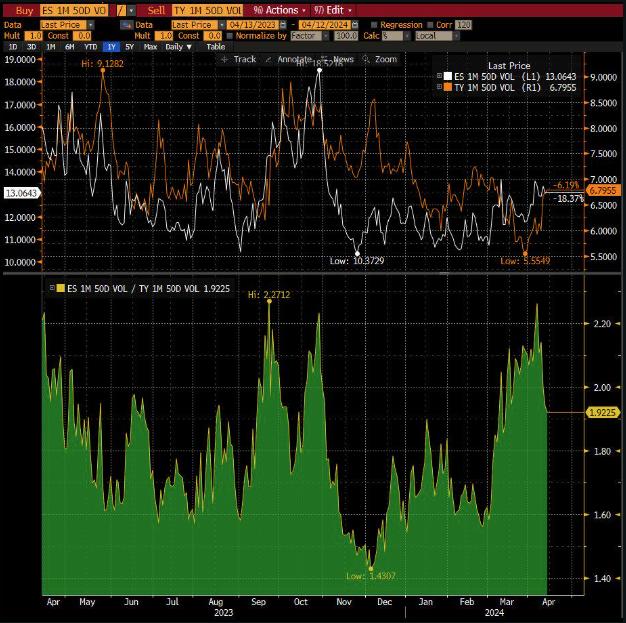

The volatility (vol) of equities (stocks) is decreasing quickly compared to the volatility of interest rates. It’s measured by the ratio of the respective 1-month (1M) and 50-day (50D) volatility.

This suggests that the relative volatility between stocks (equities) and interest rates is shifting. If equity volatility is declining rapidly compared to rate volatility, it may indicate that investors perceive less uncertainty or risk in the stock market relative to interest rate movements. This could influence investment decisions, potentially leading investors to adjust their portfolio allocations or trading strategies based on changing volatility dynamics between equities and interest rates.

Views: 68