As I keep emphasizing, another round of inflation is coming.

And the worst part?

The Fed knows it, but is playing political games to boost the economy/ stock market for the Biden Administration.

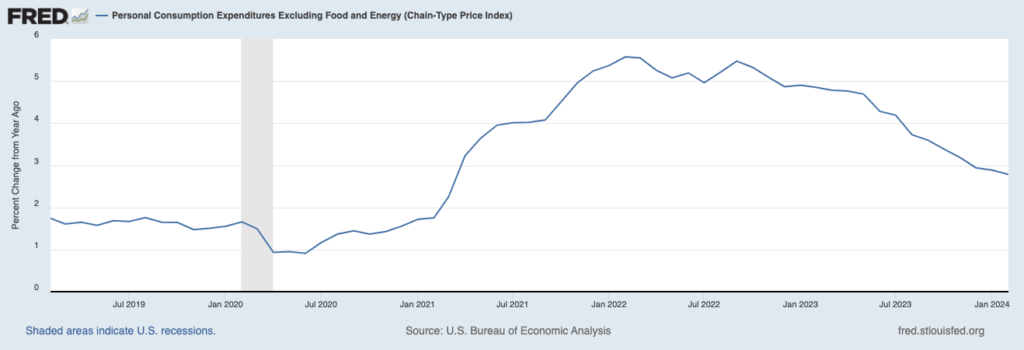

“But wait a minute, Graham,” you’re no doubt thinking, “the Fed’s preferred inflation measure is core-Personal Consumption Expenditures and that is trending down to the Fed’s 2% target.”

Let me let you in on a little secret… PCE is a terrible predictor of future inflation… and the Fed knows it.

The Fed is the largest employer of economics PhDs in the world. All told, the Fed has over 400 economics PhDs and 150 research assistants on payroll. As a result of this, the Fed is constantly doing research on various issues.

Back in 2001, the Fed had several researchers dive into the subject of inflation. Their goal was the analyze whether the Fed’s preferred measures of inflation (the CPI and the Personal Consumption Expenditures or PCE) are decent predictors of future inflation. The Fed also investigated a whole slew of other inflation measures for comparison purposes.

The results?

The Fed found that food inflation, NOT CPI or PCE, is the best predictor of future inflation. Fed researchers wrote the following:

We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure [CPI and PCE]…Comparing the past year’s inflation in food prices to the prices of other components that comprise the PCEPI (as in Table 1), we find that the food component still ranks the best among them all…

Source: St Louis Fed (emphasis added).

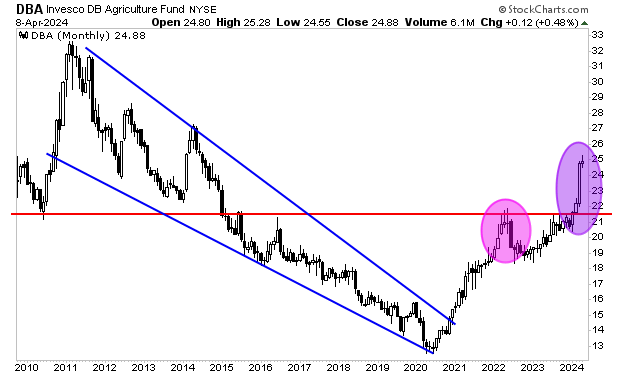

Now, food is derived from agricultural commodities. And what have agricultural commodities been doing in the last few months?

The first round of inflation is highlighted with a pink oval. The current price move is significantly larger. According to the Fed’s own research, this indicates a second wave of inflation is about to hit the US.

Views: 135