by theSilverVigilante

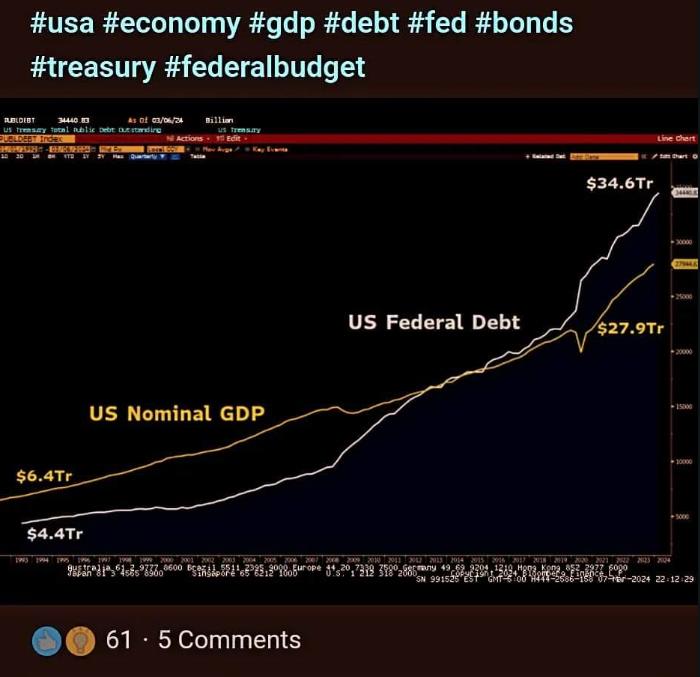

This isn’t sustainable. Once debt to GDP goes above 90% it’s impossible to go back. We’re currently at 125%.

“In 1994, the US GDP was $6.4Tr and the Federal debt $4.4Tr for a respectable debt-to-GDP ratio of 68%. Today the debt is going to cross the $35Tr mark in the next month, while GDP is ~$28Tr. That is a debt-to-GDP ratio of 125%… Yes, we know Japan has a higher debt-to-GDP ratio, but all of that is INTERNALLY FUNDED, which makes a big difference! Remember those indirects in every bond, bill, and note auction from the Treasury department. That is code for Japan and China and they take between 50% and 75% of every auction. Foreigners own almost $8Tr of US Federal debt, and the US relies heavily on continued external funding to bankroll the spending deluge from DC…”

Views: 309