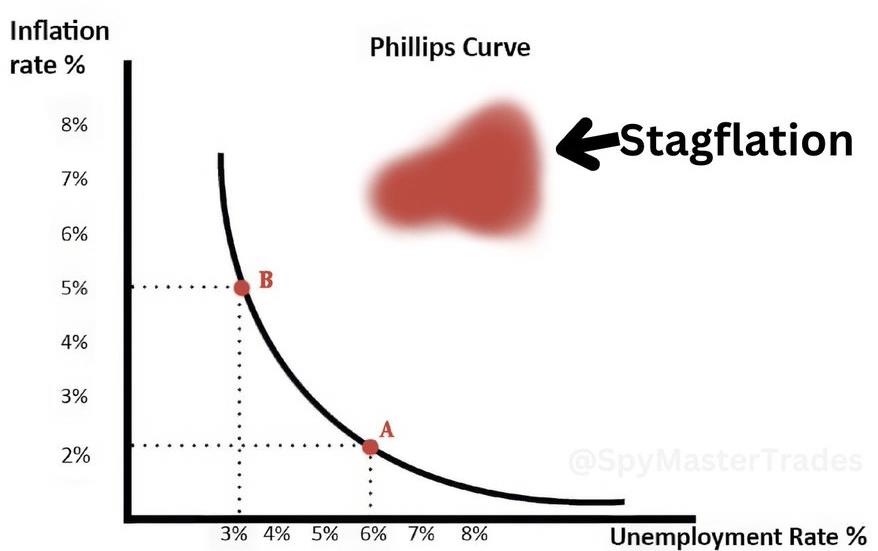

In the intricate web of economic indicators, a red flag is waving, signaling a potential storm on the economic horizon – stagflation. This term might not be part of everyday conversations, so let’s break it down. Stagflation is a unique and challenging scenario where high inflation and high unemployment coexist, defying the usual dance depicted by the Phillips Curve.

Traditionally, we see inflation subsiding as unemployment rises, but stagflation throws a curveball, suggesting that both might be on the rise simultaneously. How does this happen? Well, one way is if commodity scarcity worsens at a faster rate than demand cools. This can be triggered by supply-side shocks, such as those arising from geopolitical conflicts.

Adding to the mix are poorly designed fiscal policies that can pave the way for stagflation. If a government spends excessively relative to its Gross Domestic Product (GDP) or introduces financial incentives that discourage productivity, stagflation becomes a lurking threat. This complex economic puzzle is now causing concerns among economists, who fear that inflation might resurge, leaving the Federal Reserve (#Fed) in a tricky spot – unable to cut rates even as the economy slows down.

Now, let’s zoom in on the housing front. The Great American Housing Squeeze has reached a critical point, where nearly two-thirds of American families find themselves unable to afford the construction costs of an average home. To put it plainly, dreams of home ownership are slipping out of reach for many. Digging deeper into the numbers, Creditnews Research reveals that less than half of American households can bear the costs of constructing a standard single-family house. Shockingly, one in four households is financially incapable of securing a mortgage beyond covering the basic structure of a home.

Simultaneously, the manufacturing sector, a backbone of economic stability, is grappling with its own set of challenges. The Dallas Fed’s Manufacturing Survey has remained in negative territory for the 22nd consecutive month as of February. Though there’s a slight improvement from January, the headline indicator remains at -11.3, pointing to ongoing struggles.

Economists have been sounding the alarm bells since October 2023, highlighting signs such as the Producer Price Index forming a massive multi-year bull flag. These indicators collectively paint a challenging economic landscape, urging a closer look at policies and preparedness for potential turbulence ahead.

In essence, the surge in housing costs, manufacturing woes, and the looming threat of stagflation create a complex economic environment that demands attention and strategic planning. It’s not just about numbers; it’s about understanding the dynamics that could shape the economic landscape in the coming years.

Sources:

The U.S. economy will likely become strongly stagflationary in the coming years.

Typically inflation subsides as unemployment goes up as the Phillips Curve illustrates (Point B ➜ Point A).

However, during stagflation, high inflation and high unemployment occur simultaneously.… pic.twitter.com/rdeaJdgHWP

— SPY Master (@SpyMasterTrades) February 17, 2024

Economists are now starting to become concerned that inflation will resurge and the #Fed might not be able to cut rates any time soon — even as the economy slows.

I've been warning about this stagflationary outcome. Here's a tweet from October 2023 where I highlighted that the… https://t.co/I1yjah6b3p

— SPY Master (@SpyMasterTrades) February 17, 2024