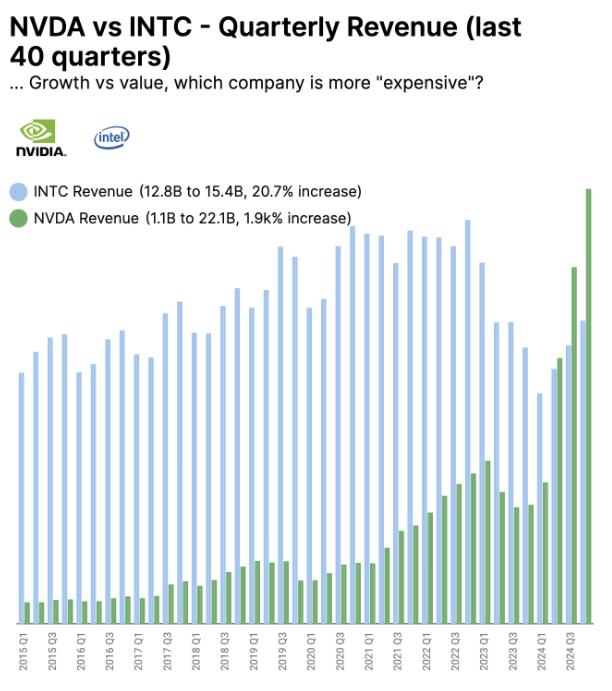

INTC has been touted as the “value” play out of the semi-conductor industry as companies like NVDA and AMD are trading at insane valuations… but when does “insane” become reality? NVDA is growing into it’s valuation at an incredible pace.

INTC: 10-year revenue growth of 20% (total).

NVDA: 10-year revenue growth of 1,900%.

Chart from ChartWiz.io

h/t TopFinanceTakes