by Dismal-Jellyfish

TLDRS:

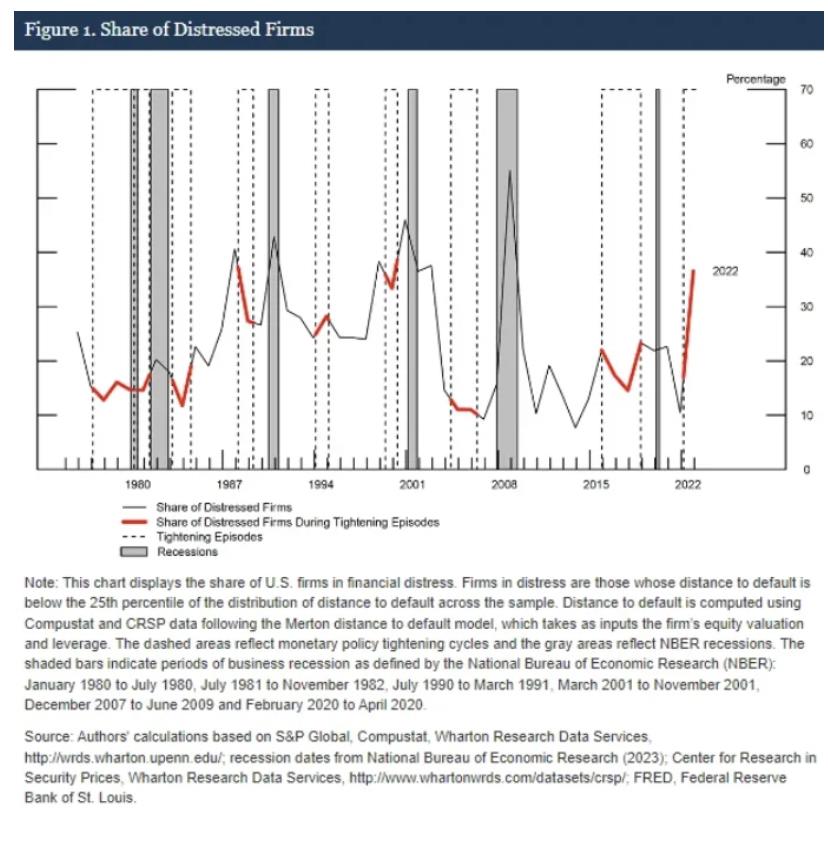

- Since March 2022, U.S. monetary policy has become tighter. More businesses are financially distressed now than in previous instances of tightening since the ’70s.

- Studies suggest that these conditions could lead to significant declines in investment and jobs in the near future.

- The theory is that when monetary policy gets tougher, distressed firms find it harder to secure external funding compared to healthy firms.

- These troubled companies then cut down on investments and jobs more than their healthier counterparts.

- On the other hand, when policy is eased, both types of firms respond similarly and weakly, not affecting investment and job rates dramatically.

- Data from U.S. nonfinancial firms from 1990 to 2022 was used for this analysis.

- To measure the potential for a firm’s default, they used a system called “distance to default”, which they claim is better than other methods to predict borrowing ability.

- The findings show that tight monetary policy has a stronger impact on investment and jobs than easy policy.

- Also, distressed firms react more severely to a tight policy by reducing their investment significantly, while healthy firms’ reactions are negligible.

- Both types of firms didn’t show a significant change in investment in response to easy policy.

- The evidence suggests that how hard a monetary policy hits, particularly when it’s getting tighter, is stronger when there are more distressed firms around.

- So, this current cycle of monetary tightening, with a high number of firms in distress, could potentially lead to significant impacts on investment, jobs, and overall economic activity.

- These effects could become more noticeable in 2023 and 2024.

Related:

Views: 184