PHOTO ILLUSTRATION: THE BUREAU INVESTIGATES TORONTO METHOD MORTGAGE LEAKS

Here is the Link from The Bureau all credit to Sam Cooper.

The publisher is a small Canadian anti-corruption web-zine, but they do appear to have the goods with a whistleblower who already tried to report this internally, and they have a lot of internal banking documents and records going back almost a full decade detailing money laundering, suspicious transfers, and fraudulent loans in the hottest real estate markets on the planet.

I’ve written several DD’s on some of the problems with Canada’s banks, Chinese entanglement, and real estate issues, but this somehow is so much worse and yet entirely expected than anything I’ve put out.

I highly recommend reading the whole thing, but here is a great highlight:

These wire transfers from China were routed into bank accounts of “multiple, unrelated individuals in Canada,” that served as “money mules” in byzantine networks involving Canada-based real estate developers, real estate agents, mortgage brokers and banks.

and

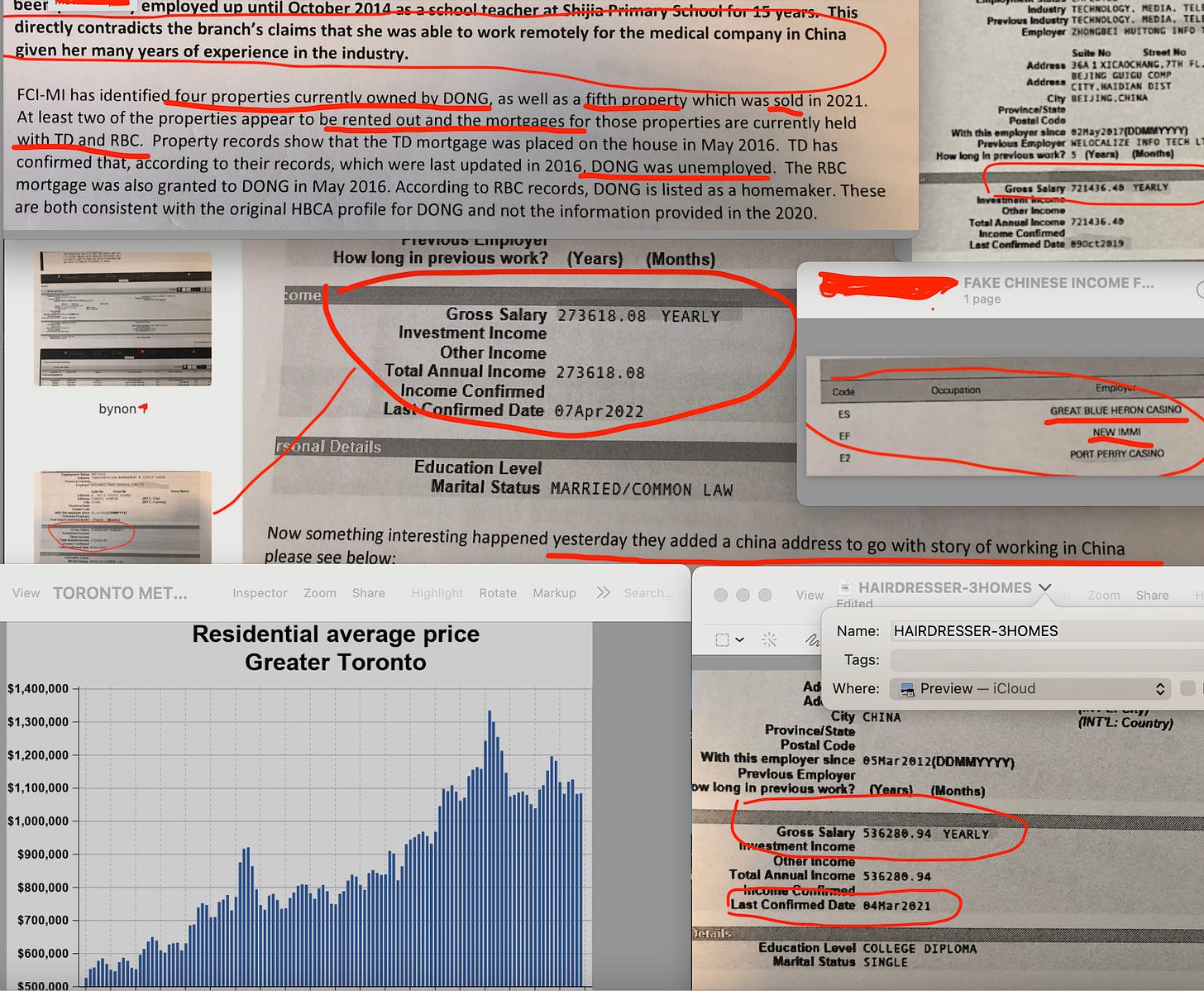

“The bank found out that one lady works in a casino part-time but got a $1.4 million mortgage showing over $300,000 annual income,” he said. “Plus she takes money as benefits from the government, for her two kids.”

In other examples, an HSBC mortgage client claimed to earn $700,000 annually for remote work in China, while simultaneously living in Canada and paying off a $10,000 student loan.

Another woman who owned homes in Aurora, Markham and Scarborough, worked part-time as a hairdresser while also claiming to earn $536,280 at a “Business Manager” job in Guangzhou.

I’m going to go out on a limb and say it’s unlikely it was only the Canadian branches of global banks pulling these shenanigans, and if I wanted to put on a tinfoil hat and make wild, completely unfounded guesses with absolutely no evidence I’d wonder about regional banks near the Canadian border with large residential mortgage portfolio’s that are having trouble.

HOLY SHIT, half a BILLION in Canadian homes purchased by Chinese immigrants out from under Canadian Families were FRAUD.@ronorr pic.twitter.com/dUxlvxGgs7

— Darth Powell 🦈🇺🇲🇺🇦🇵🇱🇫🇮 (@GRomePow) February 6, 2024