Markets finally take the blow

The Dow fell about 300 points intraday and closed down more than 250 points as the investors began to let the seriousness of Powell’s blow hit home (it appears, but who knows with this lunatic market?) Last week the market fell after Powell popped investors on the nose right after the Fed’s FOMC meeting, but then it stumbled to its feet again anyway in its usual delirium. Over the weekend, a one-two punch of Powell on “60 Minutes” and a little additional Fed speak from one of the reserve bank presidents seemed to hammer the message back home. It took those extra blows all because Powell had left the tiniest hint of hope for investors to rise on.

I laid out in my weekend Deeper Dive how serious the committee had been in turning more hawkish in its official statement and how Powell had conveyed this at first, but then undercut it with his typical soft tones in the Q&A after the FOMC meeting:

The stock market has chased Powell’s words round and round like the monkey chased the weasel around the mulberry bush. It has done its best to turn every Powell talk into a drug for a new high. This week, however, the weasel popped up and bit the monkey on the nose. Pop goes the weasel! While it was a sharp bite, that didn’t mean the monkey market couldn’t still find a way to give the weasel another chase by getting Powell to predictably beat around the bush in his post-meeting Q&A session, enticing the crazy monkeys to take another loop around their old familiar track. Powell just can’t bring himself to stand tough and stay there!…

That’s why we’ll now look carefully at what Powell did in this past meeting to that fake fantasy as the market struggles to find new ways to twist his words into drugs of hope or just decides to “soar upward” in defiance of all he said even without the shred of narrative left to justify their climb. However, the ride without the support of a credible narrative will find itself in serious trouble as the delusions give way when inflation clearly shows itself to be rising….

Then I showed the following picture of where the overpriced stock market is soon likely to go:

However, I also noted that I wasn’t about to put a date on that trip this time, as I have with fair success in the past, for the following reason:

I’m pretty sure we are just about to crest that hill where the ride gets really exciting in the wrong sort of way; but, again, I’m not going to put a date on when the stock mania will break because few things are more foolhardy than trying to make rational predictions for the end of completely irrational behavior. There have been points along this latest part of the collapse of the Everything Bubble, which began just before 2022, where it looked like the market was faltering, but I’ve stopped short of predicting it would crash again as it did in 2022 because who knows when lunacy and greed that has become this extreme will actually break? In past times, the breaking points were more apparent because the irrational exuberance was not this completely whacked out.

This could be more false faltering, so I won’t even venture to say that today begins that trip, as I have no idea. Mania as extreme as what we’ve seen cannot be predicted because there is nothing more irrational than trying to predict all-out irrationality.

That said, what I do read with interest today is the number of people saying that Powell finally got his message solidly home that there will be NO PIVOT in March, and even the market’s fade to a pivot in May, which I had talked about in that Deeper Dive, is getting shoved further off today. Here’s what I wrote, starting with a quote fro Wolf Richter:

“Powell’s press conferences that follow the FOMC meetings are somewhere between a hoot and a mess, because the reporters are trying by hook or crook, with often inane questions and speculative scenarios, to get Powell to say something that, when read in between the lines, could be twisted into “Powell was dovish,” which has been standard operating procedure for the past 18 months.”

That is SO completely true. Powell DID did exactly that again in this presser when he admitted during questioning that some loosening of policy could happen later in the year. As could be expected, market prognosticators grabbed onto every soft word and turned it into assurance of a relatively quick change in Fed policy, even if not a March pivot — maybe May, which is not exactly “later in the year.” By such maneuvering with Powell’s soft speech, the market quickly recovered its pivot mania and started reaching for those new heights again.

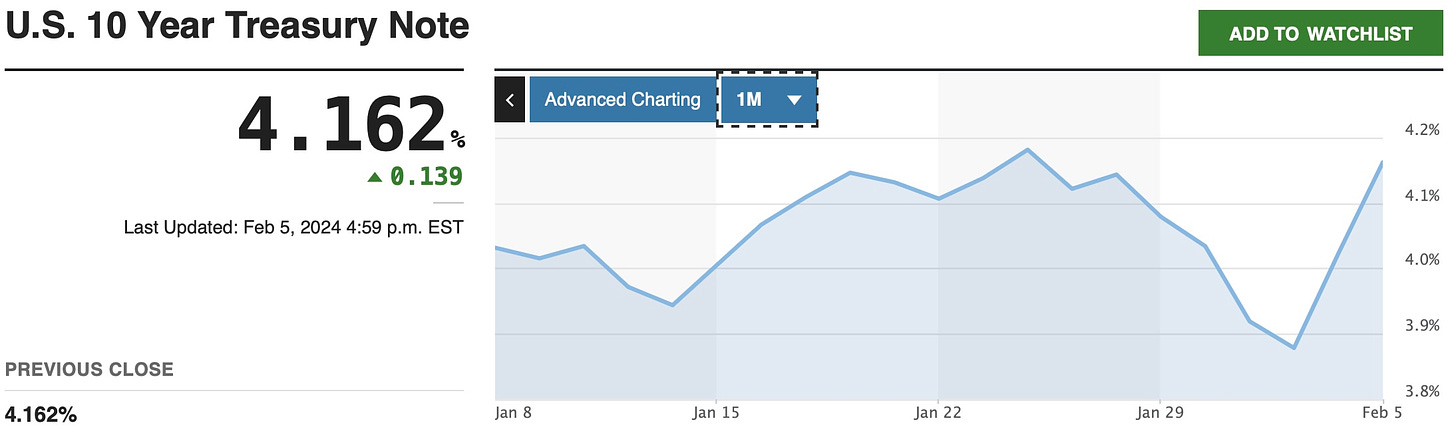

Today, the May hopes got walked backward as bond yields undid almost the entire one-week decline they had managed to achieve in just two days, which looked like this:

The press was all over it, agreeing that Powell had pounded the pivot mania far beyond March. Here are some of the examples:

Dow closes more than 250 points lower, S&P 500 slips from record as bond yields surge….

“It’s a recalibration of expectations around how soon the Fed will pivot,” said Keith Lerner, Truist’s co-chief investment officer. “The pivot trade is being unwound to a certain extent. The tension between a strong economy and what that means for the Fed is likely to continue to create these kind of reset days.”

and …

Scorching US economy throws off market’s Fed cut narrative….

Expectations that the Fed would pivot to cutting rates sent stocks soaring at the end of 2023 and pushed the S&P 500 to a record high in January. The index is up 4% this year after surging 24% in 2023.

That narrative has been jolted by evidence that the economy may be running too hot for the Fed to cut rates without risking an inflationary rebound. Friday’s blockbuster U.S. employment number was the latest sign of stronger-than-expected growth, after Fed Chairman Jerome Powell days earlier deflated hopes the central bank would begin lowering rates in March.

“Looking back on the fourth quarter and the recent rally in stocks, a lot of it was driven from the thought of a Fed pivot, and the Fed pivot is evaporating in front of our eyes,” said Matthew Miskin, co-chief investment strategist at John Hancock Investment Management.

As I said it would. The article continues …

With Friday’s jobs report, “the six or seven rate cuts that markets had been pricing in seems very offside,” Seema Shah, chief global strategist at Principal Asset Management, said in a written commentary….

“January job growth figures were strong, possibly too strong,” said Russell Price, chief economist at Ameriprise, in a Friday note. “There were multiple signs of strong wage growth which could filter through to resurgent … inflation pressures if maintained.”

Jobs, I’ve maintained for the past two years would press the Fed to keep tightening in order to keep fighting inflation. Even if the jobs numbers are not at all to be trusted, they are the broken gauge the Fed relies upon. And, so, the Fed will tighten until something in the economy, most likely banking, especially from commercial real estate, breaks badly:

A longer period of high interest rates also could increase stress for areas of the economy that are already hurting such as commercial real estate.

Many more articles today carried similar messages, and here are a couple more representative examples:

Stock market in a ‘very dangerous’ position as jobs and wages run hot, fund manager says

The U.S. stock market is in a “very dangerous” spot as persistently strong jobs numbers and wage growth suggest the Federal Reserve’s interest rate hikes have not had the desired effect, according to Cole Smead, CEO of Smead Capital Management….

“We know the Fed has raised rates, we know that caused a banking run last spring and we know that’s damaged the bond market. I think the real question can be ‘do we know that the lowering of CPI has actually been caused by those short-term policy tools they’ve used?’” Smead said.

“Wage gains continue to be very strong. The Fed has not affected wage growth, which continues to outpunch inflation as we speak, and I look at the wage growth as a really good picture of inflationary pressures going forward….”

Smead contended that the fall in CPI should be chalked up to “good luck” due to the contributions of falling energy prices and other factors outside the central bank’s control, rather than the Fed’s aggressive cycle of monetary policy tightening.

As I’ve been saying when the day comes for the Fed to finally put in a turn on interest rates, it will be because the economy is badly damaged, so that day will not be good for stocks as investors are thinking a Fed pivot will be. The Fed’s turn to lower rates won’t help stocks when the economy is crumbling all over the place because the Fed was held to tightening for longer than the faulty economy could withstand under the bursting of the Everything Bubble:

Should strength in the jobs market, consumer sentiment and household balance sheets remain resilient, the Fed may have to keep interest rates higher for longer. This would eventually mean more and more listed companies having to refinance at much higher levels than previously and therefore the stock market may not benefit from strength in the economy….

“The better question might be why is the stock market priced like it is with the economic strength and the Fed being pigeonholed into having to keep these rates high? That’s a very dangerous thing for stocks,” Smead cautioned.

Said another article:

Wall Street falls with interest rates, earnings in focus

Wall Street’s main indexes lost ground on Monday after Federal Reserve Chair Jerome Powell pushed back firmly against speculation that rate cuts would be imminent….

In an interview aired on Sunday, Powell said more evidence on a sustainable downtrend in inflation was needed to warrant lower rates, while Minneapolis Fed President Neel Kashkari wrote in an essay published on Monday that a resilient economy could defer rate cuts for some time.

Adding pressure was U.S. Treasuries, with 10-year yields up for second day straight and hitting their highest level since late January.

“Chairman Powell threw a wet blanket over trading today, taking any chance of a March rate cut off the table,” said Jack Ablin, chief investment officer at Cresset Capital in Chicago.

Bonds, it seems, finally got the message. The bond vigilantes were shaken awake in their saddles and finally started to ride back into action in accord with the direction that history will show is right. (Bonds prices fall = yields rise.)

Bonds Fall After ‘One-Two Punch’ of ISM, Fedspeak

Wall Street traders sent bonds and stocks down, with strong economic data reinforcing the view that the Federal Reserve isn’t ready to call victory over inflation just yet.

Treasuries came under renewed pressure on speculation that optimism regarding disinflation may have gone too far. In another sign that the world’s largest economy remains on solid footing, the Institute for Supply Management’s services gauge hit a four-month high while prices picked up. The news jolted trading on a day when investors were already digesting cautious views from some Fed speakers including Jerome Powell.

US 10-year yields climbed 14 basis points to 4.16% and those on two-year notes approached 4.5%. Fed swaps almost wiped out the odds of a March rate move, and the chances of a May cut have also been reduced….

And, finally, even Zero Hedge caved in all the way today to the realization that the March Mania it was preaching is just not going to happen and that even May was too hopeful on the part of the pivotheads:

Treasuries Reckon If Fed March-Cut Isn’t Likely, Neither Is May

Interest-rate traders have managed to shake off the extreme conviction they had before the start of the year that the Fed would cut rates as soon as March.

Now, they are starting to ponder whether the central bank will have sufficient incentive to loosen policy in May.

Still, never missing a chance to milk Powell’s words for the faintest hint of the drug of choice for feeding the mania, the 60-Minutes host did his best:

Scott Pelley remarked that the Fed Chair suggested the first cut could happen in the middle of the year — even though it wasn’t to be found in the transcript of the interview.

Just like all the other pivot proclamations, the words of any kind of pivot weren’t really there. It was just the media twisting in the wind to try to find a way to wrench them into the narrative Wall Street wants.

If the Fed is convinced that cutting rates in March is too soon, Friday’s data set is unlikely to persuade the policy committee that May is the time to do it either….

It strikes me that unless the labor market goes into some kind of abrupt cataclysm, we may not get a rate cut in May.

Exactly!

As I also wrote in this weekend’s Deeper Dive:

Powell has finally tried to make it crystal clear that there is no immediate pivot coming, but the market fastened onto the one sentence in the Q&A last week where he said he thought the Fed might see a way to lower rates a little later on in the year. While that would be well past the March date set by the market in recent months when I said there would certainly be NO PIVOT unless the economy experiences a major collapse with big banking breakage, stock investors have seemed willing to merely shift the Fed pivot forward a two months in order to keep right on climbing.

Investors tried to do that again after the last meeting, but that effort to rise is already appearing to break up, and the mainstream media seems to be finally moving entirely off the pivot narrative. With that, I reiterated what has been my prediction in these Deeper Dives all along:

Because the Fed does not understand that its labor gauges were broken by the Covid lockdowns to where they do not mean what they used to mean, the Fed will tighten until something badly breaks. Neither inflation nor labor will cut it any slack in time to avoid that scenario.

Views: 133