by jab136

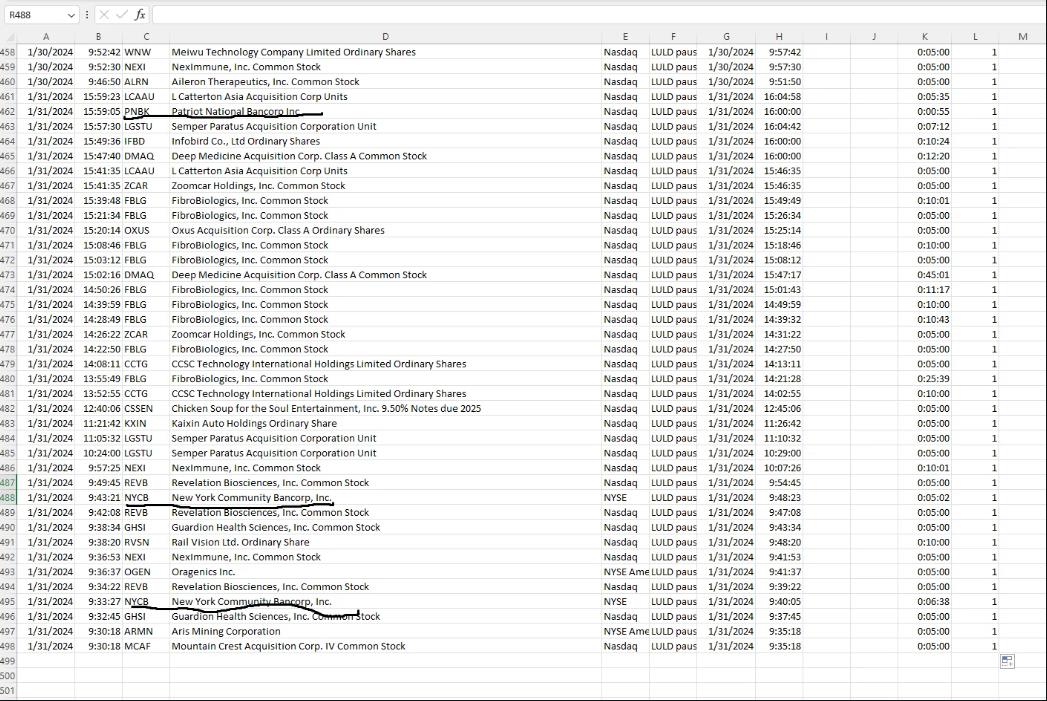

I was just compiling my Limit halt data, as I do every day (download an excel from https://www.nyse.com/trade-halt, then copy the data to my spreadsheets). I noticed that there were two separate banks that had volatility halts today, went and checked the tickers and they fell dramatically.

my spreadsheet data

PNBK (Patriot National Bancorp) fell over 16% today, they do not have much volume, but they are way down from last August. They have fallen from $10/share to $4.39 today.

NYCB (New York Community Bancorp) fell nearly 38% today to a 5 year low, the last time it was this low was last march during all the bank failures.

Keep an eye on the banks, we might start seeing some failures sooner rather than later. Yes, I am still tracking market wide halts, but my weekly posts were a lot of effort for very little engagement, and I felt I would be better suited to simply do a single post after this all shakes out.

WSJ: New run on regional banks. NYCB tanks 40 percent.

The bank that rescued Signature Bank last year, is now imploding.

Right on time:https://t.co/0uJDLmdGDX

"Its 37% decline for the day was the largest one-day percentage drop in the stock’s history." pic.twitter.com/K5tRAJmvNx— Mac10 (@SuburbanDrone) January 31, 2024