Authored by Charles Hugh-Smith via oftwominds,

Make the U.S. attractive to labor and capital with low rates and a simple, fair tax system and the populace and economy will benefit.

Tax reform is admittedly a field of dreams: the entrenched elites who pull the levers of the status quo will use their power to game or modify any reform that limits their greed, and so any real tax reform is reduced to pie-in-the-sky fantasies.

Nonetheless, discussing an alternative system of taxation that is fairer and simpler helps establish two important things: one, it reveals how far we’ve drifted from fairness, and two, it provides a template for a future reformist government to follow.

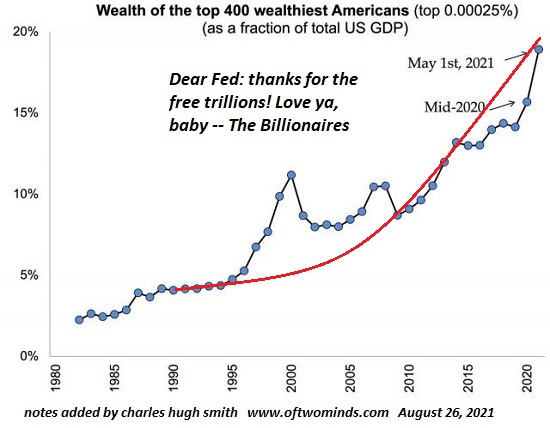

The reason why fairness in taxation matters is institutionalized unfairness rots society from the inside, and the social order and economy eventually collapse. Unfair taxes have two negative consequences: they accelerate the decay generated by unfairness, and they concentrate wealth in the top levels of wealth and power, exacerbating wealth/income inequality which also hollows out the nation from within.

Reforming taxation can’t fix all our problems, but it can reduce the negative consequences of institutionalized unfairness and soaring wealth/power inequality. Making taxation fairer and simpler won’t eliminate the dysfunctional dynamics of our way of life or reverse wealth inequality or fix our perverse dependence on asset bubbles and central bank stimulus, but it’s a step in the right direction.

So with those caveats firmly in mind, let’s get started.

What is the purpose of taxation? To raise money to fund the government/state, of course, which also includes whatever funding the state apportions to serve the common good / public interests. In the U.S., roughly half of federal revenues go to programs that distribute money directly to individual citizens or pay for their medical care: Social Security and Medicare / Medicaid consume about $3 trillion of the $6.3 trillion federal budget. Policy Basics: Where Do Our Federal Tax Dollars Go?

$800 billion is spent on defense. Veterans benefits and healthcare total almost $500 billion and another $500 billion is devoted to economic security programs: SNAP, subsidized childcare and housing, etc. Interest on the national debt (which is skyrocketing) is currently around $700 billion.

These programs, supported by the majority of citizens, consume the vast majority of federal revenues.

Taxation has social purposes as well. The issue here is known as the free-rider problem: when somebody shirks the work, duties and responsibilities carried by everyone in the group, they are free-riding on the work, effort and sacrifices of others. If free-riding becomes institutionalized, the unfairness erodes and eventually destroys social coherence and stability.

In small pre-industrial tribes, members eliminated free-riders by banishing them to live on their own wits in the wilderness. It’s much harder to survive on one’s own than in a group, so this punishment provided a strong incentive to contribute something to the group’s common good.

In our status quo, free-riders at the bottom and the top both generate the resentment of unfairness. Able-bodied welfare recipients (free-riders at the bottom of the economic hierarchy) and billionaires who pay less tax than average workers (free-riders at the top of the economic hierarchy) are a problem that the taxation system must address.

So Rule #1 of our alternative tax system is: everyone contributes something to the common good.

The second source of unfairness in taxation is the ability of those at the top to rig the system to their benefit via lavish donations to craven politicians who then modify the tax code to reward their donors. These self-serving modifications are hidden inside complexity: congressional bills running into the hundreds of pages and tax regulations running into the thousands of pages.

So Rule #2 of our alternative tax system is: KISS–keep it simple, stupid. This means that it must be against the law to add any complexity to the simple tax code: no riders, deductions, exemptions, etc. can be added to the code. (Yes, this is impossible in our hopelessly corrupt status quo, but recall that one purpose of the exercise to reveal the near-infinite depths of our corrupt status quo’s unfairness.)

The powerless have very minimal ways to game the system. The powerful have numerous ways to game the system. The powerless can barter or use cash to evade income taxes, and the wealthy can borrow money against their assets to live on and evade income taxes in that manner.

So the alternative tax system has to have multiple sieves to catch all the free-riders. If there is only one tax, free-riders will figure out a way around it, much like a bacteria evades a single antibiotic. So the tax system has to be the equivalent of a triple-layered “cocktail” to catch the free-riders.

So Rule #3 of our alternative tax system is: there must be three layers of taxation.

Incentives matter, so trying to “tax the rich” via confiscatory high rates won’t work. Capital is fluid in today’s global economy, and the well-oiled global tax avoidance industry has established secure tax havens. The practical approach is to make taxes low enough that they are viewed as the cost of doing business in the U.S. If the benefits of doing business, owning assets and residing in the U.S. outweigh the taxes that must be paid, capital will view the U.S. favorably.

This approach will collect more taxes than confiscatory high rates.

So Rule #4 of our alternative tax system is: make taxes the cost of doing business.

Other nations collect taxes, too, and the global wealthy end up paying taxes somewhere. So the goal of our alternative tax system is to not just be competitive in tax rates but offer a better deal to both labor (earned income) and capital (unearned income).

So Rule #5 of our alternative tax system is: the tax system must offer global advantages to both labor and capital.

So here’s the alternative tax system I propose:

1. Get rid of all corporate income taxation. The corporate tax system is probably the most unfair of them all, as some domestic companies pay a lot and global giants pay very little or none at all. Get rid of all corporate income taxes, but require each enterprise to file three statements which the companies already prepare as part of generally accepted accounting standards: a profit and loss (P&L) statement (income and expenses), a balance sheet (assets and liabilities) and a list of the shareholders who received dividends and the amounts paid to each. These statements must include both their global and domestic (U.S.-based) business.

An essential element of the common good is to know who is doing business in the nation, so every LLC, pass-through entity or shell entity must file these financial documents plus a sworn affidavit with scans of passports attached listing the individual human beings who own/control the LLC, pass-through entity or shell entity. Failing to submit the identity of the owners/managers or falsifying ownership / control will expose the free-riders to federal prosecution, a five-year prison sentence and fine up to $10 million.

The U.S. should not be a tax haven for free-riders.

2. Eliminate all income taxes on labor and unearned income (interest, dividends, capital gains) up to double the average/median full-time annual salary/earnings. The average/median full-time annual salary/earnings in the U.S. is about $60,000, so the first $125,000 of individual income is tax-free ($250,000 for a two-earner household).

For those whose only income is from wages, this means about 95% of all workers will pay no income tax. (Employees and employers will still pay 7.65% each in Social Security and Medicare payroll taxes, per Rule #1: everybody contributes to the common good, and these programs make up roughly half of all federal spending.)

For example, an individual who earns $70,000 in wages and makes $50,000 in capital gains would pay no income tax.

3. All income above $125,000 per person / $250,000 per household would be taxed at a flat rate of 25%. This eliminates any difference between tax rates on labor, short-term and long-term capital gains: all income, regardless of source, is taxed at a flat 25%.

Consider a household that earned $250,000 in salaries, commissions and bonuses and $100,000 in capital gains, interest and dividends. They would pay zero income tax on the first $250,000 in income, and $25,000 on the additional $100,000. Their total income tax on their $350,000 income would be $25,000.

4. The tax rate on all income rises to 33% above ten-times the average annual salary. So all income above $600,000 per individual / $1.2 million per household would be taxed at 33%. Only a small percentage of households earn more than $1.2 million. A household income around $650,000 defines the top 1%, so this tax rate would only apply to the top 0.5% of households. The bottom 99.5% would pay no more than 25% of income above $250,000 per household.

Consider the advantages for both employers and employees of this tax system. Employers don’t have to deduct income taxes on wages below $125,000 annually and employees pay no income taxes on 2X the average annual earned income.

OK, that’s the income tax level. There are two more: sales tax (a.k.a. VAT) and wealth tax. The majority of other nations have VAT taxes, national sales taxes on consumption. This level is important because even those who evade income taxes will pay sales / consumption taxes paid at the point of purchase.

5. The argument against a national sales tax is that it’s regressive, hurting the poor more than the rich. To counter this, the alternative tax system has two consumption tax rates: 5% for everything a low-income person needs to live–rent, real unprocessed food (i.e. food with only one ingredient), utilities, rock-bottom mobile phone service and public transit fares–and 10% on everything else.

6. Additionally, there is a 5% transaction tax on all asset purchases and sales: every purchase or sale of any asset or financial instrument would pay this transaction tax: stocks, bonds, options, futures contracts, derivatives, cryptocurrencies, ETFs, mutual funds, real estate, corporate mergers, issuance of stock options, and any other financial transaction or exchange.

These taxes on consumption and transactions will raise the bulk of tax revenues, and do so progressively, as low-income people consume less and rarely trade financial assets. But just as importantly, everyone who purchases anything has to contribute to the common good via the national sales tax. The tax is not high enough to make it worth evading, especially if the penalties for evading it are prohibitively stiff.

For the vast majority of households, this 10% national sales tax/VAT would be the only federal tax they pay, other than the occasional 5% transaction tax should they trade securities or buy/sell a house.

This brings us to the tax level that triggers cardiac arrest in many people: the wealth tax. Please take a dose of nitro or anti-anxiety med and hear me out on this.

The wealth tax is the last sieve to catch free-riders at the top of the wealth-power pyramid. 99.9% of the citizenry would never pay a dime of my proposed wealth tax. It’s designed to catch free-riders who own the majority of the nation’s financial assets. In this way, it’s similar to the notoriously complicated Alternative Minimum Tax (AMT) in the current tax code, but much simpler.

7. The proposed wealth tax is unlike conventional wealth taxes, as it only applies if the individual / household paid very little income tax. Here’s how it works.

Every individual / household, citizen or resident, is required to submit a statement of total income and assets and liabilities. Income is simple: earned income (wages, commissions, bonuses), net profit from a sole proprietorship or partnership, rental income, interest, dividends and capital gains.

This simple income statement is the basis for calculating any income tax as detailed above.

Every individual / household is also required to submit a statement of assets and liabilities listing both U.S. assets and global assets. This balance sheet statement will be straightforward for the bottom 99%: primary residence, second home, rental property, stocks, bonds, 401K and IRA retirement accounts, etc. Non-U.S. (global) assets must also be included.

Those households with a total net worth of $5 million or more will be taxed at .0025% annually–one-quarter of one percent. On $5 million in net worth, that is $12,500, not exactly a giant sum. Only a very thin slice of American households have a net worth of $5 million or more: $2.5 million and up defines the top 2% of all households.

This rate edges up with net worth to reach 1% at $30 million–the generally agreed-upon definition of a High Net Worth household. 1% of $30 million is $300,000.

Here’s where my proposal stands apart: all income taxes paid anywhere in the world are deducted from the wealth tax. So if the household worth $5 million paid at least $12,500 in income taxes anywhere in the world, they pay no wealth tax. If the household worth $30 million paid at least $300,000 in income taxes anywhere in the world, they pay no U.S. wealth tax.

(Reality check: the required bribes alone in many overseas locales may well exceed the wealth tax proposed here.)

The secret sauce of this wealth tax is it’s only a sieve for those who paid little or no income taxes in any nation. This also eliminates the gaming of nationality: since taxes paid in other countries are deducted along with income taxes paid in the U.S., there’s less incentive to slosh capital around the globe.

Given the tax rates in enclaves the wealthy prefer (for example, Switzerland), it’s likely that households with major income-producing assets scattered around the world already pay income taxes somewhere, and are therefore unlikely to pay any wealth tax in the U.S. This sieve only catches those who’ve evaded income taxes everywhere but want to do business or own assets or have a residence in the U.S.

Once again, the goal here is to make the tax rate low enough it’s considered a cost of doing business. Is it really worth giving up doing business in the U.S., the world’s largest and most liquid capital market, to avoid a tax that’s a modest fraction of one’s net worth and income? For those who say yes, then so be it, they can go leech off some other nation’s citizenry.

The key point to understand is the goal is to ensure that free-riding is eliminated and everyone pays something approximating a fair share based on their income and wealth. Recall that the vast majority of financial assets are owned by the top few percent of households, and so fairness demands these super-wealthy households pay more than average and upper-middle-class households.

The other key is that all the tax-related statements are already prepared by every enterprise and should be part of every household’s financial affairs: a basic income-expense statement and a basic statement of assets and liabilities. The actual tax preparation calulations are trivial. In effect, the actual tax return of everyone, rich or poor, will fit on one page: there is no complex tax return because the calculations are based on simple numbers: income and net worth.

I can hear a chorus of voices saying this alternative tax system doesn’t tax the wealthy enough. My response: look, the super-wealthy will pay consumption and transaction taxes, and either income taxes and/or a wealth tax. If we leave our tax system as unfair and complex as it is now, we’re increasing their incentives and loopholes to evade paying any tax at all.

The solution is to set low tax rates and reduce the incentives and opportunities to game the system to evade contributing to the common good. It’s far more productive to make taxes in the U.S. low enough to be viewed as a cost of doing business rather than an incentive for talent and capital to flee to other less complex, fairer economies.

Make the U.S. attractive to labor and capital with low rates and a simple, fair tax system and the populace and economy will benefit.

New podcast: Self Reliance (45 min).