by mark000

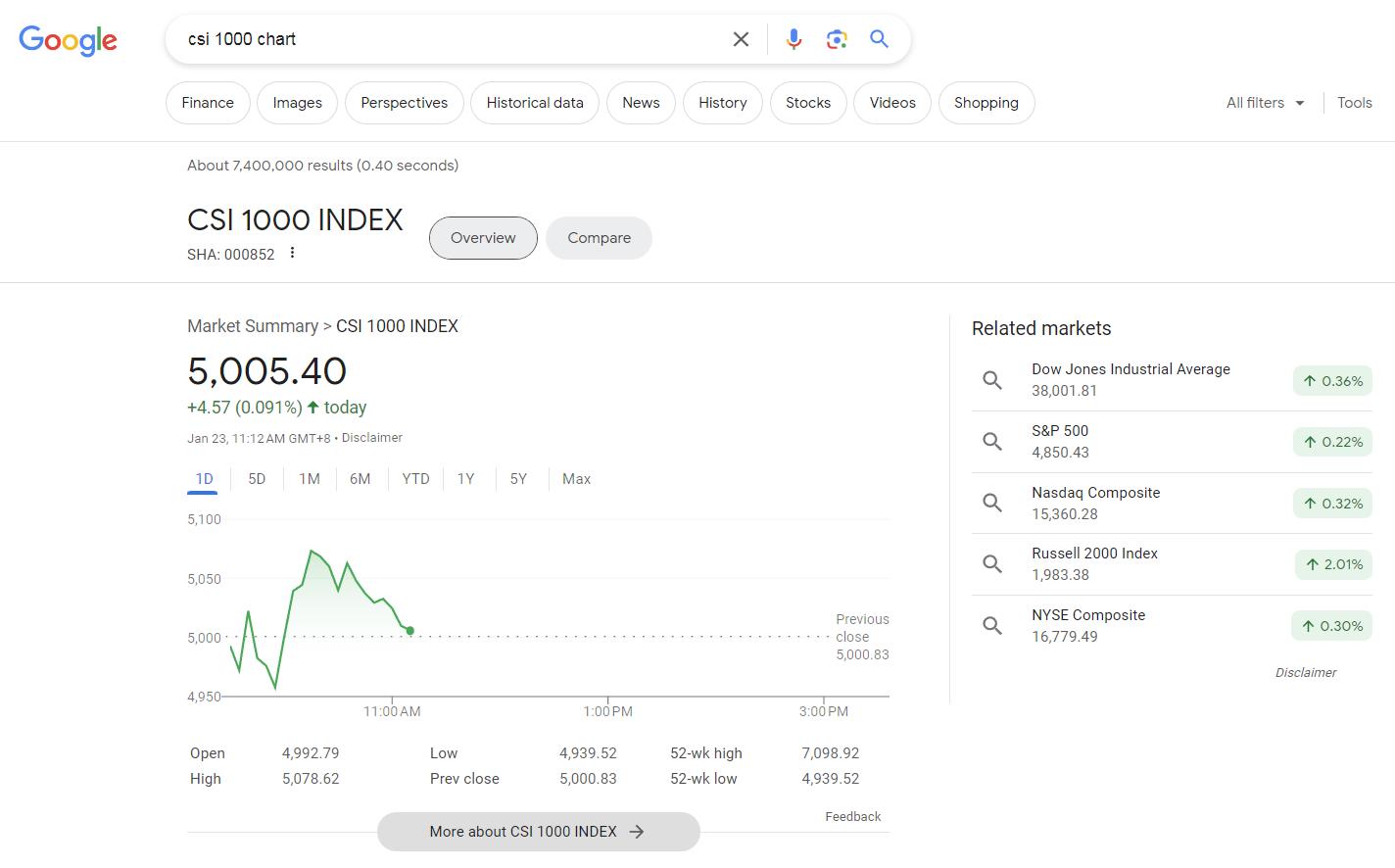

CSI 1000 just went below 4970! https://www.google.com/search?q=csi+1000+chart

via CNBC:

Deflation may soon start biting into Chinese growth, as Beijing looks at another three to six months of a “very painful economy,” according to one analyst who covers the country.

“This is something investors need to be cautious of. The economy here is bad, it’s pretty … it’s really bad. I’ve been in China for 27 years, and this is probably the lowest confidence I’ve ever seen,” Shaun Rein, founder of the China Market Research Group, told CNBC’s “Squawk Box Europe” on Monday.

“So deflation is starting to wield its ugly head. Consumers are waiting for discounts. They’re very nervous.”

via MSN:

(Bloomberg) — Chinese stocks just capped another dismal week, with a gauge of mainland firms listed in Hong Kong languishing at the bottom of global equity index rankings for the year so far.

Grim milestones have kept piling up in recent days: Tokyo has overtaken Shanghai as Asia’s biggest equity market, while India’s valuation premium over China has hit a record. Locally, a meltdown in Chinese shares is wreaking havoc on the nation’s asset management industry, pushing mutual fund closures to a five-year high.

The Hang Seng China Enterprises Index has already lost 11% in 2024. Coming after a record four-year losing streak, the slump is reinforcing a structural shift that’s seeing everyone from active money managers to passive funds turn their back on the world’s second-largest stock market.

via invezz:

- The Hang Seng index has lost over 50% of its value since 2021.

- The Shanghai Composite and China A50 indices have also crashed.

- This decline is causing havoc in Beijing as mutual funds close.

via MSN:

China is entering an era of stagnation and disappointment that may not be resolved like Japan’s, Nobel economist Paul Krugman saysThe world’s second-biggest economy is underperforming on nearly every barometer, Paul Krugman wrote in an op-ed piece for The New York Times.In fact, the problems faced by China today mirror those Japan experienced after its asset-price bubble burst in the 1980s. But where Tokyo managed to avoid issues such as widespread unemployment, GDP decline, and political strife, Beijing may not come out so positively.

To Krugman, part of the problem stems from China’s leadership, with President Xi Jinping’s arbitrary interventions — such as his crackdown on the country’s tech industry — getting in the way of efficient economic management.