The crippling impact of soaring mortgage rates was laid bare today with estimates that 1.4million Britons face losing at least a fifth of their disposable income.

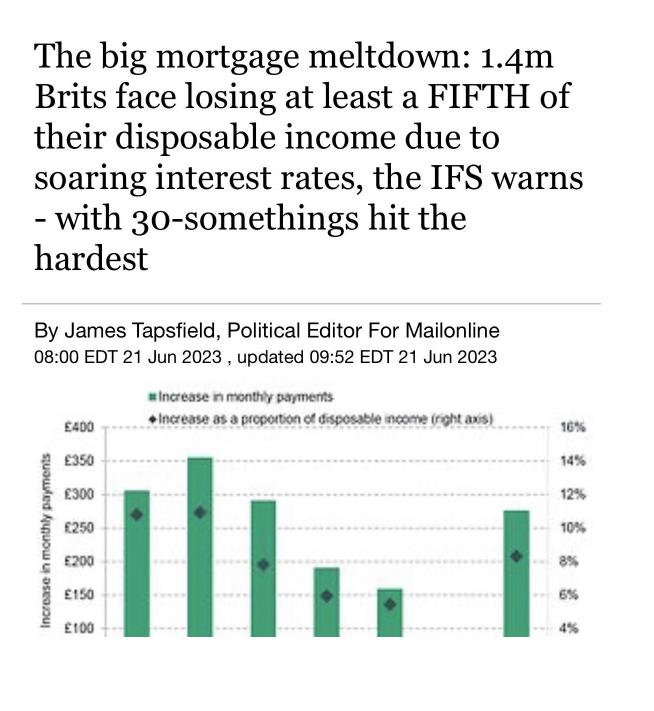

Figures compiled by the respected Institute for Fiscal Studies (IFS) think-tank show that across the country, people are set to pay nearly £280 more each month, rising to nearly £360 for 30 to 39-year-olds.

But the hit will be ‘substantially larger’ for some, costing 1.4million, including 690,000 aged under 40 – 20 per cent or more of their disposable income.

The Bank of England looks certain to impose a thirteenth interest rate hike in a row tomorrow after inflation defied expectations by staying at eye-watering levels last month.

Headline CPI came in at 8.7 per cent in May, the same as the figure for April. Analysts had pencilled in a drop to 8.4 per cent.

In a particularly grim sign, core inflation actually rose to 7.1 per cent, the fastest pace since 1992.

2/2 Oh… and this from a @BlackRock recruiter just yesterday. t.co/DyyL2Lqsgp

— Gordon Johnson (@GordonJohnson19) June 21, 2023

Views: 90