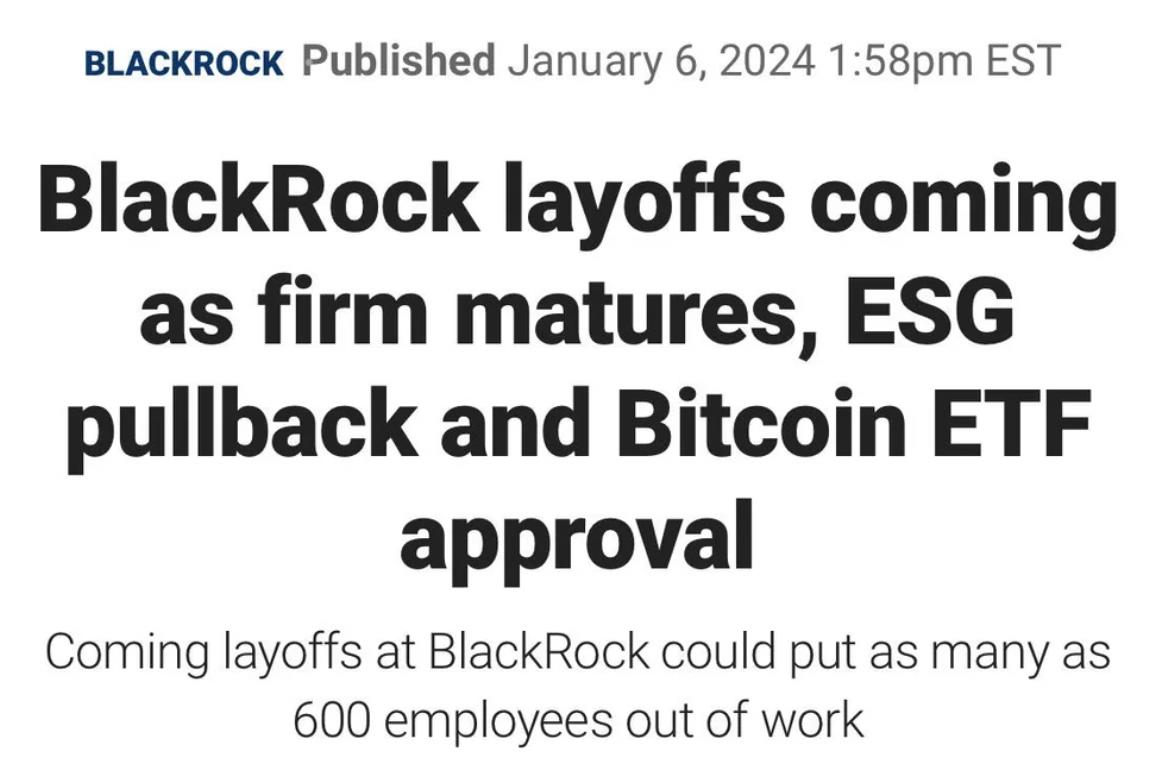

In a significant development, BlackRock, the world’s largest asset manager, is reportedly undergoing layoffs, marking a notable shift for the firm as it matures and reassesses its strategic focus. The move comes as BlackRock grapples with various factors, including a reported pullback from Environmental, Social, and Governance (ESG) investments and the anticipation surrounding the approval of a Bitcoin exchange-traded fund (ETF).

According to sources cited in a Fox Business article (www.foxbusiness.com/economy/blackrock-layoffs-coming-firm-matures-esg-pullback-bitcoin-etf-approval.amp), the layoffs are part of the firm’s evolution and strategic adjustments in response to market dynamics. As BlackRock navigates its mature phase, reassessing priorities and optimizing its workforce appears to be a necessary step.

The Twitter feeds of financial analysts and observers (@KobeissiLetter, @DonMiami3, @WinfieldSmart) provide additional insights into the situation. Analysts express diverse opinions and concerns, with some attributing the layoffs to BlackRock’s maturity and potential shifts in its investment strategies. Others speculate about the implications of the reported ESG pullback and the potential impact of a Bitcoin ETF approval.

Financial Markets kick off 2024 with wide losses pic.twitter.com/vaPgQTyQ29

— Win Smart, CFA (@WinfieldSmart) January 8, 2024

Recession probability according to the 10y/3m spread remains at 99.5%, a level not seen since the early 1980s. pic.twitter.com/XcYFMtoY5E

— Don Johnson (@DonMiami3) January 8, 2024

Unrealized losses now account for ~33% of all bank equity capital in the US.

Currently, banks are sitting on nearly $700 billion of unrealized losses.

To put this in perspective, even at the worst point in 2008, unrealized losses only accounted for ~5% of equity capital.

Prior… pic.twitter.com/GTTqotE4oU

— The Kobeissi Letter (@KobeissiLetter) January 7, 2024

M2 money supply is contracting—which is very concerning for stocks.

M2 is the Fed’s estimate of total money supply held by people including all money in checking, savings, and CD’s.

M2 is down 4.37% from July 2022 marking the largest drop in 90 years. pic.twitter.com/aHCGN8c2oa

— GoldSilver (@GoldSilver_com) November 10, 2023

Views: 338