Energy prices have managed to stay low with the help of lower oil prices. WTI even briefly dropped below $70/barrel. But that might not be enough to tame inflation, and not to the point of rate cuts.

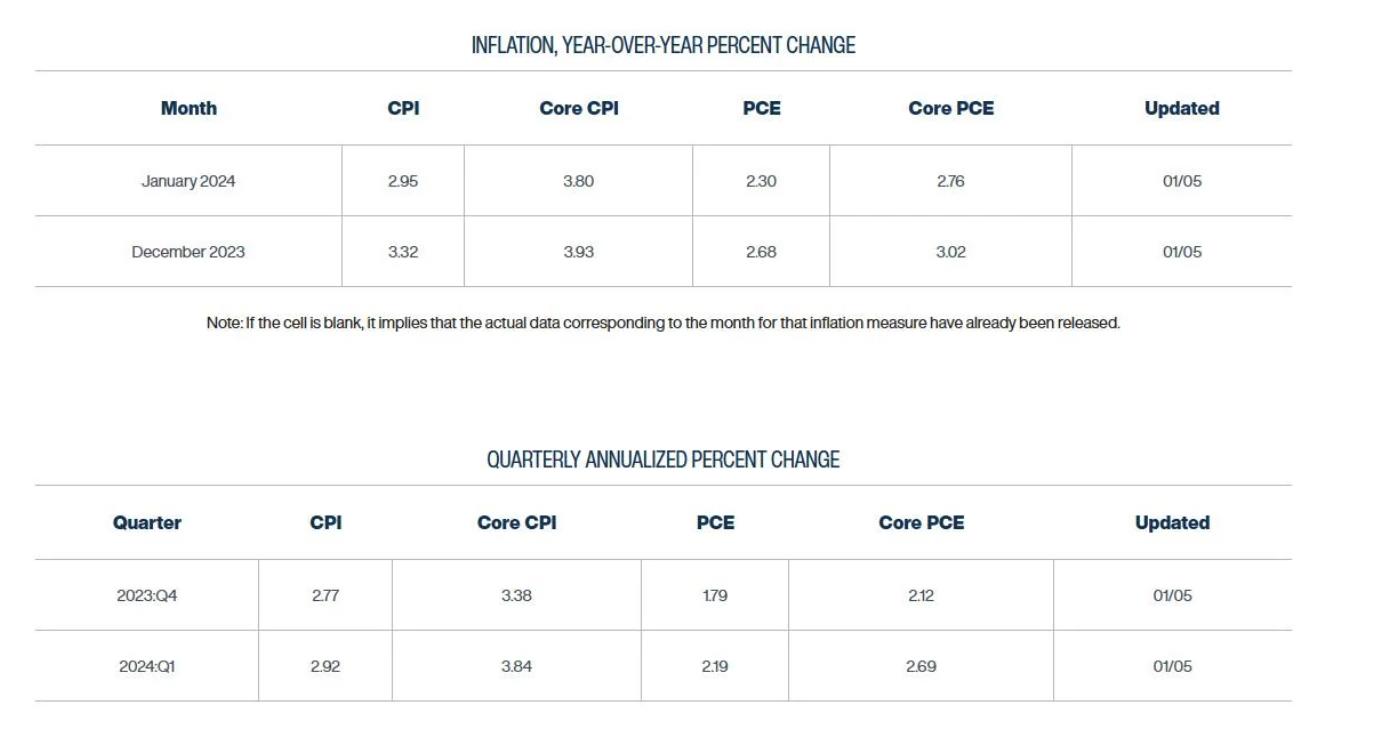

Current forecast for inflation.

We don’t have the numbers yet, but it’s not looking likely that CPI will be down.

Here are the current forecast estimates for CPI and PCE from the Federal Bank Reserve of Cleveland.

Note: these are only forecast estimates, and changes daily as they get more data.

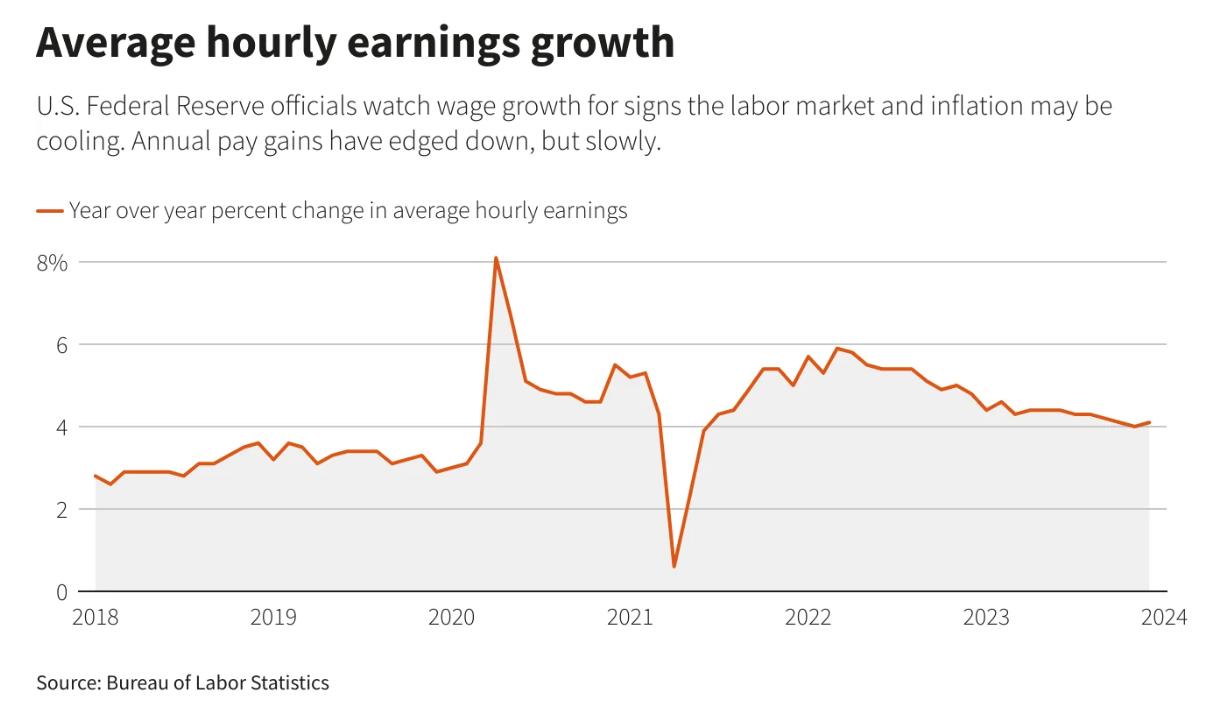

Unemployment is still low, with more jobs created in December.

One of the aims of rate hikes was to push unemployment higher to help cool off inflation.

Employment rose by 216,000 in December, putting the unemployment rate at 3.7% (it was also at 3.7% in November). This could create headwind for taming inflation.

On the bright side (for taming inflation) wages haven’t gone up too much, and have slowly been cooling. But they may not have cooled enough for creating enough of an effect.

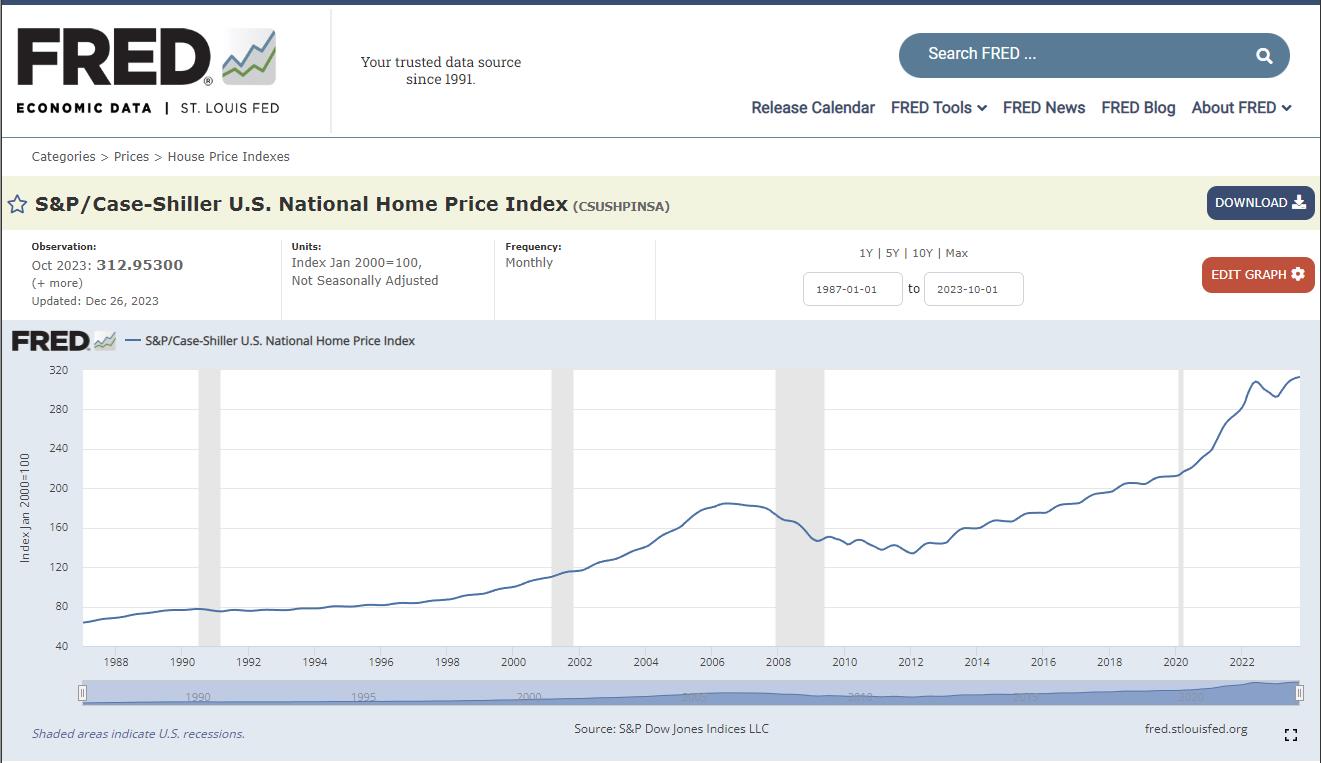

Housing cost and affordability.

Home prices have still been high, despite some markets seeing some dips in prices.

https://fred.stlouisfed.org/series/CSUSHPINSA

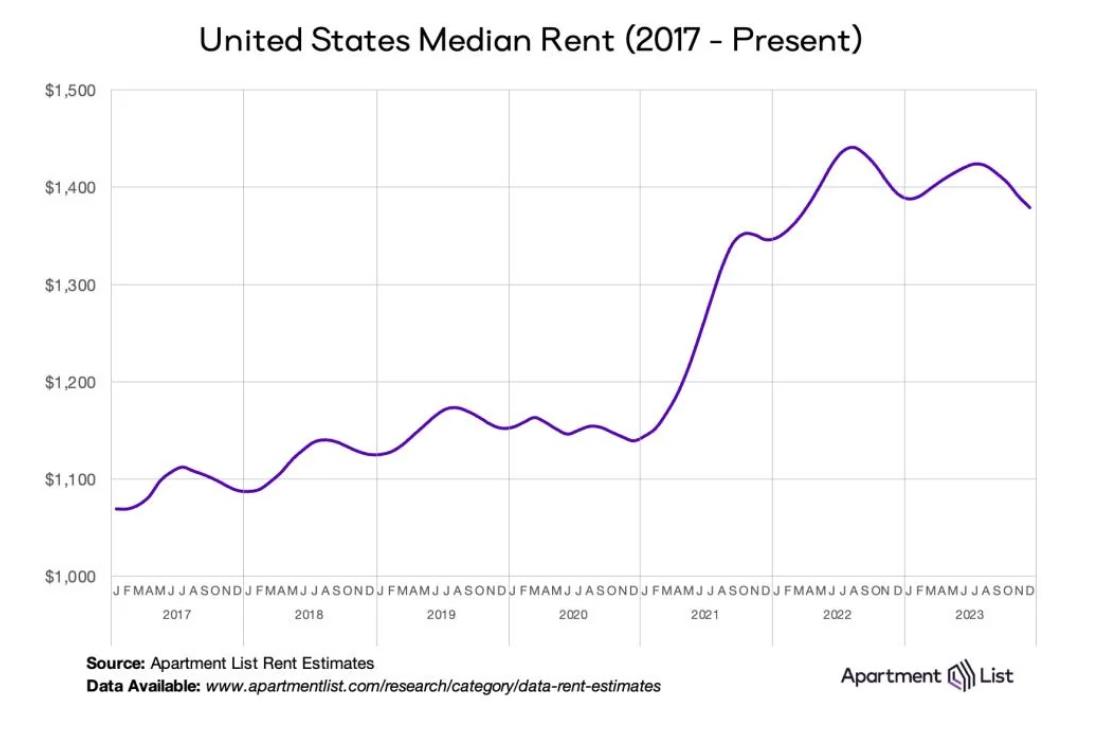

While rents have been high, there has been a recent cooling off that could help living cost stabilize:

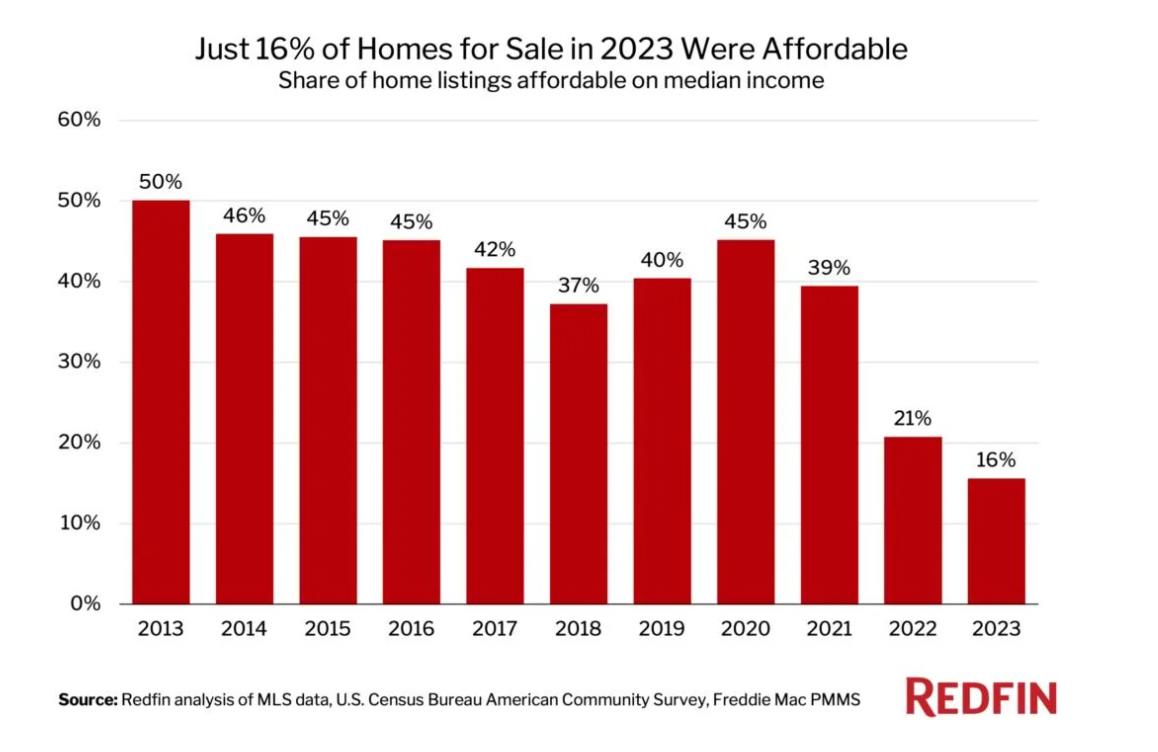

The issue is still with housing affordability that’s on the decline.

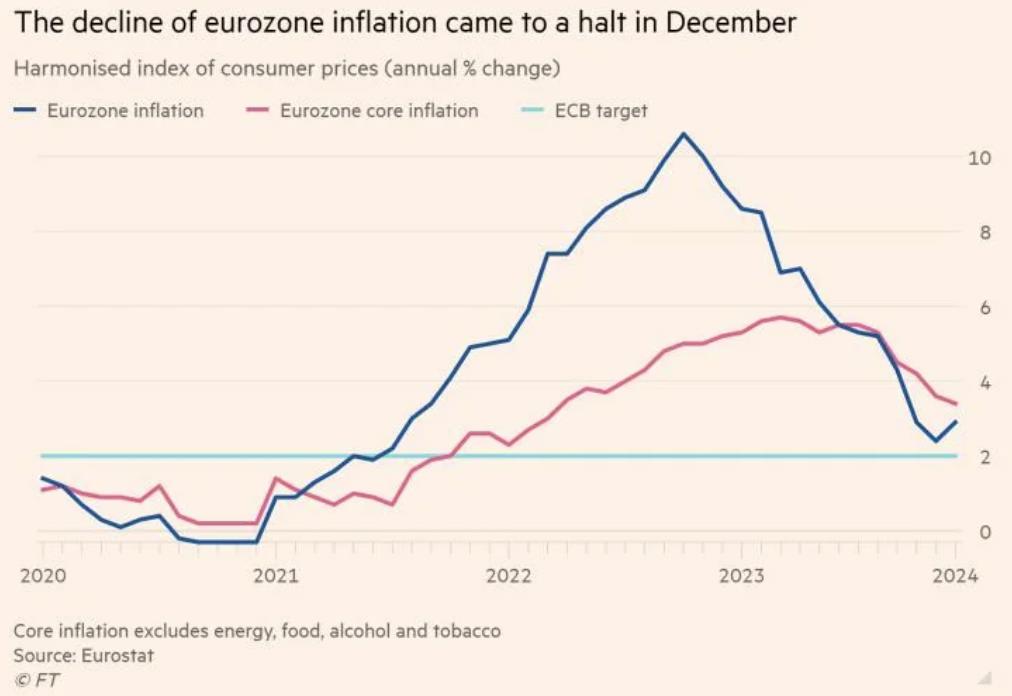

Inflation rising back in Europe.

Elsewhere in the world, we’re seeing inflation going back up a little in December. So there is a trend for this halt in the cooling off of inflation.

European countries are experiencing rising inflation again after things were cooling off. The Eurozone inflation has risen from 2.4% to a 2.9% annual rate.