It is funny how Zero Hedge admitted it was wrong. They did it by admitting everyone else was wrong who got tied up in the latest mess of pivot mania without mentioning that they were caught up in it themselves. In fact, they were practically championing the mania, rather than criticizing it as they should have been.

Sometimes I think ZH exists just to sow mayhem and confusion in America. I like the fact that they share the negative news about American economics that others won’t (when that news is true), and their coverage is broad, but they seem to be against America in all respects, always voting for it to fail. In this case they were pushing a pivot fantasy that was ludicrous.

They have relentlessly pushed the idea that the Fed is going to pivot for a year and half now. That made them overly quick to claim victory with Powell’s last post-FOMC speech. When they said the Fed had pivoted, I said they were dead wrong—that the Fed clearly had not pivoted at all. Today, ZH comes out and admits the Fed’s minutes revealed everyone was wrong who believed the Fed had pivoted — that, in fact, the Fed is going to run interest high for longer and maybe even higher if it has to. The only thing is they forgot to mention that they were part of mania crowd who believed that Powell had pivoted.

What I said on that day of the meeting was that Powell had miscommunicated — either very stupidly or very slyly. He either was too dumb to realize, after all these months of the market not believing him on “higher for longer,” that stock and bond market would seize any scrap of red meat (hope for Fed easing) that he waved in front of them – or – he actually wanted the market to do the Fed’s work of easing financial conditions without a policy change, as his way of goosing his 747’s jet engines a little to ease the Fed’s landing. (The latter is giving him the undeserved benefit of the doubt.)

Here is how ZH put it in the title of their article

Fed Minutes Push Back On Powell’s Dovish Pivot

As if there ever was one! Powell actually never dovishly pivoted, as I said back then. All he did was show the Fed’s dot plots which revealed more Fedheads hoping they could lower rates sometime in 2024. But even ZH has said many times those dot plots of where each FOMC voting member believes interest will go by the end of any year have been too optimistic about the battle against inflation every single time, and have always had to be revised toward tighter policy for longer. So, ZH knew better than to pay any attention to those … or should have, except for their own pivot mania.

That was a flimsy basis for claiming, as they did, that the Fed had actually just pivoted, especially since Powell made clear that what the Fed will actually do will depend entirely on how the data comes in over the year ahead and that the committee felt very reticent about how that would turn out. The dot plots are neither a promise nor a plan. They are merely the wistful guesses of FOMC voting members, and the Fed warns every time that what they actually do will depend on what the data shows when the time comes.

I heard nothing in Powell’s speech or the Q&A that indicated the Fed had even seriously talked about pivoting to lower interest rates. When Powell mentioned in response to a question that there had been “some” conversation about when they might consider how to approach lowering rates (because that is what was asked), it came across to me about as serious as admitting to a two-minute conversation over a cup of coffee at lunch. Still, I knew the market would seize upon that tiny scrap of red meat, so that he should never have mentioned it. He casually tossed the reporters something they were slavering to hear.

And, so, ZH continues, trying to make it sound like the Fed had been tricky about this,

Today we get to see the cherry-picked highlights from The Fed’s ‘Great Pivoting’ in December.

There was no “great pivot” at any time. It was only great in ZH’s mind. It was entirely non-existent in mine. They word this as if the Fed wants to walk back something Powell never actually said, wants now to only present a starker message. It couldn’t possibly be that the market did what it has done for a year-and-half and leaped to euphoria over nothing and that ZH made the same mistake.

Will they admit what we all think happened? Of course not.

First off, we don’t “all think” it happened. I certainly did not think that for one second after listening to Powell, but I could easily see that the maniacal pivotheads would take it that way because they wanted to.

Will ZH admit they were wrong in so boisterously proclaiming the Fed had actually pivoted (because they were weary of predicting the infamously evasive pivot for the last eighteen months or so and being wrong every time)? Of course not, but they do admit that the Fed minutes certainly show no signs of any talk about actually lowering rates. (No surprise to me.)

Since the ‘dovish’ flip-flop at the last FOMC meeting on December 13th, markets have mimicked ‘the QE trade’ – dollar down, everything else up (led by crypto).

There was no flip-flop—just an ill-advised answer to a question and the usual overly optimistic dot plots. It’s more like this: Since the always-delusional market once again interpreted the Fed to be going softer than anything Powell actually said about policy, it leaped to betting on a return to QE because that is the narrative it wants. I said the leap was insane but predictable because the market is filled with mania, but ZH ran with the maniacal crowd and actually enticed that kind of betting with the QE trade.

(In full disclosure here, ZH used to publish my articles regularly, but stopped entirely when they disagreed with some of my viewpoints, perhaps particularly on the Fed pivot but also on Putin’s War. Nevertheless, I continue to frequently publish links to their articles where they are good; but on this subject they have been out to lunch for a year and half. It seems to be a mistake they just can’t stop themselves from repeating.)

Short-term rates markets have clung to the belief that The Fed will start cutting in March – with all the hawkish jawboning failing to shift expectations too much (75% odds of March cut now)…

ZH points out that the markets clung to that belief, but so did they. The one thing I will say again is that, while Powell said nothing about lowering rates, he was a fool not to see that he needed to come out tough as nails if he didn’t want the market to run that way because it was already going that way. As a result of his soft tones, the market leaped to expecting even more rate cuts, taking things all the way to six cuts in 2024, starting in March, which is just bizarre.

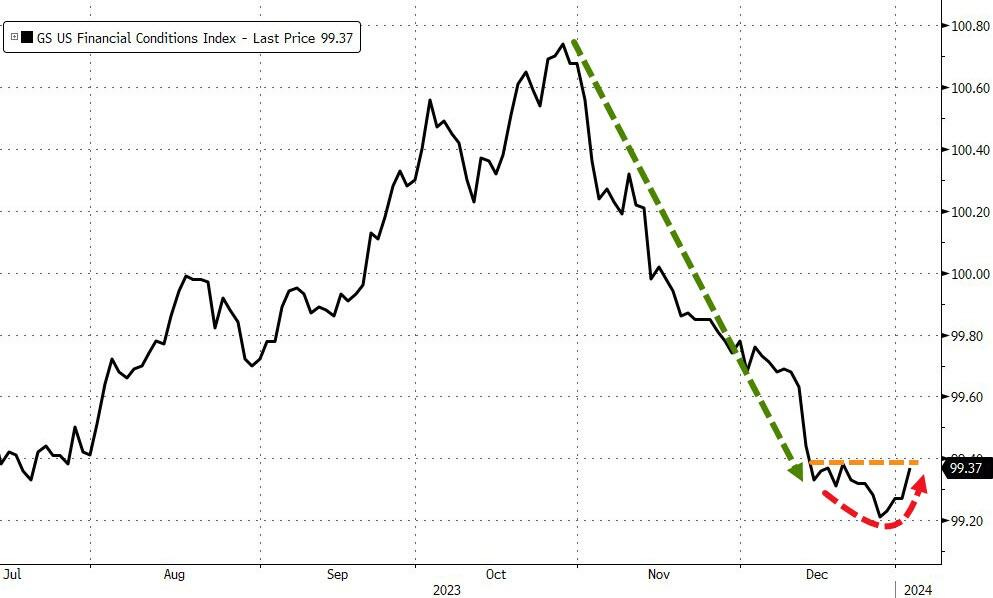

Interestingly, after the unprecedented easing of financial conditions since the start of November, the last three weeks since the Dec FOMC has seen Financial Conditions stabilize (and start to tighten very modestly)…

ZH presents the following graph to illustrate this:

The graph is a little distorting because the orange line makes it look like market conditions have tightened back up to where they were at the Fed’s last FOMC meeting; but, in fact, that deep plunge into easier financial conditions right above the orange line is the plunge Powell triggered with his dulcet tones. Thanks to Fedheads saying, “Well, that is not quite what we all said at the meeting,” the market has walked back some of its own error in the last week. I just marvel at the market’s greed-driven insanity.

Now, notice the obvious slant in ZH’s article that comes next as they try to walk away from their own error (one they’ve made many times now and seem relentlessly stuck on):

So, what do they want us to know?

The Fed Minutes appear to be far less dovish than Powell suggested.

Oh sure, their minutes are trying to trick us into believing something that only appears to be less dovish than what Powell suggested. The problem with that slant is that it was easy to see Powell said nothing about a pivot and the Fed voted to hold rates where they were, which is the only thing that actually happened with policy, so NO PIVOT once again! The market just ran out ahead of him because it was starving for that pivot message to feed the greed.

Notice, though, that ZH has to admit the minutes were “far less dovish” than the way ZH had interpreted Powell because they were starving for a chance to finally be right about the “Fed pivot.” Yes, they were FAR LESS dovish. In fact, they gave …

No sign of imminent rate cuts…. [In fact,] several suggest rates could stay at current level for longer than they currently anticipate…. officials note that further rate hikes remain possible if the economy warrants them…. [So, yes, higher for longer is still the theme.] Several participants observed that circumstances might warrant keeping policy rate at current level longer than they currently anticipate…. It seems the discussion of rate-cuts, that Powell mentioned during the press conference, was far less of a ‘thing’ than the market went with.

ZH likes to cast this as being less of a “thing” than what the market went with, but it was also far less of a “thing” than ZH ran with!

They do, at least, admit,

These Minutes in no way support a 150bps rate-cut cycle next year.

And they admit that uncertainty about forward policy remains high:

“Participants generally perceived a high degree of uncertainty surrounding the economic outlook.”

As for whether Powell intended to ease financial conditions by giving the market just enough of a whiff of the red meat it wanted, the FOMC minutes noted,

“Many participants remarked that an easing in financial conditions beyond what is appropriate could make it more difficult for the Committee to reach its inflation goal.”

So, maybe Powell was just dumb about how the market maniacs would take his soft tones and wan’t playing the market into doing the Fed’s softening for it.

Now, with ZH having choked its way through a “Well, I guess not,” let’s look at what another source (Barron’s) says about the Fed minutes that showed ZERO sign of a Fed pivot (a claim where I seemed to the lone voice in financial media until now, as is sadly often the case and is hard ground to maintain a stand on.) The italics below are mine just to show you the words you should focus on:

US Interest Rates Likely To Stay High ‘For Some Time‘

US Federal Reserve officials expect interest rates will need to remain high “for some time” to tackle stubborn inflation, according to minutes of the most recent rate decision published on Wednesday….

Fed officials have looked to dampen the buoyant market expectations that cuts were imminent, stressing that inflation remains stuck above the central bank’s long-run target of two percent….

Barkin, who is a voting member of the Fed’s rate-setting committee this year, added that there was “no autopilot,” and that policymakers would continue to be guided by the incoming data.

And that is where I come back in. I have also been pretty much a Lone Ranger in pointing out where inflation has actually risen incrementally and certainly for claiming it will rise more. It’s worse than stuck. One of several reasons I have given for practically standing against the world by saying inflation will rise more is the global war situation, which raised the stakes for higher inflation a lot when it swept over the Red Sea. In fact, inflation would already be rising at a level no one could miss if not for the huge distortion created by the Bureau of Labor Statistics that I’ve pointed out—so bad it demands to be called a lie—where health insurance costs were dialed clear back to 2018 prices. Seriously? No rise in medical insurance over the last five years!? And now we get to see how rapidly what I forecast is coming about as the Red Sea situation is playing out.

Another article in Zero Hedge today, to give credit wherever credit is due, rightly says,

Spot Container Rates Surge By 173% Due To Red Sea Disruptions

The market has been lunatic to carry on as if this is not going to drive inflation upward, forcing the Fed to fight longer. The supply-chain crisis that I’ve said is likely to match up close to what we saw during the Covid lockdowns is now well underway with costs of shipping soaring and delays already up to more than a week of extra waiting for products and resources to arrive. Longer routes mean more ships are needed to carry the same amount of goods because each ship is going to spend, at least, twice as long doing its job. That demand for more ships drives up shipping prices. If shortages occur on store shelves due to these delays that will drive up prices even more.

The cost?

Shipbroker Braemar said daily shipping costs for a tanker from the Mediterranean to Japan through the Suez jumped from $8,000 a day in early December to $26,000 earlier this week.

That is quite a leap that adds $3 to a barrel of oil from just that cause. ZH’s article provided a good satellite map with an overlay of all the ships that are going around the Cape of Good Hope in Africa and showing the completely empty shipping lanes of the Red Sea where ships have turned around and are now pressing toward the South Africa route. It looks like a parade of ships heading the long route around Africa, as you can see in the article highlighted below. That route adds anywhere from 7 to 20 days to shipping time, depending on what final port they are aiming for.

Yet, the war around the Arabian peninsula just heated up significantly with the US government and several other governments announcing to Yemen today that the Houthis will be severely punished if they don’t stop. (That’s shorthand notice for saying, “Either you get a grip on this because it is all coming out of your country, or we will come in and do it for you!” Make that another nation at war in the Middle East.)

That threat didn’t cause the Houthis to back down any, as the pirates attacked another container ship today. At this point, I think the Houthis are seizing the opportunity to inflict as much damage on the West as they can, so they may be as likely to back down as ISIS, or Al Qaeda. Of course, all they have to do to turn this into a longtime blockade is sink a container ship while it’s in the canal. I’m sure they’ve already figured that out. It’s a matter of whether or not they can pull it off.

(Headlines set in boldface below supply the quotes for the editorial above.)

Views: 190