Are US financial conditions loose as a goose?

Source: Bloomberg

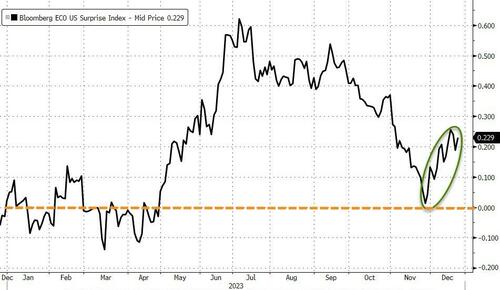

The last few weeks have seen US macro data reverse its recent trend of disappointment…

Source: Bloomberg

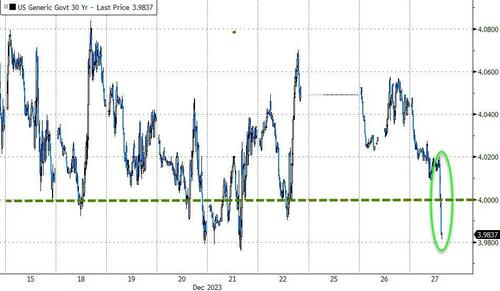

The long-end of the curve is outperforming…

Source: Bloomberg

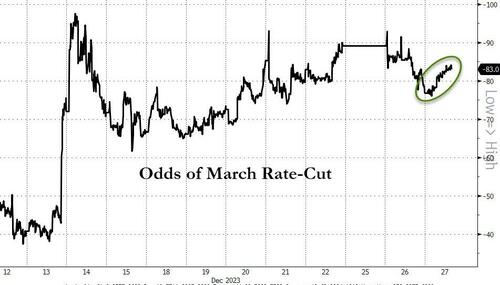

But, ‘do not fight The Fed’ seems to be the narrative and expectations for a March rate-cut are rising once again…

Source: Bloomberg

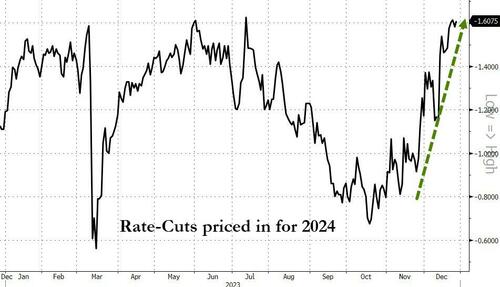

And the market is pricing in over 160bps of cuts for next year…

Source: Bloomberg

Financial Conditions are now at the same level of looseness as of May 2022…

Source: Bloomberg

That is 300bps of Fed rate-hikes ago!!! Is that really what The Fed wanted?

Jay Powell and The Gang are likely partying at a nightclub drinking Heineken while the rest of us drink Pabst Blue Ribbon.

Views: 227