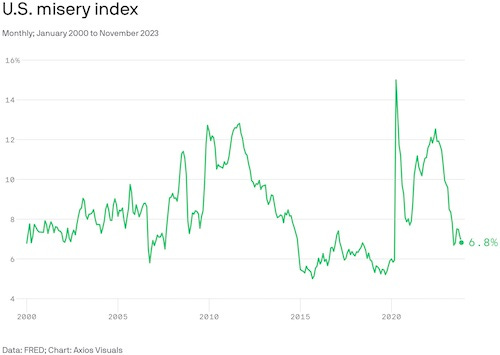

One of today’s articles about the Misery Index says that inflation is over and that will show up in tomorrow’s inflation report, but is it? Another says Americans know better than to believe that.

The Misery Index is a simple combination of the impact of inflation plus the impact of unemployment. With inflation lowering and unemployment hardly budging upward, the index looks like this right now:

By that measure, misery will stay low so long as inflation stays low, except America isn’t feeling it that way as James Rickards points out in his article today because prices have been rising so long and are now merely rising less quickly, but still rising; and those percentage increases now multiply the size of larger base numbers so smaller percentages can mean as large of a jump in total dollars and cents.

Regardless, prices have risen a lot more over two years than wages have for most Americans, so people are feeling the pinch more than ever. As Rickards says, Americans get it; economists don’t. One faces reality with the home budget. The other plays with numbers in meaningless theoretical space.

But what about that first article that offers the hope that tomorrow’s inflation report will show inflation is finished. Well, at last! You can all sigh in relief! Actually, a couple of articles say inflation is over, but here is one sample:

The bottom line: The double whammy wrought by COVID-19 — first a huge spike in unemployment, and then a big rise in inflation — now seems to be over, with both indicators reverting to low levels indicative of a healthy economy.

So, it’s all good. If you don’t believe me, just read Wall Street. For the moment, the people on Wall Street don’t feel any pain, so their reporting minions are all sharing news of good cheer. It’s all euphoria with riches for Christmas. The Fed’s war on inflation is over; so, crack open the champagne and throw the ticker tapes! (If you even know what those are. If not, throw something! But not yourself out the window. Save that for the next news cycle.)

And they will have plenty to celebrate if tomorrow’s report is as placid as today’s articles say. According to what they say, we’ll be looking at inflation hitting the Fed’s target of 2% tomorrow morning. Actually 1.9%! Hurrah!

“We’ll see,” say I in my little tacked-on addition to the headline. We’ll soon see, but I recommend not looking too much at tomorrow’s inflation report if it turns out as shiny as the writers are saying. It’s good to see the bright side, but don’t stare at the sun. Most of these reports are mirages that vanish on a closer look anyway, given how the numbers get massaged by reconciliation of past healthcare errors as if those errors actually represent deflation today … and by seasonal adjustments that always seem to go in the government’s favor, especially in December when they are always adjusted the same direction due to things being unseasonably warm one year and then unseasonably cold the next (causing me to think there must only be one thermometer reading that presents normal sales figures) … and by absurd housing-cost calculations that are truly based on nothing more than homeowners’ guesses.

What I am looking at, beside the month-on-month reports that have actually been edging upward since mid-summer, but almost no one mentions that, is the pressures that are building for brand shiny new inflation.

The Red Sea has me seeing red

Take for example the situation on the Red Sea where the waters may soon be red with blood. The US government today has revealed it is mounting the largest naval movement in decades to surround the Arabian Penninsula.

And no wonder that has me seeing red because it is costing the US over $1,000,000 for each missile it uses to shoot down a $1,000 drone — by Pentagon accounting, a bargain at any price, apparently. With thousands of drones, the Houthis will have us broke by midnight. And that doesn’t even begin to count the billions spent deploying over there.

All that spendy falderal is now finally getting the attention of oil traders and pushing crude prices back up quickly … and that is where most of the cost of inflation fell last month. Oilprice.com reports,

Markets may have been too complacent. [Ya think?] The repercussions of the conflict in the Middle East could still impact energy markets and supply chains worldwide and drive consumer prices higher, just as the Fed signaled a pivot in the U.S. monetary policy with the potential of three interest rate cuts in 2024.

[Yeah, not a brilliant message for them to have even hinted at.]

The most recent threat to global trade, including part of oil and products trade, emerged from the Iran-aligned Houthis in Yemen, who have intensified attacks on commercial vessels in the Red Sea and near its vital chokepoint….

[Who woulda or coulda guessed trouble coming out of that bunch with a major Mid-East war?]

The Suez Canal, the SUMED pipeline, and the Strait are strategic routes for Gulf oil and natural gas shipments to Europe and North America. Total oil shipments via these routes accounted for 12% of total seaborne-traded oil in the first half of 2023, and liquefied natural gas (LNG) shipments accounted for about 8% of worldwide LNG trade, the U.S. Energy Information Administration (EIA) said.

Because of the Russian war against Ukraine, a lot of oil got rerouted through the Suez Canal, but that route is now as good as fully blockaded by drones.

This year, oil flows through the Red Sea/Suez Canal route have jumped after the embargoes on Russian oil shifted Russia’s crude exports toward Asia.

Not anymore!

I’ve said for a year that the rising tensions in the Middle East and Putin’s War make any bet on lasting low oil prices a fool’s bet. High prices seem to be already coming back around, after a reprieve from prices that began in October following a few months of soaring prices.

Following intensified attacks by Houthi rebels, oil supermajor BP said early this week it was temporarily suspending all shipments via the Red Sea, becoming the latest major firm to pause vessel navigation in the area that could reverberate through global supply chains. Container shipping giants Maersk Tankers, A.P. Moller-Maersk, Hapag-Lloyd, MSC, Evergreen, and CMA CGM have all said their vessels would be avoiding the Suez Canal….

Until the security situation in the area improves, many shipping firms will reroute cargoes via the southern tip of Africa. The Cape of Good Hope route will add weeks to vessel journeys and additional costs and delays to world trade in goods. Freight and insurance rates have also increased in recent days.

Yeah, those are the same “global supply chains” Powell said were practically all better now. To which I exclaimed, “Really? With two raging wars in major energy regions?” The effective closure of the Suez Canal means shipment by sea of things that took that route will increase in length and time by anywhere from 51% to 129%, depending, of course, on point of origin and final destination.

As a result of this mayhem, shipping container costs have already soared.

The ceiling in ocean freight prices shot up in a matter of hours on Thursday as a result of more vessels diverting from the Red Sea. CNBC has learned that logistics managers were quoted this morning an ocean freight rate of $10,000 per 40-foot container from Shanghai to the U.K. Last week, rates were $1,900 for a 20-foot container, to $2,400 for a 40-foot container. Truck rates in the Middle East now being quoted are more than double.

That is why I have been saying all week, this will likely have a major impact on inflation because those rates impact the cost of everything that once moved through the canal, BUT they also impact the prices of things that did not move through the canal because it is not just about the cost of the longer routes. Doubling the length of a route doubles the number of ships it takes to move the same amount of product to the same places in the same time; SO, you either wind up with shortages of products because the time for shipping doesn’t keep up, OR you pull a lot more container ships into service from other routes, but that demand pulls up the price for shipping everywhere. Because ships float, any ship added to move products that were shipping through the canal is a ship not available elsewhere. The demand for more ships to move the same number of products around the world because they are taking much longer routes increases all shipping prices everywhere to some degree, which is distributed over the same number of products.

It also means more shortages are likely all over the world, and the inflation equation, remember, is “too much money chasing too few goods.”

… pricing is undergoing rapid adjustments as ocean carriers work to recover the added costs of diverting their vessels…. ““During Covid, we had a slower build-up in freight prices due to the impact the pandemic had on the global supply chain,” Baer said. “What we are experiencing here is a light switch event where vessels are being redirected in real time….”

So, the scale of the problem is building rapidly compared to what we saw in those horrible Covid days where the ruling lunatics who run Asylum Earth locked us all down:

As of Thursday morning, 158 vessels are currently re-routing away from the Rea Sea carrying over 2.1 million cargo containers.

How much this will mean for inflation depends, of course, on how long it continues.

There is no short-term end to the attacks in sight.

Oh.

That takes me right back to the feeling of those Covid days, which Fed Chair Powell just boldly told us were over as his basis for thinking we’re coming in for a soft landing now and maybe even ahead of schedule.

“What we can share for now is that the situation in the Suez Canal will result in delays and may cause availability constraints for certain IKEA products,” said an IKEA spokesman.

Note also that …

Vessels move on global water routes called “strings,” and containers from around the world can be on a single vessel as a result of the different ports a vessel will visit on its string. When a vessel is delayed because of re-routing that means all shippers from a multitude of countries who have cargo on that vessel, or are waiting for that vessel to pick up their containers, are faced with delays.

Does anyone see any chance that when those strings all get retied we also start to see some ports that were momentarily almost empty of ships (so products didn’t arrive on shelves) suddenly overcrowded with ships that have finally made their way through so the ports get backed up again (and so products still don’t arrive on shelves)? Just saying these kinds of jams tend to move like an inch worm and get all bunched up in the middle somewhere.

While Powell gave off visions of sugar plums dancing in heads, I have visions of Covid container ports clogged in my head. (It won’t stop me from enjoying my share of the sugar plums at Christmas, though, because I deal with reality like that. I keep on living and loving life, but I take my reality straight up … and then go live as best I can through all of it and don’t sit around and worry about things I cannot change. Today, for example, my house basement flooded with raw sewage that the town delivered for Christmas from its own system that took our basement plumbing as its emergency exit, which is why the first edition of this article had more than the usual number of typos. But now I am in a hotel and still a happy person as I come back and revise it. I take life as it revises itself and my plans get revised with it.)

On the good side, we have had a lot of experience with these kinds of traffic snarls now, so we are probably developing some alacrity for dealing with a world of shipping chaos due to forced pandemic lockdowns and wars.

Of course, not only do ships float so that demand for ships there increases shipping costs here, but so do products. Some are being rerouted to planes to make up for lost time, and that is raising the cost of air cargo all over the world, too — some places more than others, of course. So, while the Suez directly impacts Europe more than the US, the movement of planes and ships from other routes to service European-Suez routes, drive-up the cost of planes and ships in the US due to simple supply and demand. Because air transport companies are global and move their hardware wherever they can get the most money from the most desperate players, it all drives up the cost for others due to the competition to get planes and ships.

“Every day this continues it escalates, starting with Europe and then the U.S. East Coast, you will start to see more conversion from ocean freight to air,” said Bourke. “Starting with higher value goods like consumer electronics, high-value consumer product goods and fashion apparel. This is due to the longer lead times that will increase inventory carrying costs and working capital which justifies the higher cost to move goods much faster….”

And then there is that whole price-gouging thing that tends to happen in times like these:

MSC, the world’s largest ocean carrier, was the first ocean carrier to increase rates from India by 30-40%….

“To many, the jump in rates from India to the USEC [U.S. East Coast]] from approximately $2,000 per 40-foot container to $7,000 per 40-foot container in just 30 days appears egregious,” Baer said. “Is this rate increase really the level required to recover costs, or are they simply taking advantage of an unfortunate situation for the entire global community?”

Of course it is the latter, but that is also supply and demand. Sudden demand for new supply in different areas gives companies the ability to raise prices more than their own costs go up if they have the ships or planes to fill the need. So the costs passed along to the consumer are always more than the actual additional costs of just shipping via longer routes that use more fuel and time.

“Members are already being forced to divert goods and are encountering surcharges.”

He alluded to the 2021 Suez Canal obstruction as an example of how any disruption in the trade gateway has immediate implications for the delivery and cost of goods….

“As supply chains have begun to normalize again, the added pressure from these additional costs and delays could have a significant impact.”

As I was saying earlier this week, Mr. Powell….

You might have been a little premature on that supply-chain/shortages call as your basis for leading investors to keep believing the battle with inflation may be winding down.

My longtime readers probably remember the impact just a couple of years ago of a single ship getting lodged at an angle in the Suez Canal and blocking traffic for six days because I commented on the impact it would have then. Well, this is all kinds of ships getting shot at and carriers refusing to even move into the area, and the offenders promising to keep this up for as good as forever, which means until Israel gives the Palestinians everything they want or something on that order. So, if that one Chinese Ever Given container vessel raised inflation back then (and it did), how much more so all this trouble?

If chaos at the Suez Canal sounds familiar, cast your mind back to the summer of 2021 — when the Ever Given’s six-day grounding triggered supply-chain chaos and held up around $60 billion worth of goods.

The incident was a reminder that the man-made waterway is a vital link for global commerce, with around 15% of the world’s total shipping traffic passing through it each year….

Remember, we are entering what I am predicting to be “The Year of Chaos,” and with all the oil that ships through the Suez Canal, keep in mind that the increased costs of oil go into everything as an ingredient (its byproducts) used in manufacturing, as a source of energy for manufacturing, and for transport fuel of one kind or another for those products, and those costs get multiplied along the way with profit markups before they all arrive in the consumer’s doorstep by Amazon.

Shipping delays are already driving up oil benchmarks at a time when global supply has already tightened due to the OPEC+ cartel’s production cuts.

And keep in mind that …

Suez also isn’t the only major international waterway experiencing difficulties, with a severe drought forcing the freshwater-filled Panama Canal to slash its capacity, leading to delays that have already likely hampered Americans’ holiday-season shopping….

Investors are already more worried about geopolitics than anything else, according to a recent poll by Natixis – and the chaos in the Red Sea should serve as yet another reminder that wars in Europe and the Middle East could derail the world economy’s miraculous recovery next year.

I would argue that investors are obviously NOT worried enough, but they soon will be, and that will rock the boat.

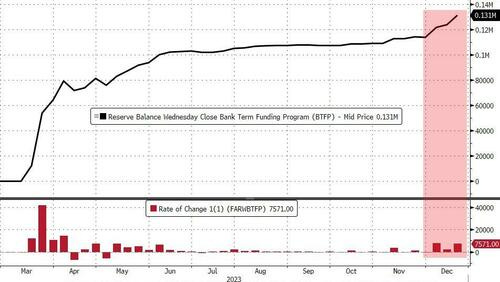

Now, just to followup on yesterday’s article about the brief spike in interest in interbank lending (repo loans), today we have an article showing a significant increase in banks using the Fed’s emergency bank bailout facility created last spring when banks were literally failing left and right — one here, one there, one here, one there until four were down in about as many weeks, three of which were reported as being three of the top-four banking busts in US history. (Depending on how you measure size and a bust ; ) Is it it a bust if it gets bailed by the Fed … apparently not.)

This month’s increase in use of the new-and-improved Fed bailout system (the Bank Term Funding Program) has suddenly gone like this:

At least, that gives us one chart on the state of the economy that is rising! So interest rates on essential interbank lending took a bump up, which is very rare in that boring funding world, and we see use of the emergency facility rising. What could go wrong with those signals on the up and up?

One thing that hasn’t changed is Zero Hedge referring again today to “the Fed’s massive pivot,” as if a pivot had actually even happened just because the sugar plums at the FOMC meeting had happy thoughts dancing in their heads while they kept interest rates and QT rock solid. But I guess “massive pivots are merely such stuff as dream are made on.” Just a reminder: No pivot has happened at all so far! (And it’s not going to if these Red Sea issues hang around, forcing the Fed to get back to tough inflation fighting … as I see likely.)

Views: 88