by Chris Black

Algos don’t understand economic reality along with the laws if supply and demand.

The market where the magical symbols representing a real company reside, is a screwed up version of Tron, where computer programs are fighting each other, with the Fed representing Master Control.

In the real world there is no fundamental dynamic that can change the oil market to cause 20% declines and 30% increases within a month.

One blip in a chart an algo sees can unleash chaos.

Did that gas in the storage tanks at the station all of a sudden increase or decrease in value?

That doesn’t stop the station from raising prices $.25 overnight.

What purpose does the stock market serve when it doesn’t represent any reality other than a fictional computer simulation?

Markets Go Wild On 3-Month-Old (Revised) Data

“Great” news America… economic growth in the 3rd quarter was not quite as hot as the government had previously guessed.

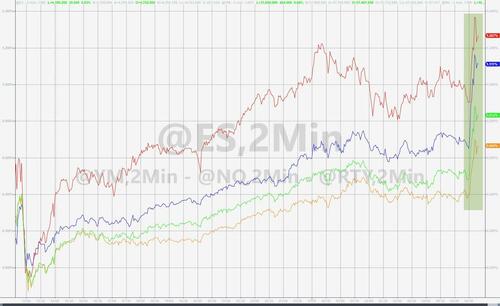

‘Worser-er’ data suddenly supports the goldilocks scenario as the algos appeared to completely ignore the current initial claims data which is practically at record lows.

Stocks soared higher…