by mrmrmrj

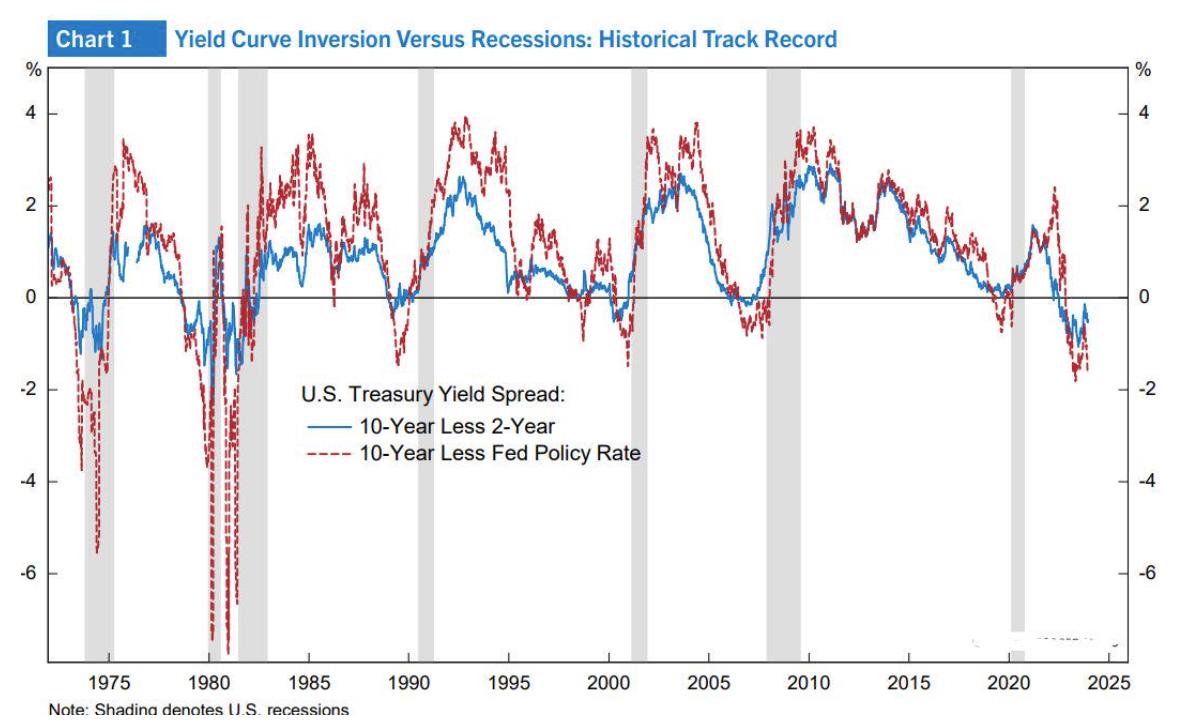

This chart demonstrates the historical relationship between yield curve inversions and subsequent recessions. As you can see, there is a strong correlation between the two phenomena. In other words, when the yield curve inverted (i.e., when short-term interest rates rose above long-term interest rates), a recession soon followed. This suggests that an inverted yield curve may be a leading indicator of economic slowdown or even recession.

There is a bit of a lag from the initial inversion to the recession’s start normally.

Views: 140