The stock market is currently experiencing its most overbought conditions since the early days of the pandemic, with traders displaying a fervent appetite for bullish options contracts. This surge in bullish sentiment is reminiscent of the situation leading up to the 2008-09 recession, raising concerns among seasoned analysts.

A striking comparison can be drawn between the current market state and the situation in December 2021, particularly in the context of “Min vol.” Despite a similar move, this time it took half the duration as volatility rapidly collapsed. The prevailing sentiment suggests that, post-options expiration (OpEx), markets are poised to surge to new highs or, in a more ominous scenario, face a potential explosion.

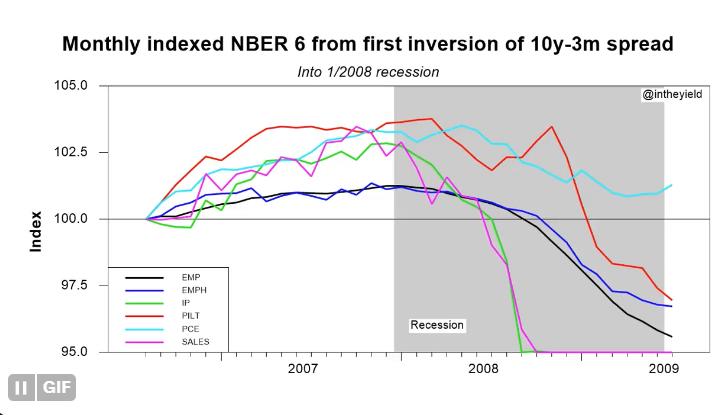

However, there is a notable disparity in market positioning regarding protective measures. Traders seem to be offside on protection, exposing the market to vulnerability. This situation echoes historical patterns where concerns about an impending recession were often downplayed until it was well underway. The 2008-09 recession serves as a stark reminder of the dangers of underestimating economic downturns.

Adding to the unease is the Federal Reserve’s decision to reduce its balance sheet through quantitative tightening. This strategy has raised red flags, particularly in critical financial systems like the repurchase-agreement markets. Recent tensions in these markets, reminiscent of the crisis in September 2019, when an overnight market rate spiked to 10%, are fueling worries of potential disruptions.

Despite these warning signs, the Composite US PMI unexpectedly rose to 51.0 in December, masking deeper economic challenges. A notable decline in Manufacturing to 48.2, set against weak global data, hints at persistent economic hurdles, even with marginal improvements in Services. This complex economic landscape raises questions about the trajectory of GDP growth in the U.S. for Q4.

As markets navigate these turbulent waters, the echoes of the 2008-09 recession serve as a stark reminder of the importance of heeding warning signs and maintaining a cautious approach amid seemingly exuberant market conditions.

Still the weakest rally of the year with respect to breadth.

And now the market is the most overbought since the early days of the pandemic. pic.twitter.com/T5w8QPUM7e

— Mac10 (@SuburbanDrone) December 15, 2023

Today, largest Opex on record. https://t.co/9MtQheHESo

"Traders have been scooping up bullish options contracts at a record pace"Compare "Min vol" to Dec. '21. Same move, half the time, as vol collapsed.

"After OpEx, markets will rocket to new highs"

Or explode. pic.twitter.com/s5Mqw80Kk9

— Mac10 (@SuburbanDrone) December 15, 2023

2008-09 was the worst recession I forecasted in real time. Again, cries of “What recession?” until it was well underway. As late as June 2008, most of the FOMC thought the economy would “skirt recession” even though it had started 6 months before. Go figure. pic.twitter.com/x0hm0nJC96

— Arturo Estrella (@intheyield) December 11, 2023

The Fed Since November 1st:

1. Nov. 1: Getting inflation to 2% "has a long way to go"

2. Nov. 21: "No indication of rate cuts at last meeting"

3. Dec. 1: Talks about rate cuts are "premature"

4. Dec. 1: "We are prepared to tighten policy further" if needed

5. Dec. 13: Rates…

— The Kobeissi Letter (@KobeissiLetter) December 15, 2023

Bears have capitulated.

After today's OPEX, Santa will come to town.

Or copious fools will be wiped off the map. pic.twitter.com/jH5KtB0VVI

— Mac10 (@SuburbanDrone) December 15, 2023

This is exactly how the 2008 Financial Crisis unfolded: pic.twitter.com/iKvb9NeGzt

— Game of Trades (@GameofTrades_) December 15, 2023

Expect a #correction sooner rather than later, providing a better entry point to increase exposure. #Markets are way offside on protection. pic.twitter.com/b2LslVI66C

— Lance Roberts (@LanceRoberts) December 15, 2023

Concerns Mount in Crucial U.S. Financial Sector Over Fed’s Reducing Balance Sheet

Weak GDP Growth Projected for U.S. Q4 as Per PMIs, Despite Prices Remain Elevated

…is another banking crisis coming in March?