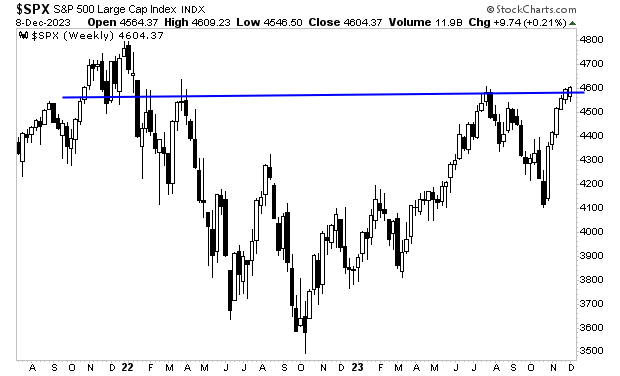

Here comes the Santa Rally.

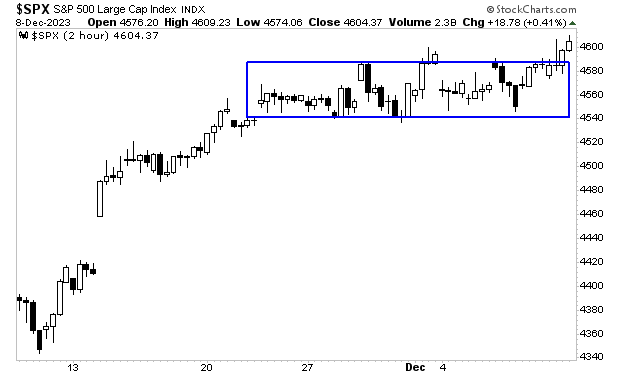

The S&P 500 has been trading in a 40-point range since mid-November. I know that sounds difficult to believe, but it’s true. For all the issues in the world (conflict in the Middle East, the ongoing war between Russia and Ukraine, economic data weakening in the U.S., political issues/ potential impeachment for the Biden administration), the stock market has gone nowhere.

See for yourself. I’ve illustrated this with a blue rectangle in the chart below.

Having said that, the market DID reveal something MAJOR in the last month… but it’s what DIDN’T happen as opposed to what happened.

What didn’t happen?

Stocks didn’t break down.

In spite of all the issues and potential risks in the world right now, the bears couldn’t generate enough selling pressure to push stocks down more than 1%. And considering the market was EXTREMELY overbought going into this period, it REALLY suggests the bears are weak right now.

Which means…

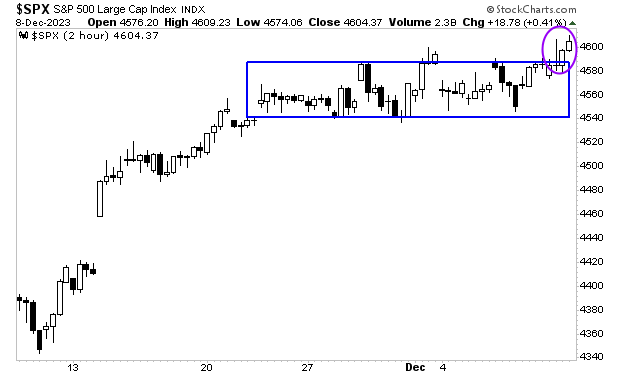

The Santa rally is about to hit. Indeed, just last week, the market managed to break out of its trading range and stay there. I’ve illustrated this development with a purple circle in the chart below.

If stocks hold this today, then the door opens to a Santa rally that sees the S&P 500 hit 4,700 before year-end. Take out 4,600 on a weekly basis and you’ve got an opening to 100 points higher relatively quickly.