Between work at home, Bidenflation and The Feral Reserve, commercial real estate and regional banks are suffering … and it could get a lot worse. And Joe Biden (aka, Negan) in general. Living in Negan Country!

By Kevin Stocklin, Epoch Times

The work-from-home trend has been taking its toll on office landlords and is now making its way through to banks’ commercial loan portfolios, leading some analysts to predict that more trauma could be on the way for regional banks this year.

And in the current climate of bank failures, short sellers, and nervous depositors, banks with large exposures to commercial real estate (CRE) loans are racing to clean up and sell down their loan portfolios in hopes that they will not fall victim to another round of bank runs.

“There is an estimated $1.5 trillion of commercial property debt that will be due for repayment in about 18 months,” Peter Earle, an economist at the American Institute for Economic Research, told The Epoch Times. “It’s not improbable that even if interest rates have fallen by that time, some of that real estate debt will nevertheless be impaired and have an adverse impact on regional banks.”

In step with a recent trend in the CRE market, tech giant Google announced in May that it was attempting to sublease 1.4 million square feet of vacant office space in its Silicon Valley home base in order to “match the needs of our hybrid workforce.” Despite more employees returning to their offices this year, average office occupancy rates across the United States are still below 50 percent.

According to a report by Bank of America, 68 percent of CRE loans are held by regional banks. Approximately $450 billion in CRE loans will mature in 2023. JPMorgan Chase estimated that CRE loans comprise, on average 28.7 percent of the assets of small and regional banks, and projected that 21 percent of CRE loans will ultimately default, costing banks about $38 billion in losses.

Double Hit (of Biden’s Policies)

Commercial mortgages are getting hit on two fronts: first, by the lack of demand for office space, leading to credit concerns regarding landlords, and second, by interest rate hikes that make it significantly more expensive for borrowers to refinance.

According to a June 12 report by Trepp, a CRE analytics firm, CRE loans that were originated a decade ago, when average mortgage rates were 4.58 percent, are now coming due, and in today’s market, fixed-rate CRE loan rates are averaging around 6.5 percent.

Banks that make CRE loans consider factors like debt service coverage ratios (DSCRs), which measure a property’s income relative to cash payments due on loans. Simulating mortgage interest rates from 5.5 percent to 7.5 percent, Trepp projected that between 28 percent and 44 percent, respectively, of currently outstanding CRE loans would fail to meet the 1.25 DSCR ratio today, and thus be ineligible for refinancing.

These calculations were done assuming current cash flows from properties stay the same and that loans are interest-only, but with vacancies rising, many landlords may have substantially less cash flow available. In addition, whereas interest-only CRE loans were 88 percent of the market in 2021, lenders are now switching to amortizing mortgages to reduce risk, which significantly increases debt service payments.

Refinancing Issues

Fitch, a rating agency, projected that approximately one-third of commercial mortgages coming due between April and December of this year will be unable to refinance, given current interest rates and rental income.

“It’s a very different world now from the one in which the majority of these loans were made,” Earle said. “In a zero-interest-rate environment, before the COVID lockdowns saw many businesses shift to a remote work basis, many of these loan portfolios full of office properties looked great. Now, a substantial portion of them look quite vulnerable.”

The Trepp report highlighted several regional markets, such as San Francisco, where office sublease offers jumped 140 percent since 2020, and Los Angeles, where office vacancies hit a historic high of 22 percent. Available office space in Washington D.C. increased to 21.7 percent in the first quarter of 2023.

New York has been hit hard, as well. Office occupancy rates in New York City plummeted from 90 percent to 10 percent in 2020 during the COVID pandemic, but only recovered to 48 percent this year. Revenue from office leases fell by 18.5 percent between December 2019 and December 2022.

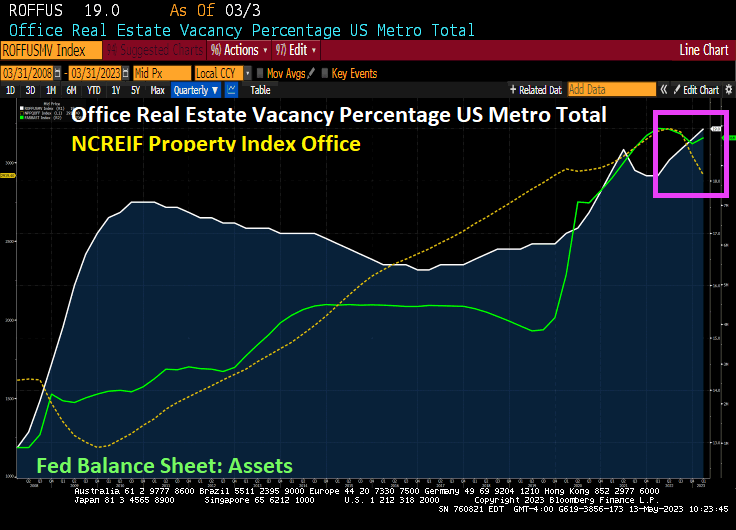

Vacancy Rates at 30-Year High

Overall, according to a report by analysts at New York University and Columbia Business School, office vacancy rates are at a 30-year high in many American cities.

The report found that “remote work led to large drops in lease revenues, occupancy, lease renewal rates, and market rents in the commercial office sector.”

The authors predict that, even if office occupancy returns to pre-pandemic levels, “we revalue New York City office buildings, taking into account both the cash flow and discount rate implications of these shocks, and find a 44% decline in long run value. For the U.S., we find a $506.3 billion value destruction.”

As predicted, delinquencies in commercial mortgage loans are now creeping up. Missed payments in commercial mortgage-backed securities (CMBS) increased half a percent in May over the prior month to 3.62 percent, Trepp reports. The worst component of the CMBS market, which includes multi-unit rental buildings, medical facilities, malls, warehouses, and hotels, was offices, where delinquencies increased 125 basis points to more than 4 percent.

To put this in perspective, however, CMBS delinquencies exceeded 10 percent in 2012 and 2020. And analysts say that lending criteria for CRE have been more conservative than they were before the mortgage crisis of 2008, leaving more cushion on ratios relative to a decade ago.

All the same, the credit crunch at regional banks has created a vicious circle, where banks race to pare down their CRE portfolios, and the dearth of financing leaves more landlords facing default as outstanding loans mature. To make matters worse, commercial property values, which provide collateral for the loans, appear to be taking a hit as well.

In an effort to rapidly clean up their CRE loan portfolios and avoid the fate of failed banks like Silicon Valley Bank, Signature Bank, and First Republic Bank, banks are now attempting to sell off the loans, often taking a loss in the process.

In May, PacWest, a regional bank, sold $2.6 billion of construction loans at a loss. Citizens Bank reportedly has put $1.8 billion of its CRE loans up for sale during the first quarter of this year. Customers Bancorp reduced its CRE lending by $25 million and put $16 million of its existing portfolio up for sale.

Wells Fargo, one of the top four largest U.S. banks, is also downsizing its CRE portfolio, and in announcing the move CEO Charlie Scharf stated, “we will see losses, no question about it.”

“Between the Fed’s 500+ basis point hikes over the past 16 months and the failure of Silicon Valley Bank, and others, earlier this year, a credit tightening is already underway,” Earle said. “That has put a lot of pressure on regional lenders.”

A March academic study titled “Monetary Tightening and U.S. Bank Fragility in 2023” stated that the market value of assets held by U.S. banks is $2.2 trillion lower than what is reported in terms of their book value. This represents an average 10 percent decline in the market value of assets across the U.S. banking industry, and much of this decline came from commercial real estate loans.

Consequently, the authors wrote, “even if only half of uninsured depositors decide to withdraw, almost 190 banks with assets of $300 billion are at a potential risk of impairment, meaning that the mark-to-market value of their remaining assets after these withdrawals will be insufficient to repay all insured deposits.”

Joe Negan. Resident destroyer of the US economy.

Views: 600