No one can afford mortgages except the rich. Even upper middle class people can’t afford them now. It’s ridiculous.

Pending home sales drop to a record low, even worse than during the financial crisis t.co/IP4AWS5sdW

— Eldrego (@Josh_Eldredge_) December 1, 2023

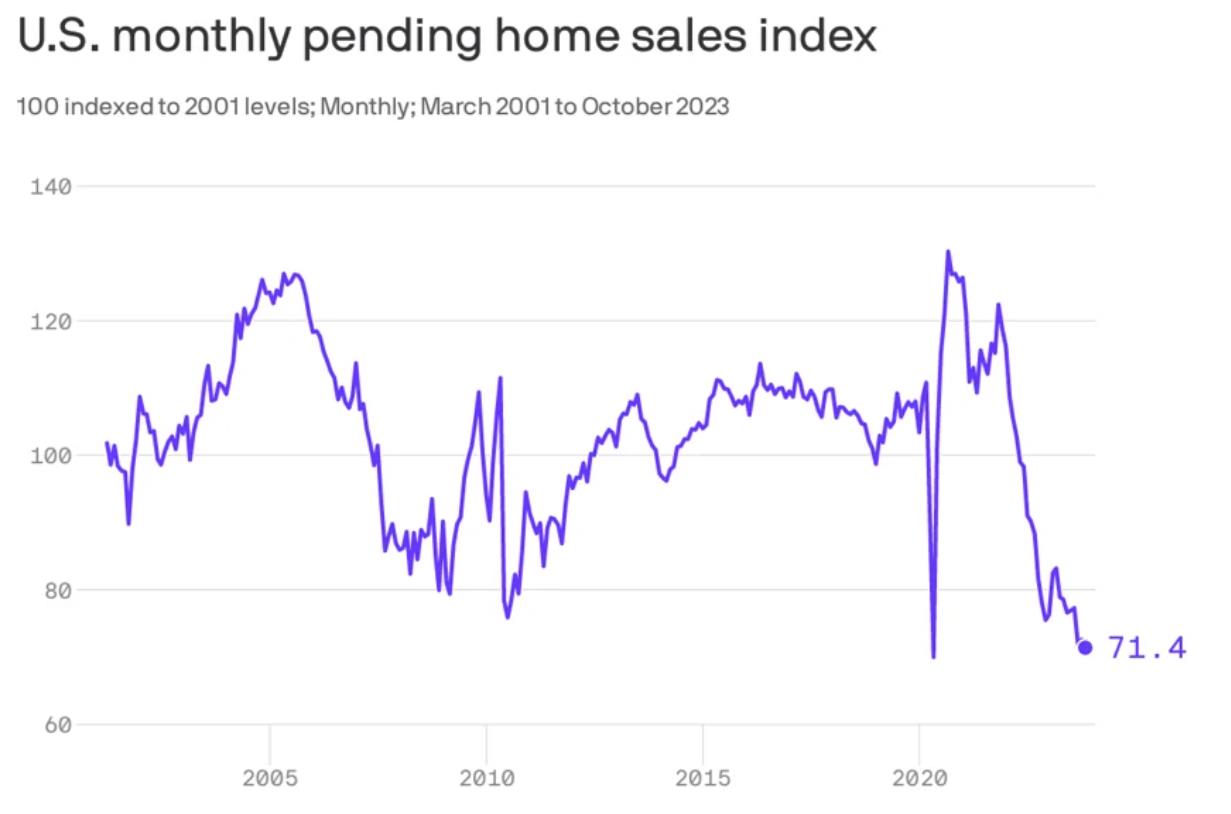

Pending home sales, a measure of signed contracts on existing homes, dropped 1.5% in October from September.

They hit the lowest level since the National Association of Realtors began tracking this metric in 2001, meaning it’s even worse than readings during the financial crisis more than a decade ago. Sales were down 8.5% from October of last year.

Because the index measures signed contracts, it is the most recent indicator of housing demand. It reflects the buyers who were out shopping in October, which was when the popular 30-year fixed mortgage rate briefly shot higher than 8%.

Rates have since pulled back to around 7.3%, according to Mortgage News Daily. The realtors continue to say it’s not just high rates but still very low supply of homes for sale that is deflating activity.

“Recent weeks’ successive declines in mortgage rates will help qualify more home buyers, but limited housing inventory is significantly preventing housing demand from fully being satisfied,” Lawrence Yun, chief economist for the NAR, said in a release. “Multiple offers, of course, yield only one winner, with the rest left to continue their search.”

Pending sales fell in all regions month to month except in the Northeast. They fell most steeply in the West, which is where homes are most expensive. Sales were down everywhere compared with a year ago.

www.cnbc.com/2023/11/30/pending-home-sales-drop-to-record-low.html

BREAKING: Pending home sales have dropped to lowest level since tracking began in 2001 pic.twitter.com/1Tm4X8NhKB

— Financelot (@FinanceLancelot) December 1, 2023

Views: 177