by Virtual_Crow

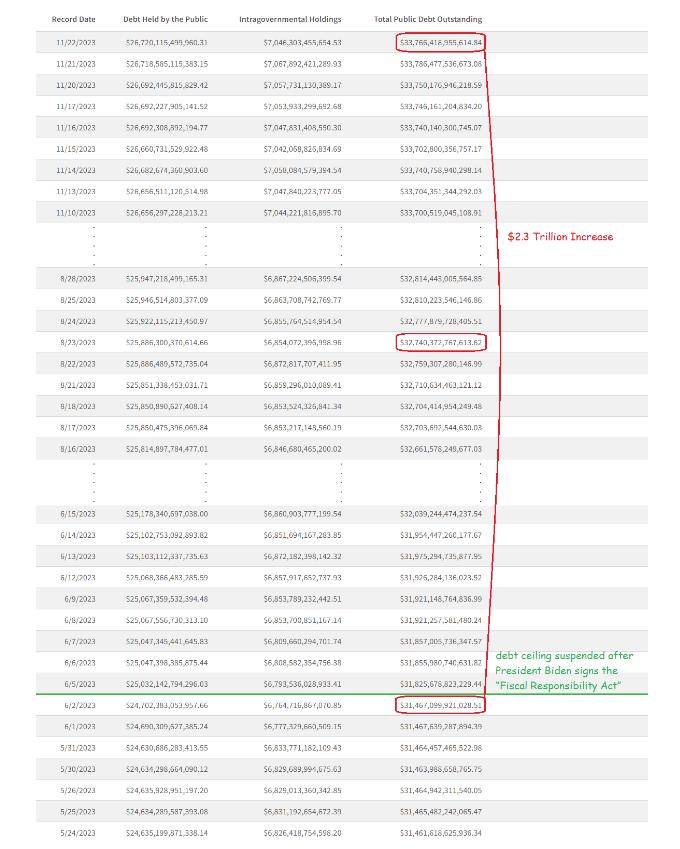

So a few months back, this was causing bond yields to rise high enough that the market started a downtrend again from the summer until October. Too many bonds being sold. Then the Treasury did Yellen’s Yolo, selling more bills instead of bonds, driving yields down. This contributed greatly to the November rally along with future expectations of lower Fed fund rates.

Yellen’s Yolo will be coming due over the next several months. The Treasury has to finance most of that $2.3 trillion again, because they spent the money they borrowed for a few months and now they have to pay it back. They could keep doing this forever and just pay 5.4% interest forever, except they’re extra special regarded and will spend another trillion or two additional of deficit that they need to raise money to borrow.

On top of this several trillion dollars of low interest debt from the QE years is also due, and money has to be borrowed again at higher rates. This is a debt snowball. The holders of the bonds receiving the payments are likely to buy more more bonds with the money, but will demand a higher yield because they’re also being asked to buy all the other debt rolling over and all the new debt too.

All this money is being diverted out of equity markets, into bonds, and the bonds are being spent on the poors, govt employees (poors with benefits), and defense contractors. It’s the reverse of QE where the money supply went nuts but it was almost entirely into equity assets and inflation was near zero. Now equity assets are seeing a drying of money supply and all the poors that drive inflation are getting a govt spending boom.

Also Papa Powell is pissed and is burning tens of billions of dollars a week to fight this inflation. The Fed owns trillions of dollars of treasuries, but when they mature the Fed is taking the money and deleting it instead of buying new treasuries like most others typically do.