by mrmrmrj

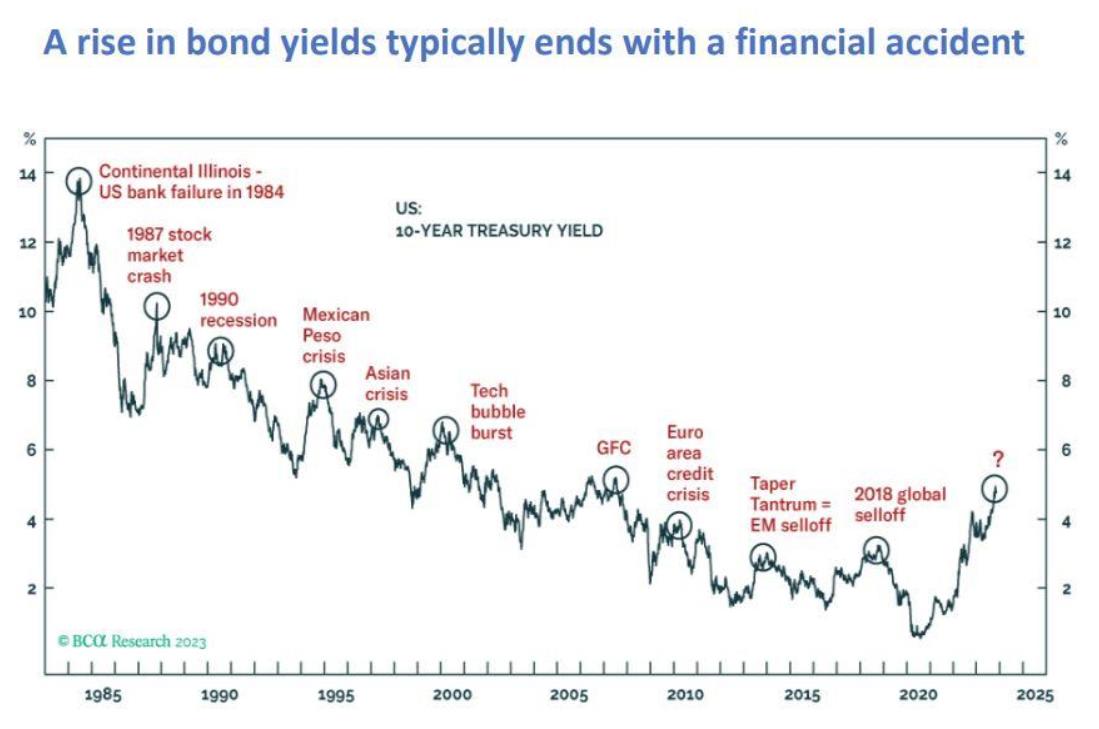

As you can see from the chart, a rise in bond yields typically ends with a financial accident. The most recent example is the 2018 global selloff that was sparked by the US Federal Reserve raising interest rates and scaling back its quantitative easing program. This led to a sharp increase in bond yields around the world, which caused widespread panic selling in equity markets.

This year, we have seen 250,000 layoffs in tech.

Between 2022 and 2023, ~415,000 tech layoffs occurred.

However, the layoffs were vastly limited to tech over the last couple of years.

It may now be spreading.

Follow us @KobeissiLetter for real time analysis as this develops.

— The Kobeissi Letter (@KobeissiLetter) November 17, 2023

The magnificent 7 are just a little bit expensive here, no? pic.twitter.com/DcJPnbWGlL

— Markets & Mayhem (@Mayhem4Markets) November 17, 2023

US equity concentration just hit another record high.

The top 5 stocks in the S&P 500 now account for 25% of the entire index.

Meanwhile, these same 5 stocks currently account for ~70% of the Nasdaq's gain this year.

Technology stocks now reflect a record ~26% of all equity… pic.twitter.com/ToteS9EGpV

— The Kobeissi Letter (@KobeissiLetter) November 17, 2023

WeWork may be the straw the broke the camel's back in commercial real estate loans.

Former venture capital darling WeWork collapsed from $47 billion to almost nothing. This could cancel 590 commercial leases worth $12.7 billion, sticking landlords and their regional banks with… t.co/SePWcPasf6

— Wall Street Silver (@WallStreetSilv) November 17, 2023

Views: 352