To get a good overall sense of where the economy is heading, all you need is a rundown of today’s news. An economic news brief for today follows, but first the biggest of the stories about the Fed’s broken gauge that is finally moving into the recession zone, just two days after the Papa Powell said there is no recession in sight, which times out perfect with the Fed’s past track record on such predictions:

Jobs are finally falling like Jack and Jill

The Fed works with a faulty and delayed set of gauges because they are always revised lower with time, and once again, all past jobs reports (one of the Fed’s most critical gauges) were revised lower, making us closer to recession all along in terms of job action than has been admitted. You’ve heard me rant about it, but this time you can hear Zero Hedge rant about just how ludicrous the Bureau of Lying Statics was in its past reports, and how today’s report for October confirms the track we are really on:

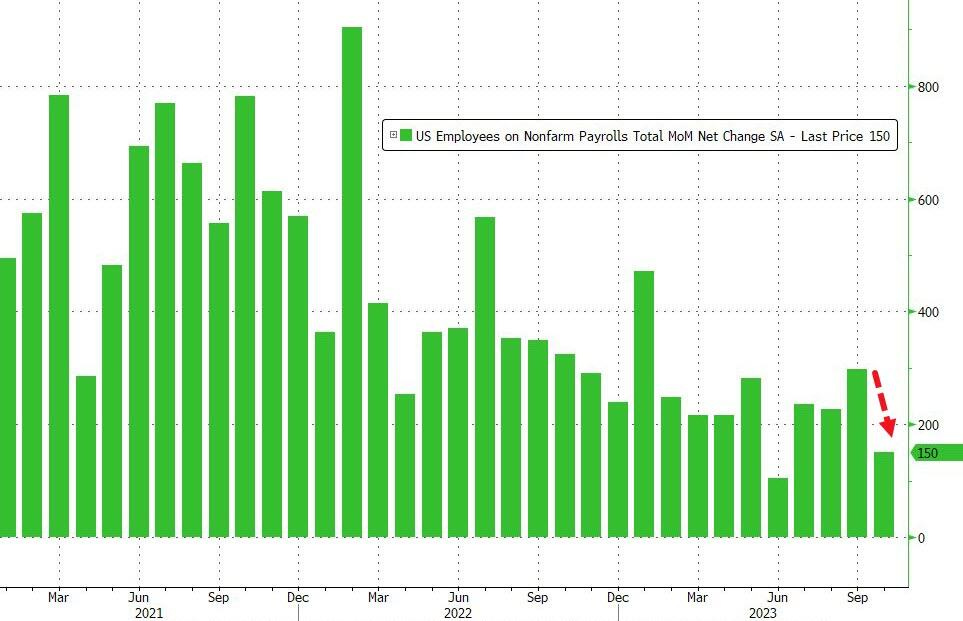

With the October jobs report already expected to be a big drop from September’s 336K, as consensus expected a 180K print (below the whisper number of 211K), moments ago the BLS confirmed that last month’s surge was nothing but a Bidenomics mirage and as we warned in our preview, the October print indeed came “crashing down to earth”, sliding to 150K, a drop of more than 50% from the original Sept print, and the second lowest since 2022!

That surge, of course, was presented as evidence that Bidenomics was going to keep us out of recession and that the Fed would score a soft landing.

As usual, historical data was revised massively lower, with the jobs change for August revised down by 62,000, from +227,000 to +165,000, and the change for September was revised down by 39,000, from +336,000 to +297,000. With these revisions, employment in August and September combined is 101,000 lower than previously reported. In total, 8 of the past 8 months have been revised sharply lower in what only idiots can not see is clearly mandated political propaganda designed to make the economy look stronger at first glance then quietly revise the growth away.

Apparently, the BLS was no longer able to find a way to justify even initial numbers that put the economy up in the safe zone, while stocks loved the bad news as if it were good today only because the whole stock market has been reduced by Fed intervention for years to a casino for betting on what the Fed’s next major move will be. That is what happens when the Fed intrudes this far into the economy. Stocks were happy today that the Fed’s broken gauge for telling it when to stop tightening is finally getting closer to the orange time-to-stop zone. (That unemployment rate, in today’s report, hit 3.9%, just a breath away from the Fed’s orange zone of 4% based on where the last ultimate low was. It is, however, the economy’s red zone because the Fed rarely stops tightening until we are well into recession.)

Of course, the downward revisions are nowhere near done: as Pantheon Macro writes, “the jobs number likely will be revised down, continuing the pattern of downward revisions” as “the unemployment rate is on course to breach the 4.0% mark soon” tripping the recession redline.

And here is what one analyst I respect, Lance Roberts, has to say about that 4% unemployment number that we are finally brushing up against as well as those retail sales numbers that I wrote about earlier this week as actually reflecting a failing economy, once corrected for their inaccuracy, and actually reflecting a failing consumer as well:

What we currently see in the job and retail sales data is not suggesting a more robust economic growth rate in the future. As we will discuss, it is just a reflection of the fading economic activity driven by the last remnants of financial stimulus.

He hits the same two points today that I have been hitting about the Fed’s broken gauges that will cause the Fed to tighten us deep into a recession. I also wrote about how recession can turn down on a dime from GDP that is being reported as high, just as Roberts does:

Economic data runs with a reasonably significant lag. Such is because the data is subject to extensive negative revisions in the future….

Uh huh. This relates particularly to my comment this week about Jerome Powell’s claim that economic data doesn’t show a recession anywhere in sight. Roberts quotes someone else on this:

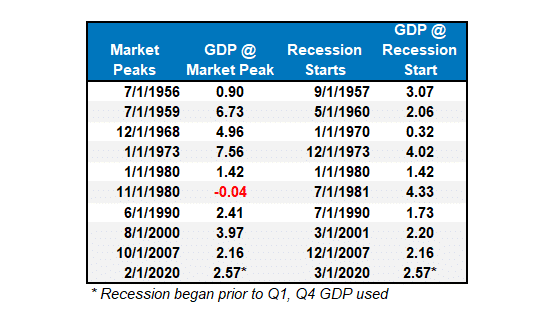

“Each of the dates [in the table below] shows the economy’s growth rate immediately before the onset of a recession. You will note in the table that in 7 of the last 10 recessions, real GDP growth was running at 2% or above. In other words, according to the media, there was NO indication of a recession. But the next month, one began.”

GDP almost always turns negative at the last second and isn’t what it is right now anyway

To see what Roberts is talking about, look at the GDP given for the month immediately before the recession in the right column of the table:

Note that in three of those dates GDP growth, immediately before going negative into recession, was even in the 3-4% range. The very next month it was negative.

The Federal Reserve manages monetary policy in the “rear view” mirror.

Yes, the Fed steers its policy by looking backward while driving forward. It looks at what the economy has been doing because the current month’s or quarter’s activity is never known, and even past months tend to be reported high by all governments that want to look good and then get revised down significantly to reality as later months fly by (when they think you are not looking).

The Fed’s broken unemployment gauge is finally moving

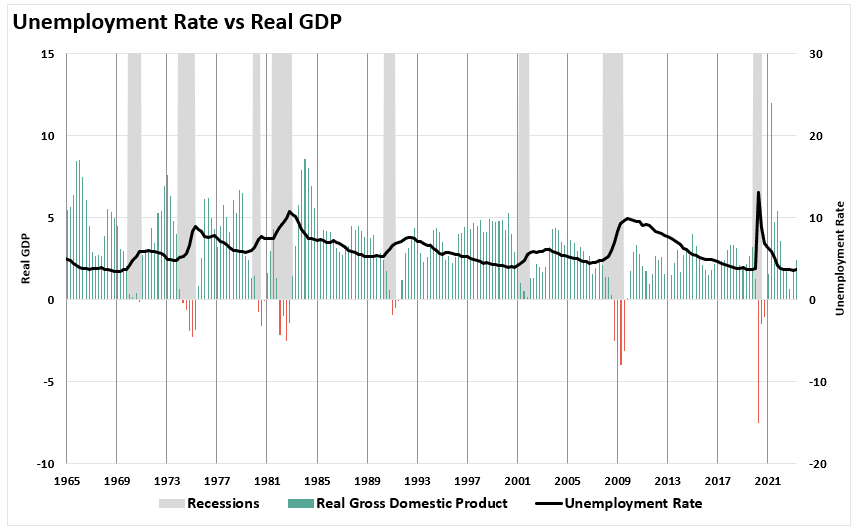

And here is where the Fed’s most historically accurate recession gauge (when it is working) comes in because it is very consistent in predicting recession about the instant the unemployment number rises 2-4 tenths of a percent from its lowest point in the cycle, which puts 4% as the highest number that needs to be hit for this last cycle before we go immediately into recession:

As you can see, recession ALWAYS butts right up to the first whisper of an upturn in unemployment, and we are now just one more tenth of a percent from hitting the highest amount of upturn needed to put us solidly in recession.

The Fed’s broken gauge is finally wiggling, but other signs say we are actually in a recession already (because the gauge, as I’ve noted had been broken this time, as we all know employment had made no sense by historic standards; therefore, it would show the critical number late in the game. ACTUAL “real” GDP is also possibly negative or close because the government has been seriously understating actual inflation for years, so when inflation is running very high as it is now, it has a bigger impact when the numbers are off by the same percentage they are normally off because we’re talking much bigger numbers in all categories with the same percentage of error.

They are all laggards

Roberts notes how recession dating always starts with a lag because the agency that makes the official call waits until revisions are in for GDP and unemployment to finally make the call retroactively. At that point, the recession gets declared to have started as soon as unemployment hit that critical small upturn:

Low unemployment precedes recessions because we are looking at “revised” data. As noted last Friday, it is often 6-12 months later when the National Bureau of Economic Research (NBER) dates the start of a recession. This is because the data must be revised before the official dating of the recession start is made….

“The chart below shows the S&P 500 with two dots. The blue dots are when the recession started. The yellow triangle is when the NBER dated the start of the recession. In 9 of 10 instances, the S&P 500 peaked and turned lower before the recognition of a recession.”

What he’s saying is the yellow triangle marks when the NBER made its decision. The start of the gray bars is when they decided the recession actually started. Later, they decide when retroactively when it actually ended and that becomes the end of the gray bars.

The S&P peaked long ago, but as I say, the jobs numbers are so distorted by the government plus so broken in terms of what is happening due to the huge breakdown in the labor pool that happened due to the Covid lockdowns and tightness that is due to missing laborers, not strong demand. That’s why the gauge is faulty this time. We haven’t been in that situation before. (Plus we entered a technical recession when I said we would at the start of 2022, but it wasn’t officially recognized because of that broken labor gauge that was lying labor was strong when it was effectively dying, and the huge number of jobs being fulled were largely part-time jobs filled by the same workers.) However, the unemployment gauge is finally moving in the direction the Fed needs to see in order to stop tightening, as I said it would do too late in the game to guide the Fed, EXCEPT that this time the Fed is tightening because inflation is hot (and back to slowly rising). That was not the case in most past times, so the Fed may not stop as easily as it normally would without inflation driving it.

And here, Roberts, hits my other point about retail sales this week and Powell’s lame claim of no recession in sight based on current indicators:

Do you see the problem of the “no recession” call by economists? The same issue comes to retail sales data. Economists believe that recent robust retail sales data negates the recession.

That was also my claim earlier this week. Roberts quotes one of the numbskull economists, who gives a huge number of major reasons to believe we are already in a recession, but then hangs his claim that we are not in recession solely on consumer spending (retail sales):

“Despite a low saving rate, slow demographics, depressed confidence, a crippled housing market, rising interest costs and growing credit problems, we estimate that American consumers increased their inflation-adjusted spending by more than 4% in the third quarter.” – David Kelly, chief global strategist at JPMorgan Asset Management

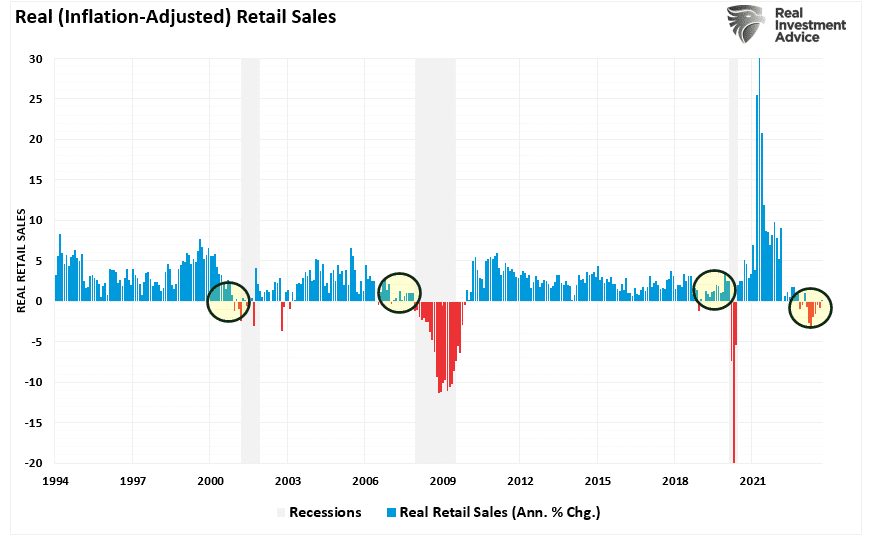

No, they didn’t. Reported inflation is just that far off, so it is not being subtracted properly out of sales data. That is largely because CPI (and PCE) is hugely lagging in reporting actual housing expenses. Everyone knows — even the Fed — that there is, at least, a six-month lag between what happens in housing prices (and probably more like a year) and what gets shown in CPI. Likewise, actual medical costs were hugely under-reported on purpose in CPI due to an intentionally year-long large adjustment every month to “make up for past mistakes.”

That is why everything looks recessionary in today’s news, except jobs and “real” GDP (because not nearly enough inflation is being taken out of the raw GDP numbers) and consumer sales (for the same reason). Now jobs appear to be catching up to what everything else looks like as all the grossly overestimated jobs numbers get revised down and as the unemployment needle in the broken labor market finally starts to quaver.

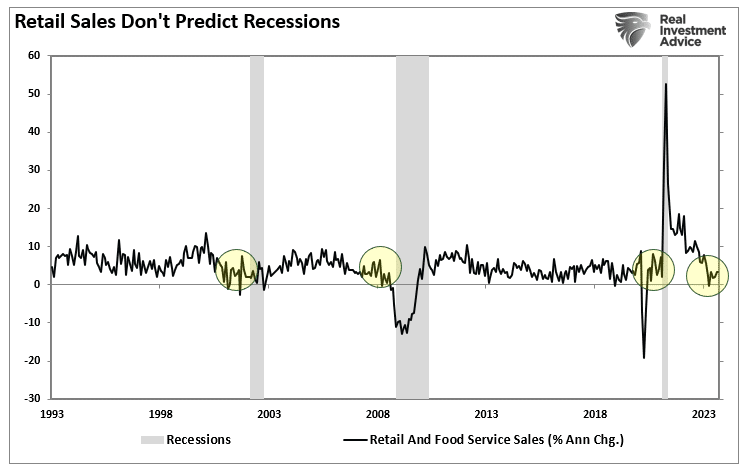

Retail sales are recessionary

On a nominal basis [i.e. not adjusted for inflation], it is pretty clear that retail sales have ticked up recently. However, as shown, upticks in retail spending, like the jobs data, are often seen just before the onset of a recession. As such, the recent strength in trailing retail sales data gives us little to no indication of the recession risk ahead.

“Nominal,” of course, meaning the raw sales data, not adjusted for inflation. That has gone up.

So, we got those burps in nominal sales recently that you see circled in the graph above, but those typically DO happen right before a recession. In reality, factor out inflation to get REAL sales, and sales are down; but the nominal number going up is not even a sign that we are avoiding a recession. It typically does burp up then the recession begins.

In his graph, Roberts puts REAL retail sales in the negative (as do I) and shows how that happens inside of recessions, so it not a forward indicator. When it is happening, we are usually already in recession:

And, so, we are, as I was claiming this week, already likely back in recession this quarter, but it won’t get declared right away and maybe not as beginning in this quarter because the unemployment gauge used by both the Fed and NBER has been broken and inflation is grossly underestimated right now.

And the likelihood of overtightening by the Fed — something I have said for a couple of years, at least, I am absolutely certain they would do when we finally got to this juncture — is high based on Powell’s own words:

“Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing could put further progress on inflation at risk and could warrant further tightening of monetary policy.”

The Fed will over tighten because it does not understand why the data is faulty.

Says Roberts,

That robust data is subject to sharp negative revisions in the future. Such puts the Fed at risk of exacerbating an economic contraction by keeping monetary policy “too tight for too long.” Historically, when the Fed hikes rates, there is eventually a breaking point where unemployment rates shoot higher. Such is because the data is strong until it isn’t.

That has long been a theme of mine as well.

Everything else in today’s news screams recession already

And what about that news brief showing how the rest of today’s economic news stories shout out “recession?” Well, here is the gist of the other headline economic stories:

- Consumer confidence falls to five month low. (No wonder.)

- Bankruptcies are spiking.

- The services sector of the economy signals the “summer surge” is over.

- Burger King reports a dismal sales miss (and it is not because the American consumer finally hates their cheeseburgers; it is a change in spending due to actual inflation hitting the consumer hard, and those sales numbers would be far worse if actual inflation were subtracted out).

- Major shipper cuts 10,000 jobs because global overseas shipping is WAY down.

But my favorite headline is the one about Treasurer Janet Yellen defending herself over Stanley Druckenmiller’s claim that she is completely inept and should be fired for not issuing more of the nation’s debt in long bonds when low interest on long bonds could be had, which I covered earlier this week. Yes she is, and yes she should be.

Views: 463