Biden’s leading “economist” Lael Brainard loves to brag about the strong economy under Bidenomics, and then pulled a brain freeze when asked about crashing savings rates as consumers struggle with inflation.

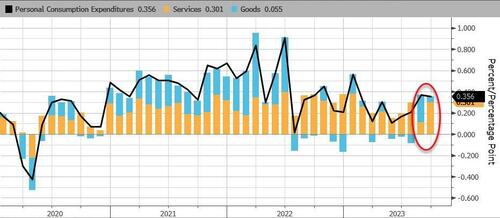

The good news? One of The Fed’s favorite inflation indicators – Core PCE Deflator – slowed to 3.7% YoY in September (its lowest since May 2021). Headline PCE was flat at 3.4% YoY. Both were in line with expectations… But 3.4% is still far too high compared to The Fed’s target of 2%.

Source: Bloomberg

Now for the bad news. However, while the YoY data slowed, Core PCE rose by 0.3% MoM – the biggest MoM jump in four months.

Services inflation excluding housing and energy accelerated to 0.4%, from 0.1% in the prior month.

The overall PCE price index, meanwhile, rose 0.4%, bolstered by higher energy prices.

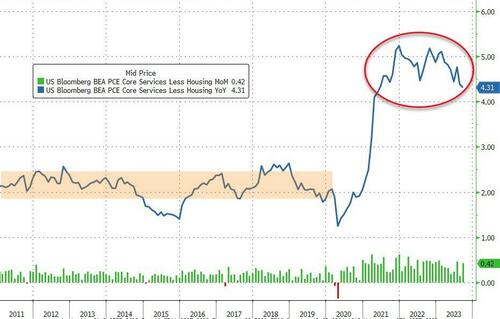

Even more focused, is the Fed’s view on Services inflation ex-Shelter, and the PCE-equivalent shows that it is slowing/trending lower but very much still stuck at high levels (and rose a large 0.4% MoM)…

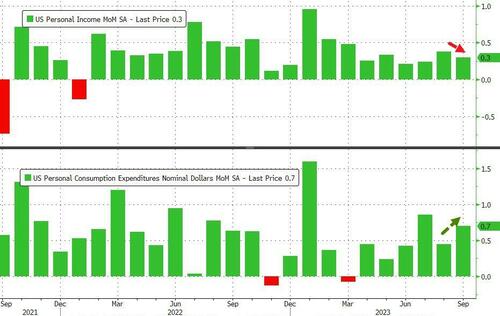

Personal Consumption soared 0.7% MoM while incomes grew at only 0.3% MoM…

Source: Bloomberg

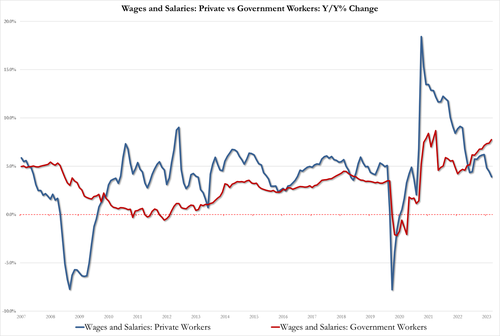

Focusing on the income side alone, private workers wages plunged to 3.9%, down from 4.5% and the lowest since Feb 2021.

So where is the offset to hot wages you may ask? Why government workers: wages of govt workers are up 7.8% YoY vs 7.4% in August and approaching the record high of 8.7% in Oct 2021

All of which means the personal savings rate collapsed even further, from 4.0% to 3.4% of DPI…

Source: Bloomberg

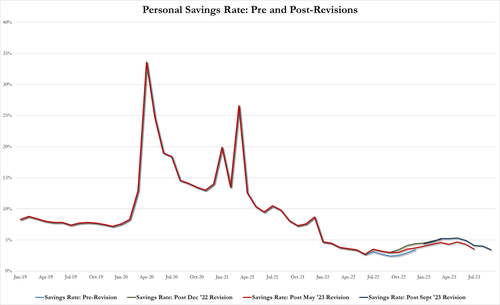

The savings rate is down 4 straight months, back near record lows… AND this is after artificial revisions that artificially boosted the savings rate 3 times in the past year (see above chart)

Bidenomics, hard at work.

On the commercial real estate front, office delinquencies are on the rise again. But in San Francisco (queue the late Tony Bennett), the office vacancy rate soared to 30.4% in Q3.

And if you’re going to San Francisco, be careful where you walk because of exploding crime, feces on the sidewalk, homelessness and used needles.