Japan is slowing losing control of its bond market.

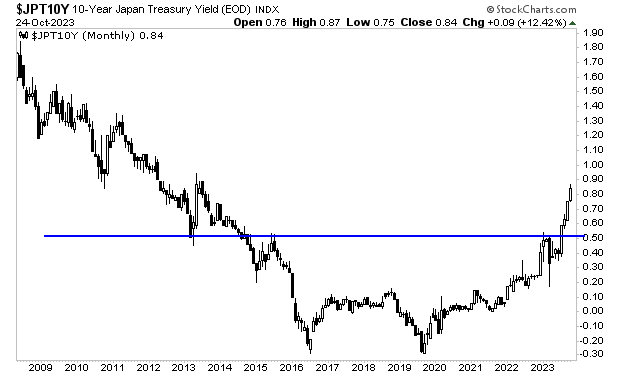

The Bank of Japan (BoJ) is currently engaged in an open-ended Quantitative Easing (QE) program. In its simplest rendering, the BoJ starts buying the 10-Year Japanese Government Bond any time that bond’s yield rises to 1% or higher.

It’s possibly the boldest QE program in history: a definitive “line in the sand” drawn by a major central bank as far as bonds are concerned. Again, this is an open-ended, unlimited QE program through which a MAJOR central bank does whatever it takes to keep is country’s bond yields from rising.

However, even this program is proving inadequate.

The BoJ has had to engage in previously unscheduled bond market interventions SIX TIMES in the last month. The below chart needs little explanation. You can see that yields broke above critical resistance in mid-2023 and have gone vertical ever since.

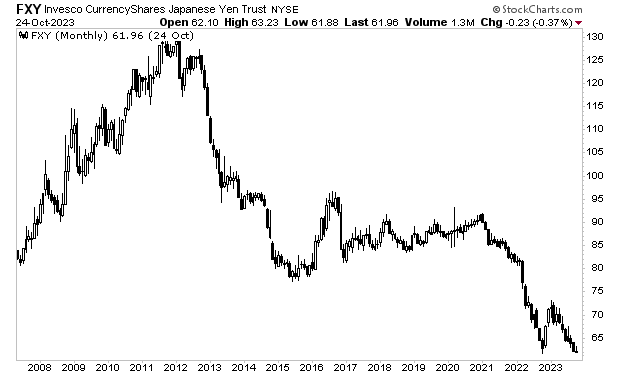

At this point, the BoJ is now having to engage in direct interventions in its bond market more than once a week. And this is happening at a time when the Japanese currency (the Yen) is about to break to new lows.

As I keep warning, the Great Debt Crisis of our lifetimes is fast approaching.

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

The Great Debt Bubble burst in 2022. And the crisis is now approaching.