Bidenomics strikes … again. No, not his inane ramblings about Hamas being “the other team” or that Hamas has to learn to shoot straight. But his policies freezing effects on the economy. Like housing.

Existing-home sales faded in September, according to the National Association of REALTORS®. Among the four major U.S. regions, sales rose in the Northeast but receded in the Midwest, South and West. All four regions registered year-over-year sales declines.

Total existing-home sales – completed transactions that include single-family homes, townhomes, condominiums and co-ops – waned 2.0% from August to a seasonally adjusted annual rate of 3.96 million in September. Year-over-year, sales dropped 15.4% (down from 4.68 million in September 2022).

…

Total housing inventory registered at the end of September was 1.13 million units, up 2.7% from August but down 8.1% from one year ago (1.23 million). Unsold inventory sits at a 3.4-month supply at the current sales pace, up from 3.3 months in August and 3.2 months in September 2022.

The total existing home sales SAAR dropped back below 4mm for the first time since October 2010 (during the foreclosure crisis)…

Source: Bloomberg

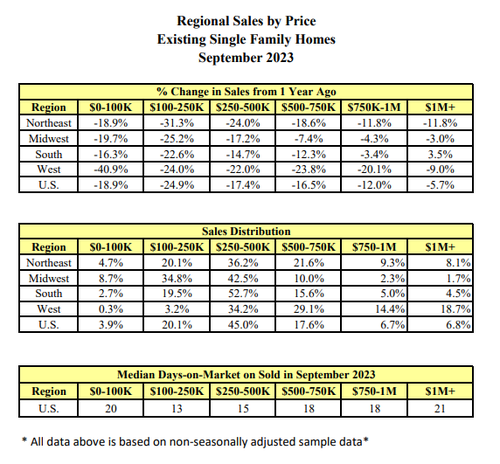

Sales fell in all regions except the Northeast in September… and in every price range…

Single-family home sales fell to an annualized 3.53 million pace, the lowest since 2010. Condominium and co-op sales also declined.

“As has been the case throughout this year, limited inventory and low housing affordability continue to hamper home sales,” said Lawrence Yun, NAR’s chief economist.

“The Federal Reserve simply cannot keep raising interest rates in light of softening inflation and weakening job gains.”

First-time buyers made up a historically low 27% of purchases, down from the prior month.

Cash sales represented 29% of total sales, matching the highest level in over a decade. Investors, who often purchase with cash and are therefore less sensitive to mortgage rates, made up 18% of the market.

“It would be very unusual to have higher cash compared to first time buyers,” Yun said on a call with reporters.

And, if mortgage rates (and thus affordability) are anything to go by, things are about to get real…

Source: Bloomberg

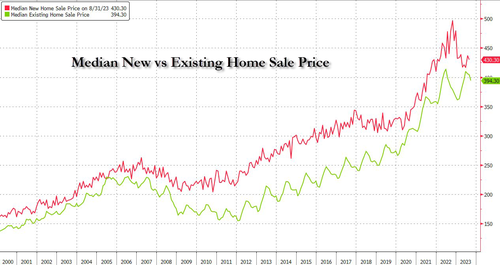

The median selling price rose 2.8% from a year earlier to $394,300, the highest September reading on record, pushing affordability even lower. But existing home prices are falling relative to new home prices (with the ratio near record lows)…

Finally, amid all this un-affordability for shelter, some Americans are turning elsewhere…and with mortgage rates back above 8%, it can only get worse.

It looks like The House may elect a RINO as Speaker (Patrick McHenry, RINO-NC) to replace McCarthy. One RINO replacing another RINO … all so The House can continue its insane, inflation inducing spending.