Its the Biden Bop! As Bidenomics continues its blitzkrieg on the US economy with the Federal government massively expanding its debt while households and business cut back on debt.

The US government is the only sector to have notably borrowed on a net basis over the last five years. The market sees that as inflationary, driving yields higher.

The pandemic saw an increase in the borrowing of all sectors. But it was the government that saw the biggest rise in GDP terms, and it is the government whose debt is still considerably higher than it was before the pandemic – the debt-to-GDP ratio is up 16 percentage points over the last five years.

In contrast, the household sector’s leverage is now lower than it was pre-pandemic, while the corporate sector’s is only marginally higher. The US government has become the borrower of first as well as last resort.

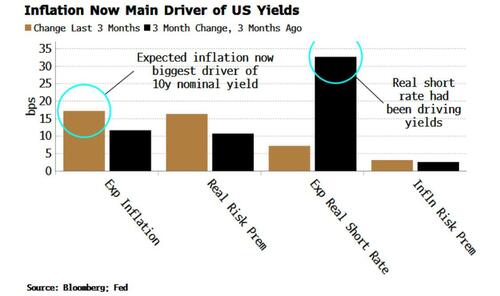

The market is picking up on this and is pricing accordingly. We can decompose nominal yields into a sum of expected short rate + real term premium + expected inflation + inflation term premium (see here for more).

Over the last three months, the main driver of rising yields in the US has been expected inflation, followed by the real risk premium. This marks a change from earlier in the year where the principal driver was the expected short rate, i.e. expectations of increases in the Federal Reserve’s policy rate.

Regressing the fiscal balance with the yield components shows that only inflation and the inflation risk premium have a negative sign, i.e. when the fiscal balance falls (greater deficit), expected inflation and the risks surrounding it increase.

Not only does increased government borrowing push up borrowing costs through greater inflation risks. When the sovereign is the only borrower, it crowds out the rest of the economy. With governments’ reputation for inefficiency, this depresses real growth.

The lost decades in Japan were primarily a result of the government stepping in to borrow as the private sector nursed its wounds from the late 1980s financial crash. But that perpetuated and entrenched the situation. With the Treasury now the sole borrower of any significance, the US risks going down a similar, yet more stagflationary path, hindering real growth, and keeping yields elevated.

On the private sector side, bank credit fell again last week.

Views: 43