The great debt crisis of out lifetimes is approaching.

The U.S. has now reached the point at which it is adding debt at an exponential rate.

It took the U.S. 232 years to rack up its first $10 trillion in debt. Thanks to the Fed’s egregious monetary policies following the Great Financial Crisis, the U.S. added another $10 trillion in debt in just nine years as the government went on a spending spree.

It’s added another $10 trillion in a little over FOUR years, thanks to the insane spending the U.S. implemented following the pandemic.

And the pace is only accelerating.

In June of this year, the U.S. had $31 trillion in debt. Today, it’s over $33 trillion. So we’ve just added another $2 trillion in a little over FOUR MONTHS.

And the Fed is confused as to why U.S. Treasuries are collapsing!?!

Basic economics tells us that the more of something there is… the less value it holds. Small wonder then that as the U.S. issues more and more debt, the debt is collapsing in value.

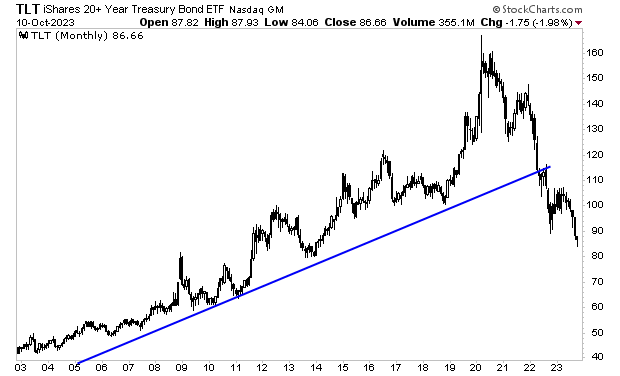

Below is a chart of the long-term U.S. Treasury ETF (TLT). It needs no explanation.

Again, the great debt crisis of our lifetimes is fast approaching.

In 2000, the Tech Bubble burst.

In 2007, the Housing Bubble burst.

The U.S. Treasury bubble burst in 2022. And the crisis is now approaching.