by qtrinh3

CNBC: Wholesale inflation rose 0.5% in September, more than expected

The producer price index (wholesale price) is up 0.5% month to month. Beating the expected 0.3% rise MoM for September. CPI this Thursday will be bad as well (trust me bro). However, the US10Y is down yesterday and today. This is NOT because inflation is going down but due to the flight to safety because of the conflicts between Israel and Hamas (in time of worries, people buy treasuries as a safe haven which pushes down yield). However, combining wars with a strong labor markets, union strikes, and crazy consumers spending, inflation is NOT going away anytime soon. As a matter of facts, just like the 70’s, it will come back with a revenge. This inflation ‘fight’ may last up to a decade. YES a DECADE.

Wall Street and Hedge Funds hate QT and normal (Not high!) interest rates. They are crying for the FED to cut rates and relaunch QEs again. They need more assets bubbles to inflate away their debts and inflate their assets to kingdom ‘CUM’! At the same time, QEs have caused F**KING huge wealth gaps. They or the 1% want the people to work for pennies while they can borrow for free and get unlimited printed money. Well F*ck them! They have been calling for a recession for a while now! Eventually that will happen but your puts will have expired by then!

Don’t believe all these PIVOT talks. They are pure propaganda BS. Inflation is here to stay. At some point in the future, YES we will head back to the 2% target rate. But only if all of these three things happen together.

- Interest rate must be well ABOVE the inflation rate. YES! We need interest rate to go much higher! 5.25-5.50% is still historically very low and that is not high enough to combat inflation! For example, if car prices are going up 10% a year and saving rate is 5%, are you stupid enough to wait to buy a car next year? No, you buy it now! If you wait, you lose out. You will only wait to buy if saving rate is 12% or 13% or higher!

- Government cannot spend more money then they take in! US government cannot do deficit spendings anymore. This year alone we will have a over 2 trillions dollars deficit. This is like pouring gasoline onto the fire. Interest rate is still not high enough to force anal pain to the drunken morons in the government. STOP spending money you don’t have Assh*les!

- All the asset bubbles must BURST! The Everything Bubble must go BUST! This includes housing bubble, stock bubble, bond bubble, sh*tcoin bubble, art sh*t bubble, classic sh*t car button, luxury sh*t watches bubble, etc. Too much money was printed and it went into mal-investments. This must stop and normal asset prices must match their fundamentals.

What is the probability of all of these 3 things happening this year or next? 0.00001% (again, trust me bro).

Now wait, you are probably thinking Oh Great Regard, if asset bubbles burst and prices come crashing down, wouldn’t that bring down inflation. NO NO NO NO!!!! You are confusing asset prices with consumer prices! Assets prices like stocks, bonds, houses, etc., are prices or costs of investments. Consumer prices are prices of everyday things we need! Things like your monthly shelter cost, food cost, energy cost, transportation cost, etc. So if house prices crashed 50%, it doesn’t matter. They don’t use house prices in the CPI anyway. They use owners’ equivalent rent measurements which have been underestimating real rents for decades. Just think about this, your landlords have a mortgage on the property they rent to you. Housing prices crashed 50% but at the same time, his costs like property taxes, maintenance costs, mortgage go up or stay the same. Do you fu*king think you can ask for 50% drop in monthly rents? F**KED NO!

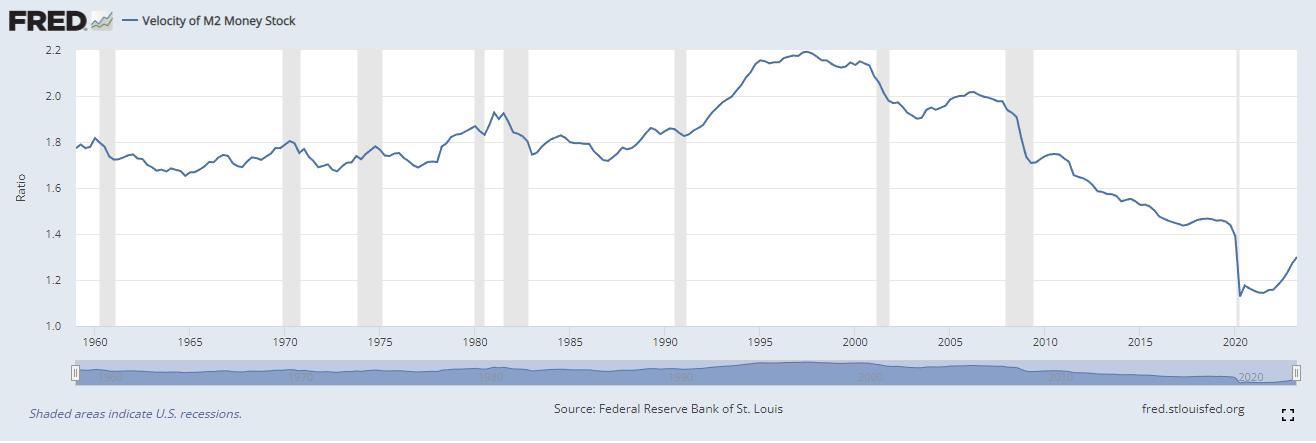

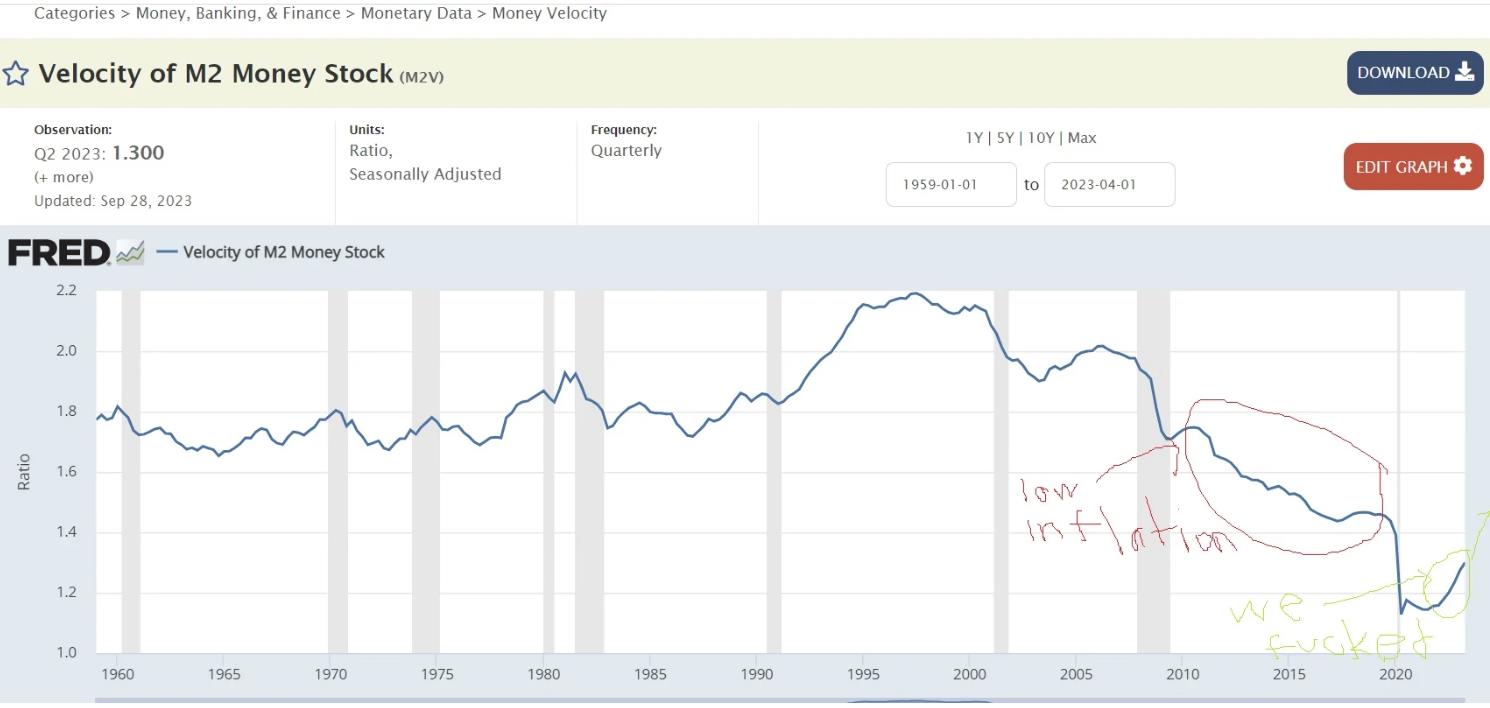

We have been printed money since QE1 Nov 2008 so why didn’t we get inflation? We got QE1, QE2, QE3, etc, so what gives? Well, to have inflation you need three things:

- Money Supply (M1/M2) –> Ding Ding (money is created)

- Velocity of Money Supply –> X (money gets to the consumers)

- Dumb Idiots to spend it again –> X (Money gets recirculated through the economy)

We had 1 but not 2 or 3. Look at https://fred.stlouisfed.org/series/M2V

Money got stuck in sh*tcoin or other bad \”investment\”

So why didn’t we get money velocity? What happened to all the money from QEs and suppressed low interest rates? Well, the money (most of it) went to the 1% MF c*cksuckers at Wall Street, Hedge funds, Billionaires, Money losing start-ups, which didn’t need the money in the first place and invested most of that crap in stocks, bonds, real estates, sh*tcoins, etc. That money got sucked into mal-investments and were not spent into the economy! That ended with the COVID-19 pandemics when money finally hit the average people on main street. See the green circle I draw with my green Crayola. Once we got 2 and 3, we are now officially f**cked!

Summary

Long story, short. Interest rate will be normal again. Not high, normal again. QE is a thing of the past. All of the problems we have today is because of government deficit spendings and the QEs that enable it. We cannot go back to 0% rate or QEs. You need to invest wisely again.