Bonds finally bounced yesterday. However, the bounce was relatively weak and didn’t signal the “all clear.”

Simply put, things stabilized. But they didn’t actually improve much. And market leading indicators suggest this correction isn’t over yet.

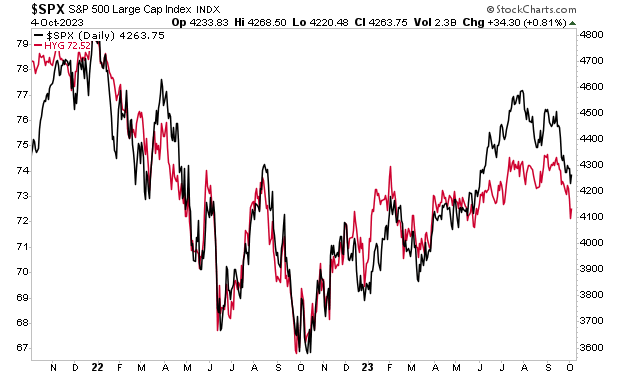

High yield credit typically leads stocks both the upside and the downside. It bottomed weeks before stocks did in October 2022. And right now, it’s telling us the S&P 500 could easily go to 4,100.

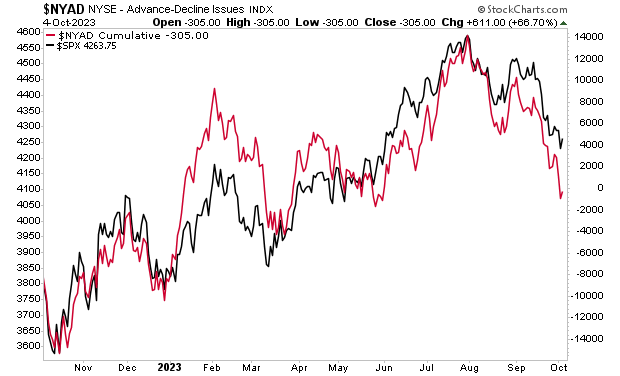

Breadth is another market leading indicator I watch. And it is also telling us stocks are not finished falling just yet. Again, I don’t trust this bounce in stocks at all.

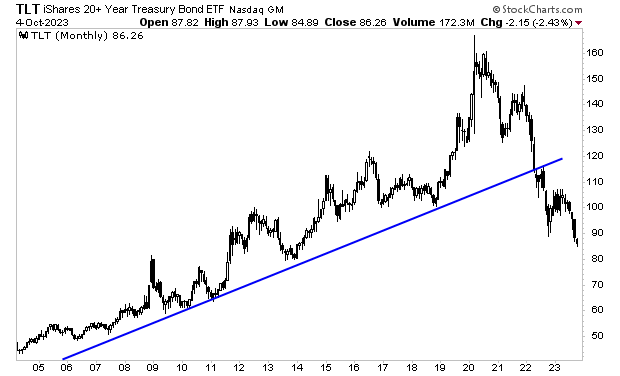

Again, the long-end of the Treasury market has completely collapsed. Banks and financial entities are sitting on hundreds of billions of dollars worth of losses. As I keep warning, the Great Debt Crisis of our lifetimes is fast approaching. The time to prepare is NOW, before it hits.