via Mike Shedlock:

The Fed erroneously does not consider rising home prices as inflation. Here’s the result in pictures.

Chart Note

- Case-Shiller measures repeat sales of the same home over time. This ensures an accurate comparison of room size, yard size, and amenities. The only drawback is the data lags a bit. The most current data is from July representing transactions in May and June.

- OER stands for Owners’ Equivalent Rent. It’s the price of rent one would pay to rent one’s own house, unfurnished without utilities.

For 12 years, home prices, OER, Rent, and the overall CPI all rose together. That changed in 2000 with another trendline touch in 2012. Then it was off to the races as the Fed did round after round of QE, suppressing mortgage rates.

Case-Shiller Home Price vs Hourly Earnings, the CPI, and Rent

As with the previous chart, for 12 years, home prices, rent, the overall CPI and hourly earnings all rose together. That changed in 2000 with another trendline touch in 2012.

How Much Are Homes Overpriced?

If the 12-year trend of home prices rising with average hourly earnings stayed intact, the home price index would be 211, not 308.

From that we can calculate home prices are ((308-211) / 211) percent too high, roughly 46 percent too high. If you prefer, home prices would need to fall ((308-211) / 308), roughly 31 percent.

Alternatively, if home prices stagnate for years, wages may eventually catch up.

Case-Shiller Home Price 1988=$150,000

The same home that cost $150,000 in 1988 now costs $678,366. But wages have gone up too. And mortgage rates have had wild swings.

Mortgage Payment and Wage Adjusted Mortgage Payment

The Least Affordable Mortgages in History

Factoring in wage growth, home prices, and mortgage rates, homes are the most expensive ever.

It’s actually much worse than the chart indicates because property taxes and insurance are not factored into.

Mortgage Rates

Through massive and totally unwarranted QE, foolishly hoping to create more inflation, the Fed suppressed interest rates to record lows and mortgage rates followed.

Anyone with an an existing mortgage could and did refinance at 3.00 percent or below.

This increased “affordability” and we now have two classes of people courtesy of the Fed: winners and losers (existing home owners who refinanced low and those who want to buy).

Mortgage Application at 30-Year Lows

Please note Mortgage Application Volume Nears 30-Year Lows

“Mortgage rates continued to move higher last week as markets digested the recent upswing in Treasury yields. Rates for all mortgage products increased, with the 30-year fixed mortgage rate increasing for the fourth consecutive week, up to and above 7.53 percent – the highest rate since 2000,” said Joel Kan, MBA’s Vice President and Deputy Chief Economist. “As a result, mortgage applications ground to a halt, dropping to the lowest level since 1996. The purchase market slowed to the lowest level of activity since 1995, as the rapid rise in rates pushed an increasing number of potential homebuyers out of the market. ARM loan applications picked up over the week and the ARM share increased to 8 percent, as some borrowers searched for ways to lower their payments.”

What About the Winners?

Good question. The winners refinanced at 3.0 percent or below. This put extra money in their pockets every month to spend.

And rising wages further stimulated ability of the winners to buy goods and services.

Thus the Fed is still paying for its asinine push to create inflation.

Meanwhile, the housing market is dead and will remain dead with mortgage rates approaching 8.00 percent.

What About Rent?

That’s another good question. For 24 months or so, economists have been predicting an ease in rent inflations.

On September 13, I noted Consumer Price Inflation Jumps 0.6 Percent Led by Energy and Shelter

The price of gasoline rose 10.6 percent, rent another 0.5 percent, shelter, 0.3 percent, and new cars 0.3 percent leading the way for a 0.6 percent increase in the CPI in August.

The price of rent has gone up at least 0.4 percent for 25 straight months. Not to worry, Paul Krugman says this is lagging.

When Will Record Housing Units Under Construction Ease Rent Inflation?

On October 2, I asked When Will Record Housing Units Under Construction Ease Rent Inflation?

That’s really a trick question. For a better question, remove the lead “when” from the sentence.

The answer is: I don’t know, nor does anyone else, although people claim to be clairvoyant.

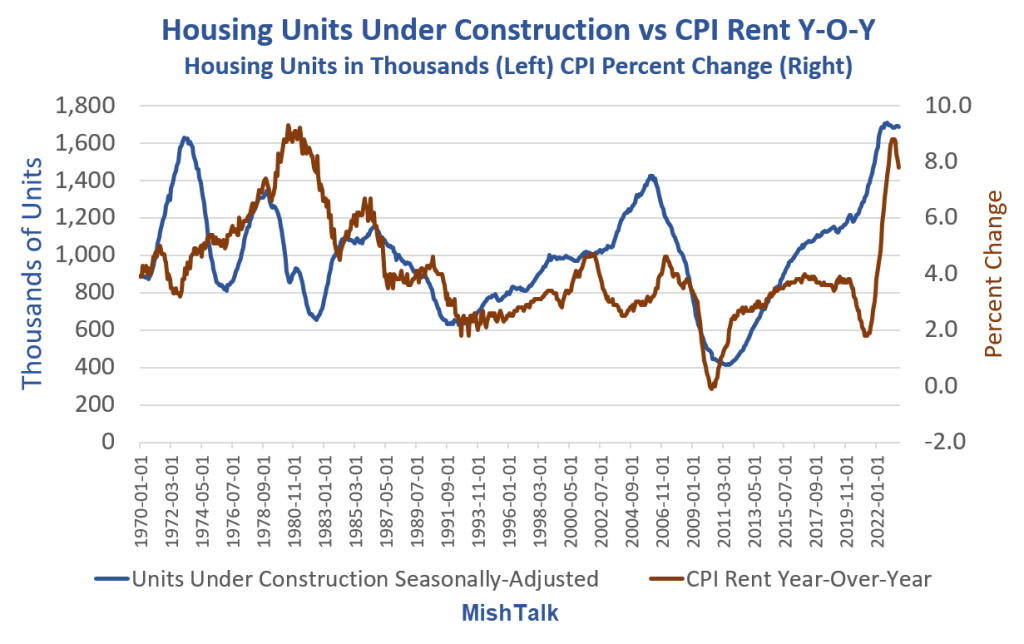

Housing Units Under Construction vs CPI Rent Year-Over-Year

I saw the theory that rent would collapse as soon as housing units get completed so many times that I almost started believing it myself.

However, the data shows no discernable correlation no matter how you shift the lead or lag times.

The chart looks totally random. So perhaps rent abate. Perhaps not. The data itself provides no reason to believe anything.

Regardless, please note the floor. Year-over-year rent has a floor of about 2 percent except in the Great Recession housing crash.

And these charts are not imputed Owner’s Equivalent Rent prices for which people pay no actual rent. These charts reflect rent of primary residence.

34 Percent are Screwed

Well, don’t worry. Only 34 percent of the nation rents, and besides, rent is lagging.

Sarcasm aside, the Fed blew huge asset bubbles and did not see that as inflation. Nor did the Fed see that three massive rounds of fiscal stimulus would cause inflation.

Real Income and Spending Billions of Chained Dollars

Note the three rounds of massive fiscal stimulus in the Covid pandemic. This triggered the most inflation since the 1970s. Economists debate how much “excess savings” still remains.

For discussion of excess savings, please see Excess Pandemic Savings, How Much is Still Unspent?

The Fed never saw this coming, never saw a housing bubble in 2007, and has never once predicted a recession.

Heck, former Fed chair Ben Bernanke denied a housing bubble and denied a severe recession that had already started.

Expect More Inflation Everywhere

Unfortunately, Biden is doing everything humanly possible to stoke inflation with EV mandates, natural gas mandates, union pandering, student debt forgiveness, and regulations, some of which is blatantly unconstitutional.

As a result, Fed Rate Interest Rate Hike Expectations Are Still Higher for Even Longer

Looking to Buy a Home?

If you are looking to buy your first home and need to finance, good luck.

The longer the Fed holds rates high, the longer the housing transaction crash lasts. But cutting rates will further expand the housing bubble, asset bubbles in general. And bubbles are destabilizing.

That is the Fed’s tightrope dilemma, of its own making.

If you are one of the winners, congrats. But that extra money the Fed put in your pocket every month may stoke inflation for a long time.