The Bear Market never ended. The end of this bear market rally is rapidly approaching…….

— Win Smart, CFA (@WinfieldSmart) October 5, 2023

G, we already there…

Long-duration US TSY bonds have now lost more in % terms than stocks did during the GFC in 2008-2009

The drawdown in Vanguard Ext Duration Treasury ETF (-58.3%) now exceeds the peak-to-trough losses suffered in the S&P 500 during GFC crash (-56.0%) pic.twitter.com/QOVEUECknP

— Blake B. Millard, CFA (@BlakeMillardCFA) October 5, 2023

Losses are surely widespread among many institutions at this point. Certainly the BTFP facility implemented in the March bailouts is still at highs in terms of usage. https://t.co/dGfUH0AZFk

— David Sommers (@dgsommersmkts) October 5, 2023

The United Nations is essentially recommending to central banks worldwide to reconsider the 2% inflation target to prevent a full-blown recession.

The script continues to get better by the day.

What a time to be alive.

— Gold Telegraph ⚡ (@GoldTelegraph_) October 4, 2023

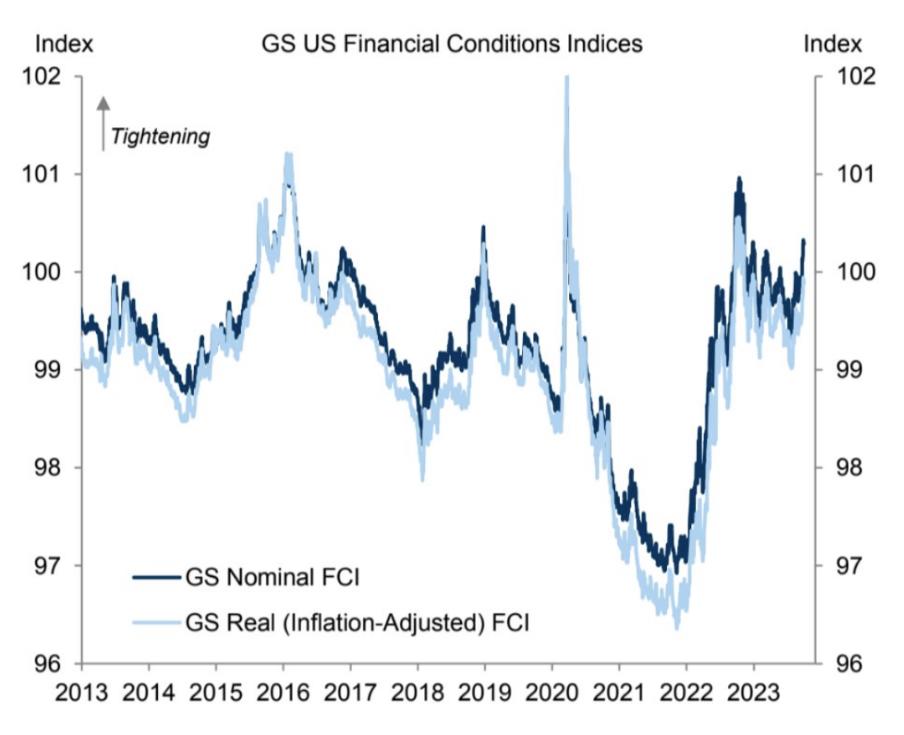

Financial conditions tightened the last week, due to a higher 10-year Treasury yield, lower equity prices, a stronger dollar, and higher BBB credit spreads

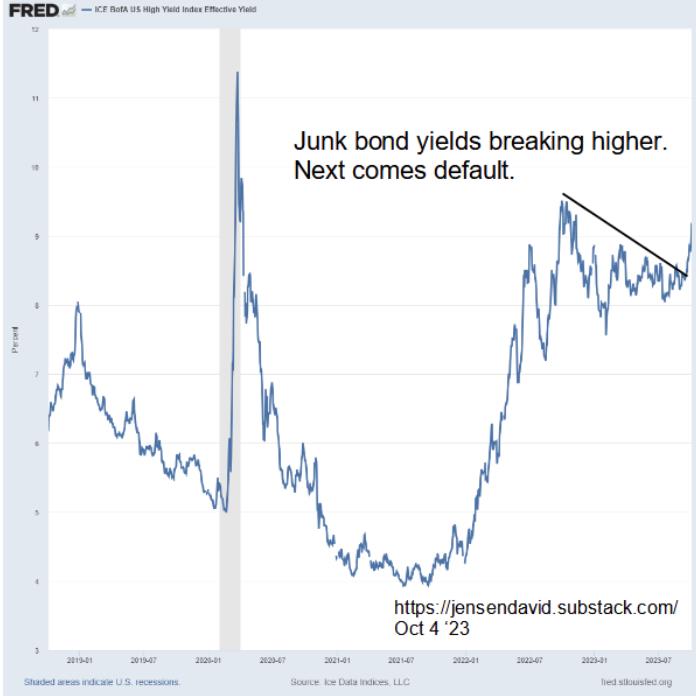

Accelerating Junk Bond default is coming.

We Need a Stock Market Crash to Save Treasuries — Just Like 1987

h/t mark000