by Chris Black

The Treasury market may be entering a period of historic volatility on par with March 2020 as leveraged investors have stalled in their purchases and a new marginal buyer has not yet arrived.

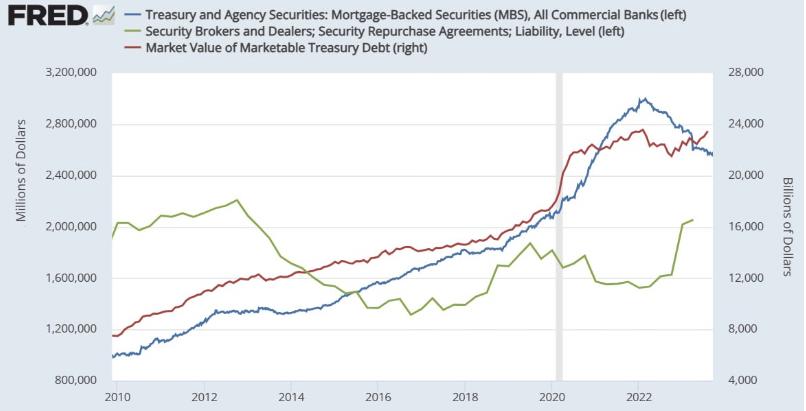

When the Fed and commercial banks stepped away from the Treasury market in mid-2022, hedge funds stepped in (fedguy.com/back-to-2019/) and bought cash Treasuries in size as part of a cash futures basis trade.

The financing for that trade is sourced through dealer repo, which grew rapidly in mid-2022 and has since stalled.

While dealers have access to virtually unlimited financing from Fed repo borrowing (libertystreeteconomics.newyorkfed.org/2022/01/the-feds-latest-tool-a-standing-repo-facility/), the size of their activity is constrained by balance sheet costs.

If the leveraged buyers are reaching financing limits, then a new marginal Treasury buyer must emerge to absorb the sizable upcoming issuance (www.bloomberg.com/news/articles/2023-08-02/us-plans-103-billion-debt-sale-says-issuance-to-keep-rising).

This post describes the constraints of investor repo financing and suggests that the search for next marginal buyer will be difficult .

Dealer Repo Limits

The amount of financing the dealer community can provide their investor clients is limited, but that limit is not directly observable.

Basel III places capital costs (fedguy.com/to-slr-or-not-to-slr/) on activity of banks, who then ration capital along subsidiaries, divisions and business lines according to firmwide strategy.

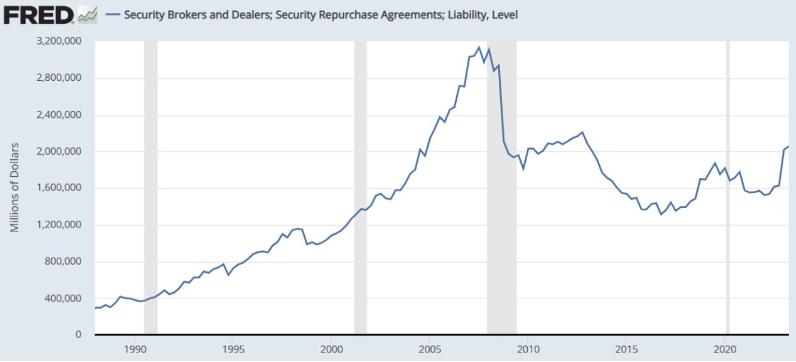

Repo financing is an activity that is relatively low in margin and high in capital costs (www.ecb.europa.eu/pub/conferences/ecbforum/shared/pdf/2016/duffie_paper.pdf), so it is disfavored and has actually declined since 2007.

This is a major difference from the pre-Basel III world, where balance sheet was virtually unlimited so even marginally profitable trades could be financed. The aggregate amount of repo financing dealers can provide their clients is thus inelastic in the short-run, as allocating more capital to a particular business line is a bureaucratic process.

It is thus possible for Treasury investors relying on repo financing to run out of money .

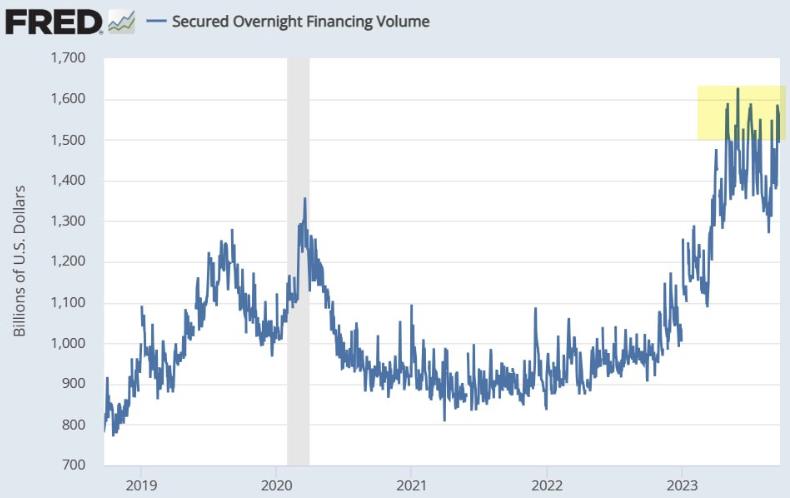

Dealer repo borrowing and lending activity suggests that the dealer community may be approaching a limit in their ability to provide investors with Treasury repo financing. While dealer balance sheet limits are unobservable, some indicators of dealer cash borrowing and cash lending have stalled for months.

Dealers borrow and lend to each other as they fine tune their positions, but net cash into the dealer community is largely from cash providers like money market funds.

Dealers then take this cash and re-lend it to their leveraged investor clients, such as hedge funds.

SOFR (www.newyorkfed.org/markets/reference-rates/sofr), a measure of overnight Treasury repo, captures the main segments of the repo market where dealers borrow from cash providers. SOFR volumes surged in line with the widely reported increase in the cash-futures basis trade (www.federalreserve.gov/econres/notes/feds-notes/recent-developments-in-hedge-funds-treasury-futures-and-repo-positions-20230830.html) activity, but has since stalled for months (fred.stlouisfed.org/series/SOFRVOL).

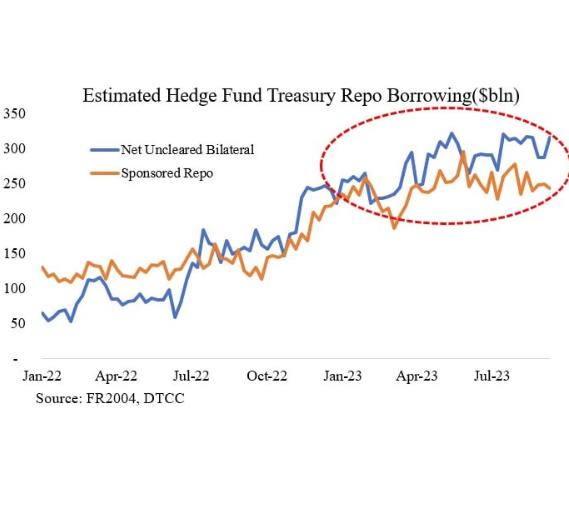

Dealer net lending in Treasury repo to leveraged investors also appears to have also stalled. The bulk of dealer lending to leveraged investors is either via uncleared bilateral repo (www.financialresearch.gov/the-ofr-blog/2022/08/24/non-centrally-cleared-bilateral-repo/) or through sponsored repo (www.dtcc.com/clearing-services/ficc-gov/sponsored-membership).

New reporting requirements (www.federalreserve.gov/econres/notes/feds-notes/insights-from-revised-form-fr2004-into-primary-dealer-securities-financing-and-mbs-activity-20220805.html) have unmasked activity in the uncleared bilateral repo market and reveal a pattern of surging and then stalling.

Sponsored Repo, a relatively new form of repo borrowing that is more balance sheet efficient, also shows that hedge fund sponsored repo borrowing grew (www.federalreserve.gov/econres/notes/feds-notes/recent-developments-in-hedge-funds-treasury-futures-and-repo-positions-20230830.html) and then stalled in recent months.

Note that a decline in leveraged investor borrowing could also be due to less demand for Treasury exposure due to factors such as changes in investment strategy or risk appetite.

In any case, it shows that a significant source of marginal cash Treasury demand is exhausted.

Running Out of Money

The Treasury market is entering a period of uncertainty as it seeks a new marginal buyer amidst elevated net issuance.

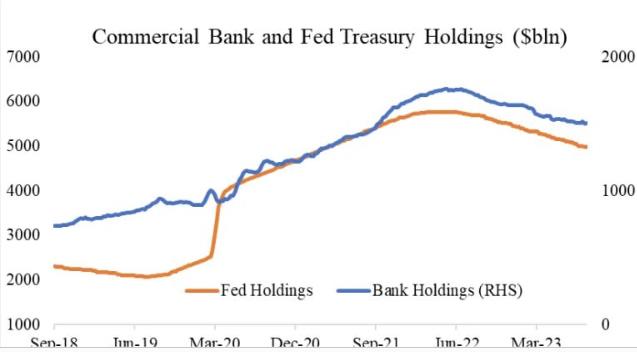

The Fed and commercial banks were the major Treasuries buyers post-2020, but they began reducing their holdings in mid-2022.

They were replaced by leveraged investors, who significantly increased their Treasury holdings in latter half of 2022 and into 2023.

The Treasury then softened the impact of large coupon issuance (jargon for Treasury notes and bonds, which have been financed by households (www.federalreserve.gov/releases/z1/default.htm)) by shifting towards bill issuance , which were bought by money market funds.

The Treasury even went so far as to change their issuance strategy by allowing bills to comprise 22.4% of debt outstanding (home.treasury.gov/news/press-releases/jy1670), above a previously self-imposed 20% guidance.

But that was only a temporary reprieve, and large coupon issuance is resuming (home.treasury.gov/news/press-releases/jy1671) again even as the leveraged investor purchases have stalled.

Interest rates going forward may be both higher and more volatile, with the potential for sudden discontinuities.

With leveraged financing potentially tapped out, the next marginal investor is likely a “real money” investor.

Real money investors like pension funds and insurance companies tend to move slowly, while on-going Treasury issuance is steady and significant.

Foreigner investors are also unlikely to step in as they have not been meaningful marginal buyers in over a decade (home.treasury.gov/system/files/221/TreasuryPresentationToTBACQ32023.pdf).

The QT timebomb (fedguy.com/the-qt-timebomb/) is still ticking, and only a return of the end investor of last resort can disarm it.

Views: 227