by j_stars

The era of free money and repeated financial bubbles driven by loose central banks is over.

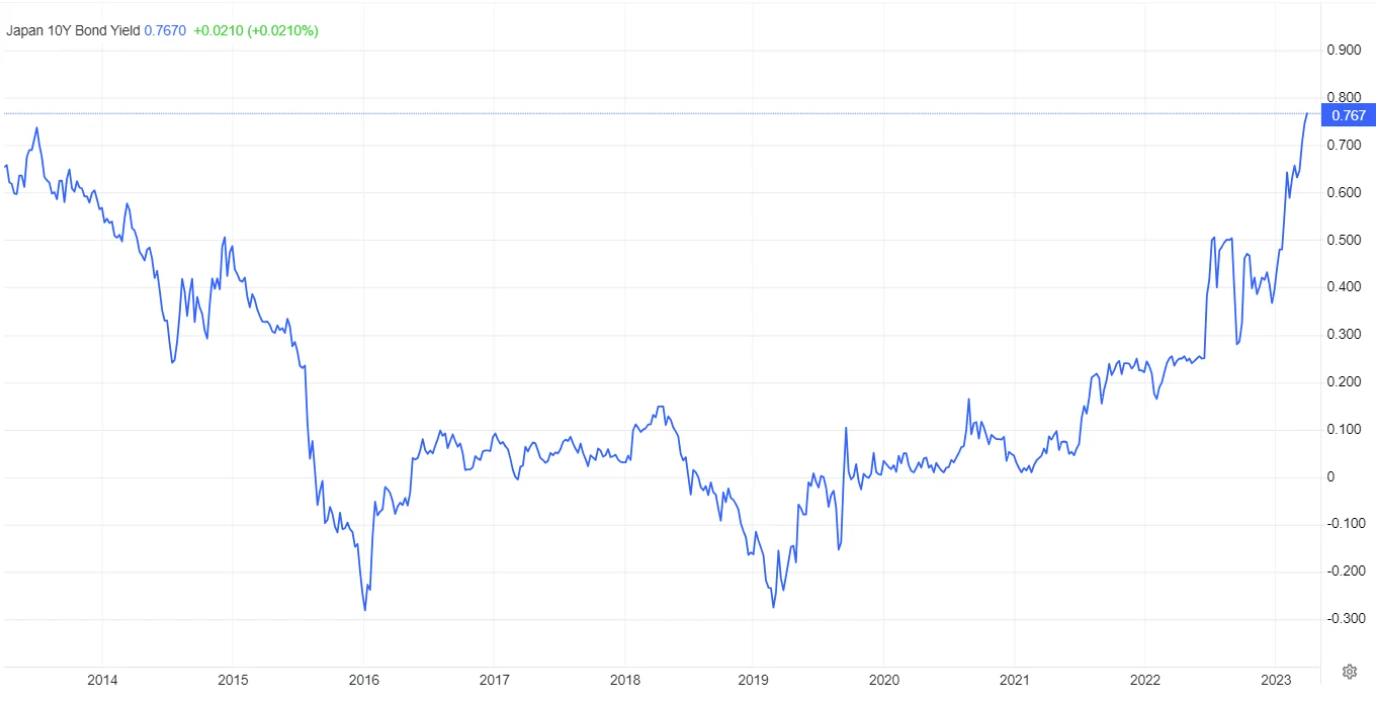

Japanese 10 Year Bond Yield

And Japan’s free money has been fueling US asset bubbles for decades through the carry trade. Imagine holding a negative rate long bond and rates shoot to 5+% suddenly.

BOJ Loosens Grip: Biggest Selloff in 25 Years Hits Japan Bonds

Amidst a fragile economy, Japan’s government bonds experienced their most severe quarterly selloff in over two decades, plunging 3% in Q3. This downturn underscores the market’s heavy dependence on the central bank’s actions. With rising speculation of the Bank of Japan terminating its negative-rate policy, Japan’s looming debt crisis becomes increasingly worrisome.