Credit card companies are facing their highest losses in nearly 30 years, while energy prices are going up again, despite people thinking inflation was under control. Banks are dealing with huge losses, and it’s becoming very hard for people to afford their own homes. More than 75% of homes on the market are too expensive for middle-income buyers, and banks are paying extra to protect their money because they’re worried about losing it. Mortgage rates have also jumped to their highest levels in 23 years.

Credit card companies are racking up losses at the fastest pace in almost 30 years.

Energy prices are now creeping up again.

People thought the fight with inflation was over.

Banks have tens of billions in unrealized losses.

“Houston, we have a problem.”

— Gold Telegraph ⚡ (@GoldTelegraph_) September 23, 2023

Meanwhile, housing has become so unaffordable that over 75% of homes on the market are too expensive for middle-income buyers.

Read more: t.co/95PT24E9A4

— unusual_whales (@unusual_whales) September 22, 2023

— Don Johnson (@DonMiami3) September 22, 2023

BBB Corporate Index Effective Yield

2008 vs 2023 t.co/bUwNa6Fp6L pic.twitter.com/96TztRpplk— Financelot (@FinanceLancelot) September 22, 2023

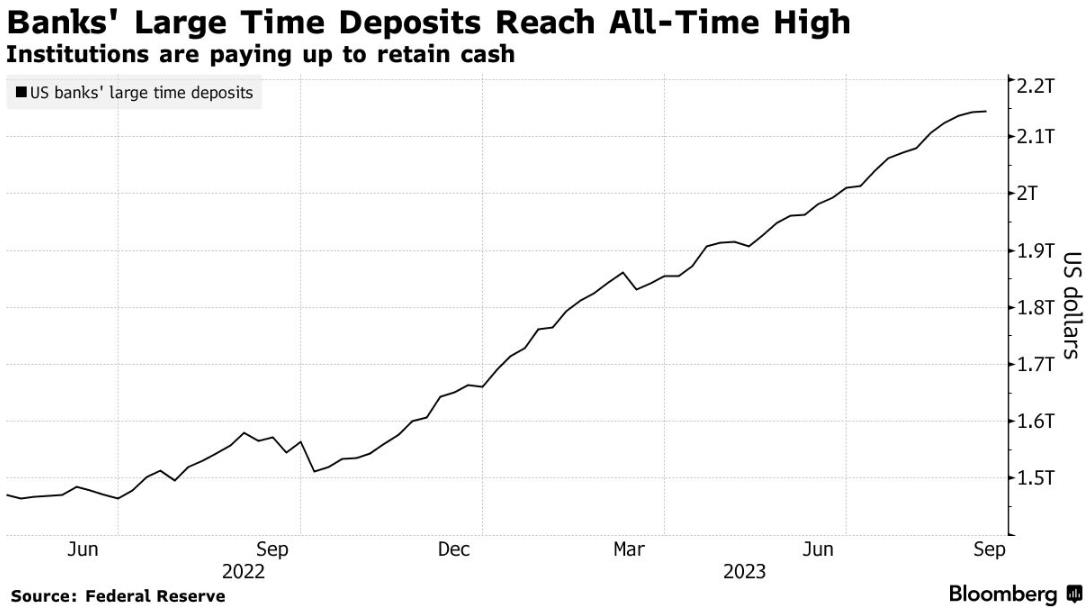

Banks Fearing a Liquidity Crunch Pay More to Cling to Cash

- BofA says banks seek ‘extra buffer’ in case deposits leave

- Large time deposits have risen $675 billion since June 2022

Banks are paying up to protect their cash holdings from sinking further and to safeguard against future runs on deposits, according to Bank of America Corp.

Big and small institutions alike started doing this even before the turmoil in the US banking system in March, said strategists Mark Cabana and Katie Craig. Data show large time deposits — or certificates of deposit issued in amounts greater than $100,000 — have risen by about $675 billion since the beginning of the Federal Reserve’s balance sheet unwind in June 2022.

Mortgage Rates Jump to the Highest Level in 23 Years

If you are looking to buy your first home and need to finance, good luck.

Views: 798