The global economic landscape is currently marked by significant uncertainty, and this uncertainty carries substantial risks for Japan’s economy.

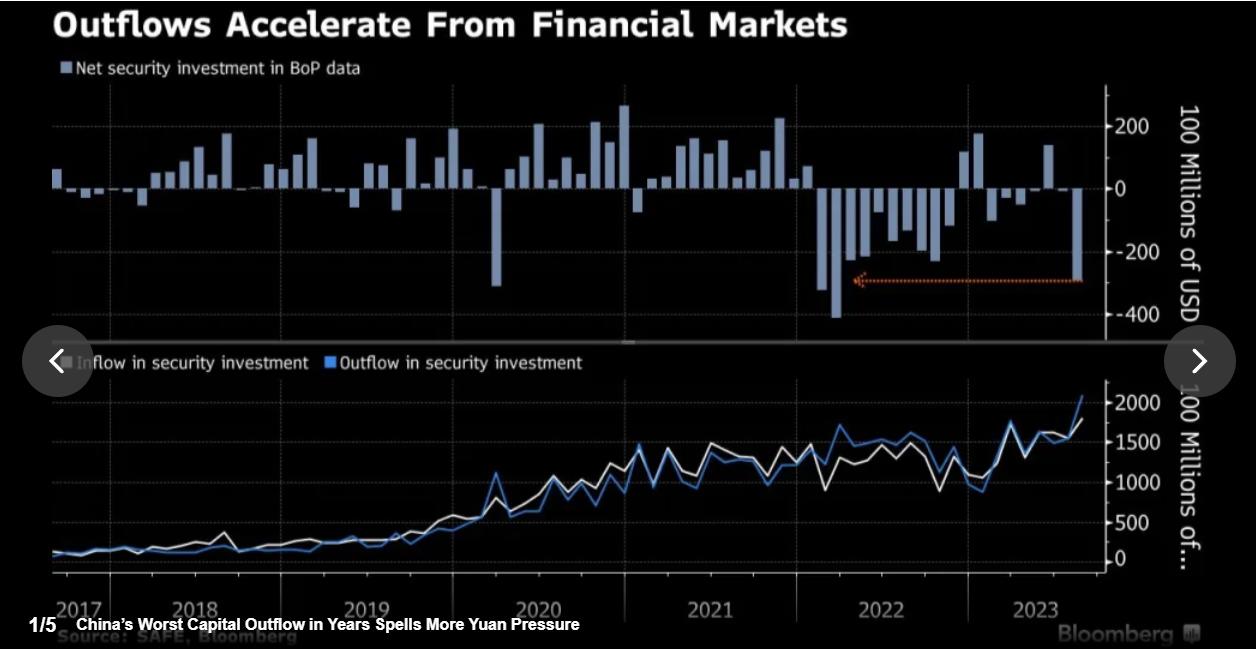

China, one of the world’s economic powerhouses, is experiencing a notable flight of capital, which has raised concerns among authorities. This situation adds further pressure to the already-struggling Chinese yuan, compounding economic challenges.

Germany, a major player in the global economy, is also grappling with the implications of these uncertainties. The Bundesbank has issued a warning, highlighting that a considerable 29 percent of German companies rely on China for essential materials and parts. This reliance exposes them to the potential for “significant” damage should disruptions occur due to escalating geopolitical tensions.

Meanwhile, in Canada, the housing market is experiencing a significant shift. Rising interest rates are leading to a scenario where housing investors are being forced out of the market. This transformation reflects years of overbuilding, resulting in a substantial oversupply of homes.

These economic dynamics are interconnected and underscore the delicate balance that global economies must navigate in the face of various challenges. Maintaining stability and preventing panic in financial markets, particularly in China, becomes a paramount concern as the consequences of these uncertainties ripple across the globe.

Sources:

Uncertainty over the global outlook is very high, posing a huge risk to Japan’s economy

Housing Investors Are Getting Flushed Out as Canada’s Rates Rise