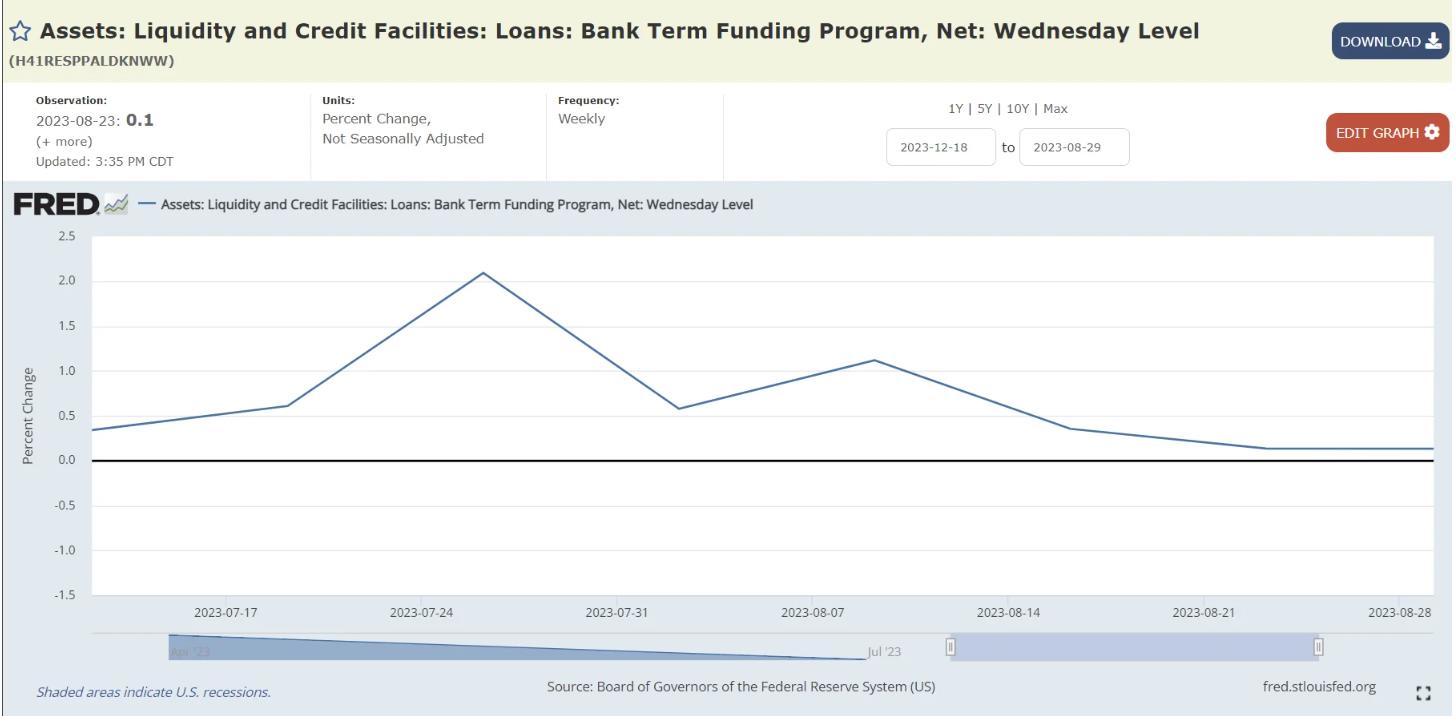

Borrowing from the Bank Term Funding Program hit a NEW all time high–the 15th consecutive week above $100 billion!

What we are reviewing:

- Bank Term Funding Program (BTFP)

- Discount Window/Primary Credit

- “Other Credit Extensions”

I hope to shed light on the recent uptick in borrowing due to an attempt to offset the initial shrink in M2 and dip in deposits. Buckle up!

Bank Term Funding Program (BTFP):

https://www.federalreserve.gov/releases/h41/20230914/

https://fred.stlouisfed.org/series/H41RESPPALDKNWW

10 straight weeks of growing!

- Association, or credit union) or U.S. branch or agency of a foreign bank that is eligible for primary credit (see 12 CFR 201.4(a)) is eligible to borrow under the Program.

- Banks can borrow for up to one year, at a fixed rate for the term, pegged to the one-year overnight index swap rate plus 10 basis points.

- Banks have to post collateral (valued at par!).

- Any collateral has to be “owned by the borrower as of March 12, 2023.”

- Eligible collateral includes any collateral eligible for purchase by the Federal Reserve Banks in open market operations.