by BoatSurfer600

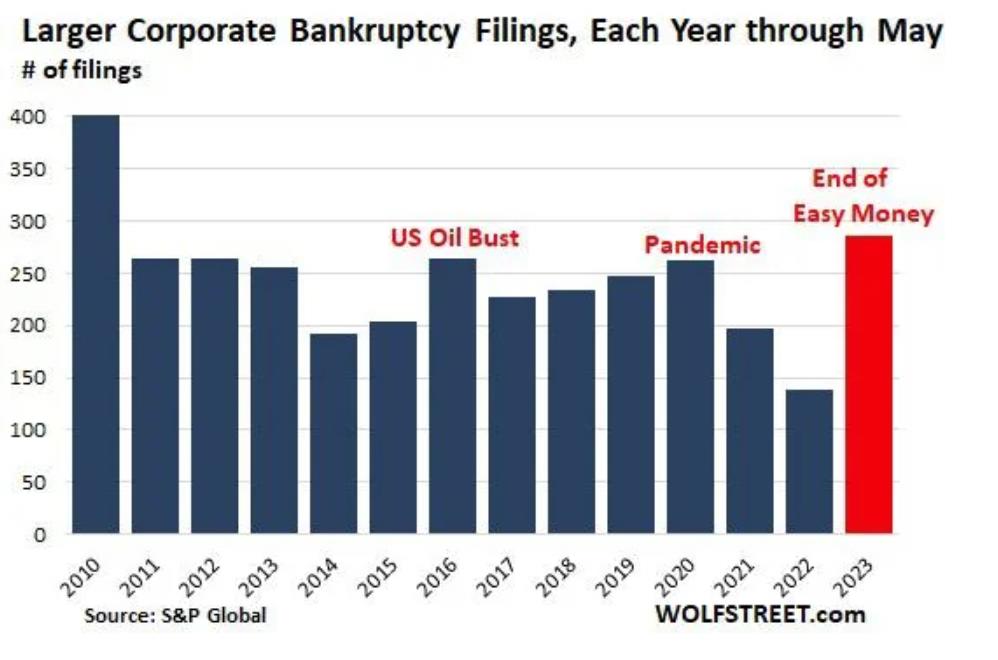

It’s turning into a banner year for corporate bankruptcy filings, after years of Easy Money that caused all kinds of excesses, fueled by yield-chasing investors, in an environment where the Fed had repressed yields with all its might. Those yield-chasing investors kept even the most over-indebted zombies supplied with ever-more fresh money. But that era has ended. Interest rates are much higher, and investors are getting a little more prudent, and Easy Money is gone.

At the peak of the Fed’s yield repression in mid-2021, “BB”-rated companies – so these companies are “junk” rated – could borrow at around 3% (my cheat sheet for corporate credit rating scales by ratings agency). Companies are junk rated because they have too much debt and inadequate cash flow to service that debt. In other words, investors risked life and limb to earn 3%, and now these investors are asked to surrender life and limb, so to speak. But that’s how it goes with yield-chasing.

These “BB” junk bond yields have risen to nearly 7%. This means these companies that had trouble producing enough cash flow to service their 3% or 5% debt, have to refinance this debt when it comes due, or add new debt, at 7%. That 7% may still be low, considering inflation running around near that neighborhood, but it puts a lot more strain on those companies.

Views: 66