https://www.newyorkfed.org/microeconomics/sce#/spendexp-1

Wut mean?

- The Federal Reserve Bank of New York’s Center for Microeconomic Data released the August 2023 Survey of Consumer Expectations.

- Income growth perceptions declined in August, and job loss expectations rose sharply to its highest level since April 2021.

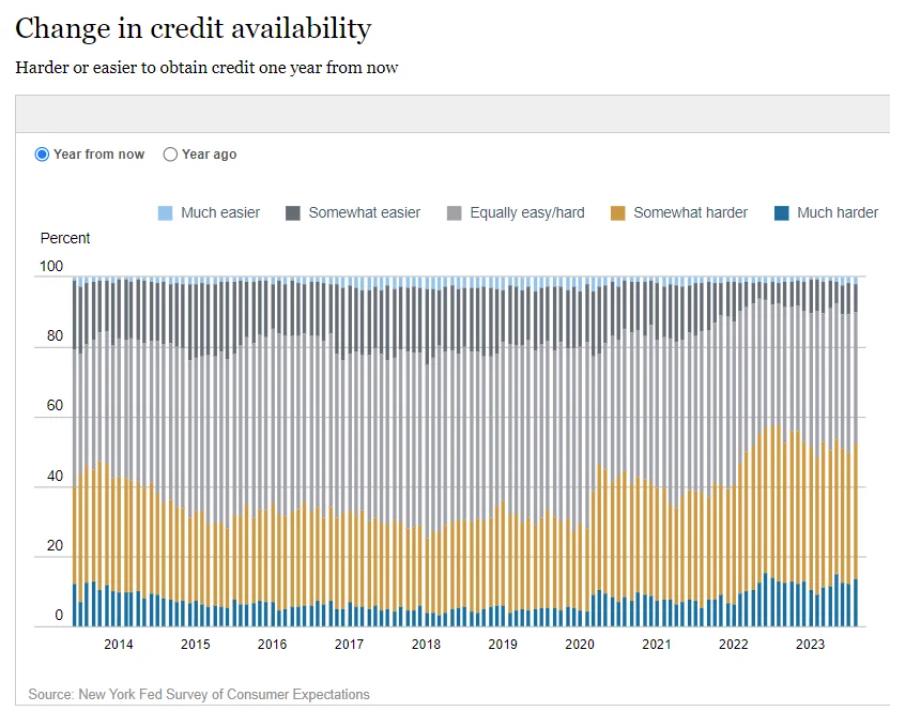

- Perceptions about current credit conditions and expectations about future conditions both deteriorated.

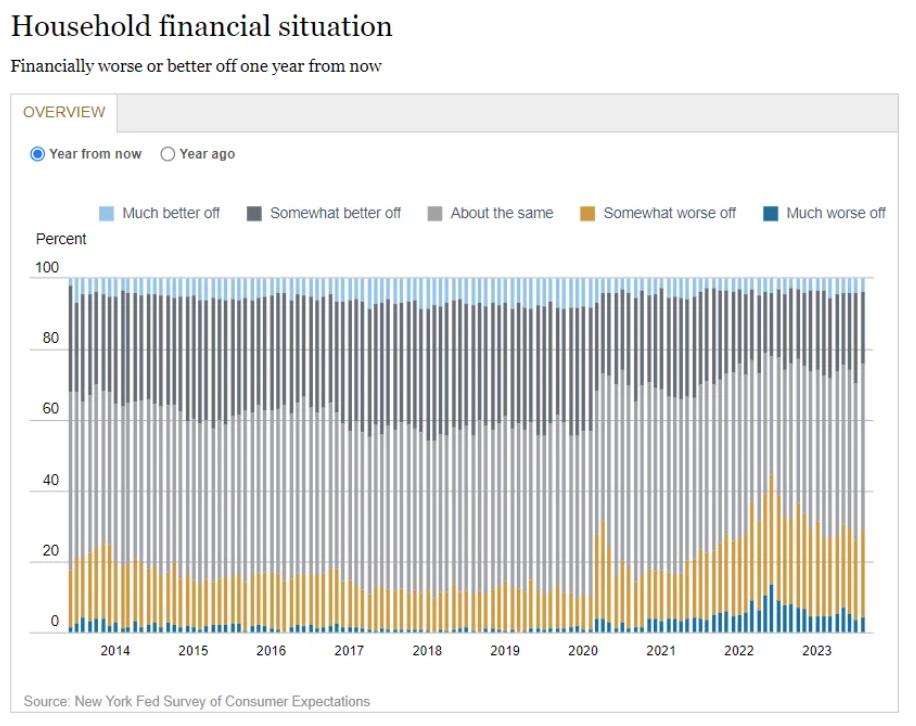

- Households’ perceptions about their current financial situations and expectations for the future also deteriorated.

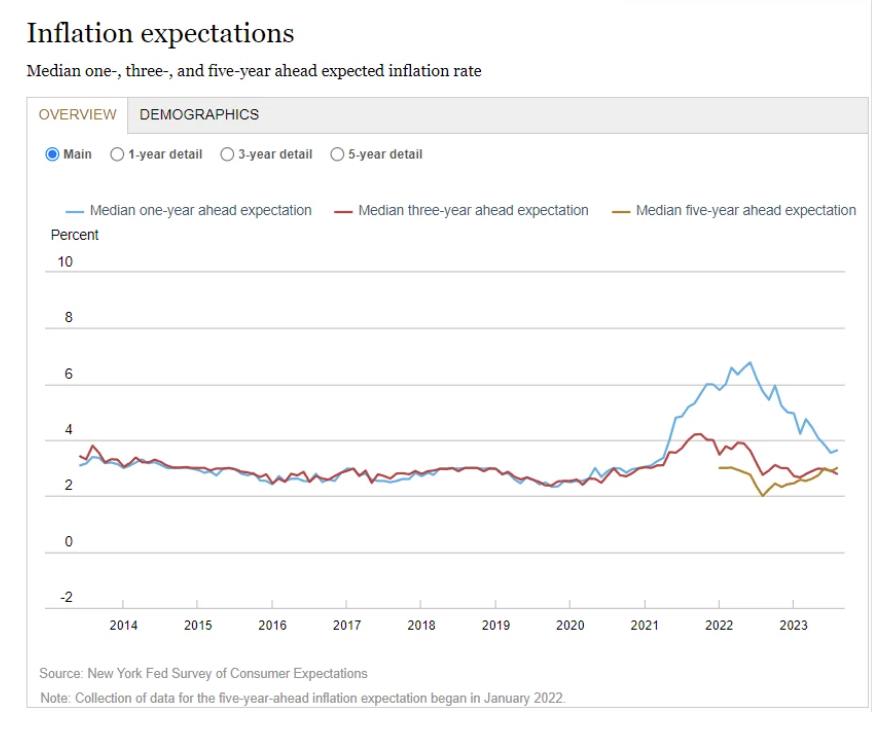

Inflation:

- Median one- and five-year-ahead inflation expectations rose slightly in August, both increasing by 0.1 percentage point to 3.6% and 3.0%, respectively.

- Conversely, three-year-ahead inflation expectations declined by 0.1 percentage point to 2.8%. The survey’s measure of disagreement across respondents (the difference between the 75th and 25th percentile of inflation expectations) increased at the one-year-ahead horizon and decreased at the three- and five-year-ahead horizons.

- Median home price growth expectations increased by 0.3 percentage point to 3.1%, its highest reading since July 2022.

- The increase was most pronounced for respondents under the age of 60 and those with a high school education or less.

- Year-ahead commodity price expectations rose across the board in August, increasing by 0.4 percentage point for gas (to 4.9%), 0.1 percent point for food (to 5.3%), 0.8 percent point for the cost of medical care (to 9.2%), and 0.2 percentage point for the cost of college education (to 8.2%) and rent (to 9.2%).

Labor Market:

- Median one-year-ahead expected earnings growth rose by 0.1 percentage point to 2.9% in August. The series has been moving within a narrow range of 2.8% to 3.0% since September 2021.

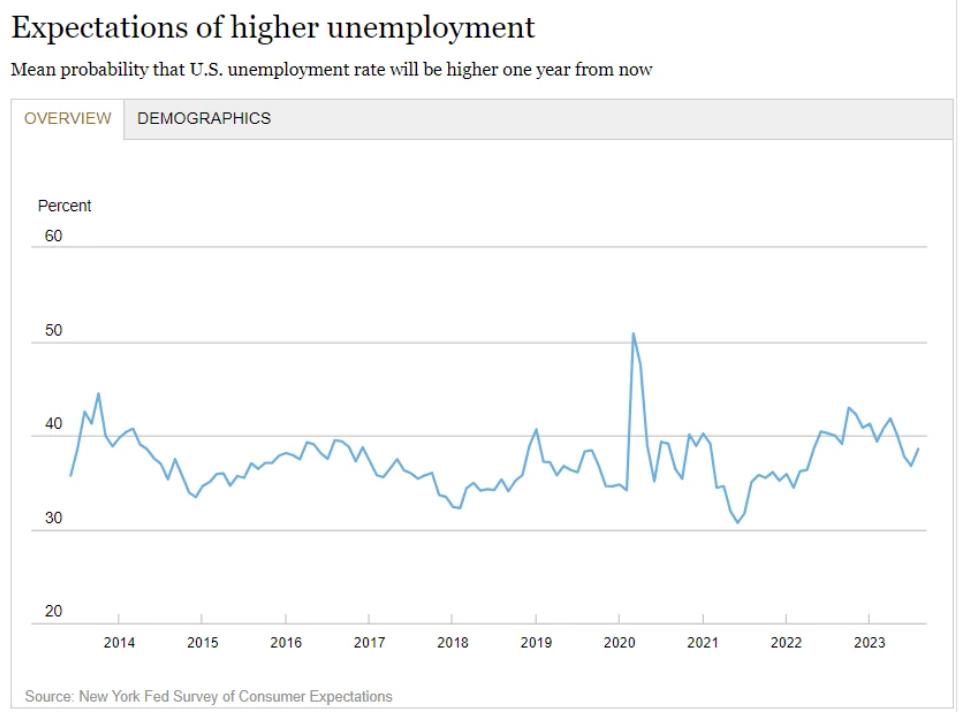

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased by 1.8 percentage points to 38.5%, remaining below its 12-month trailing average of 40.2%.

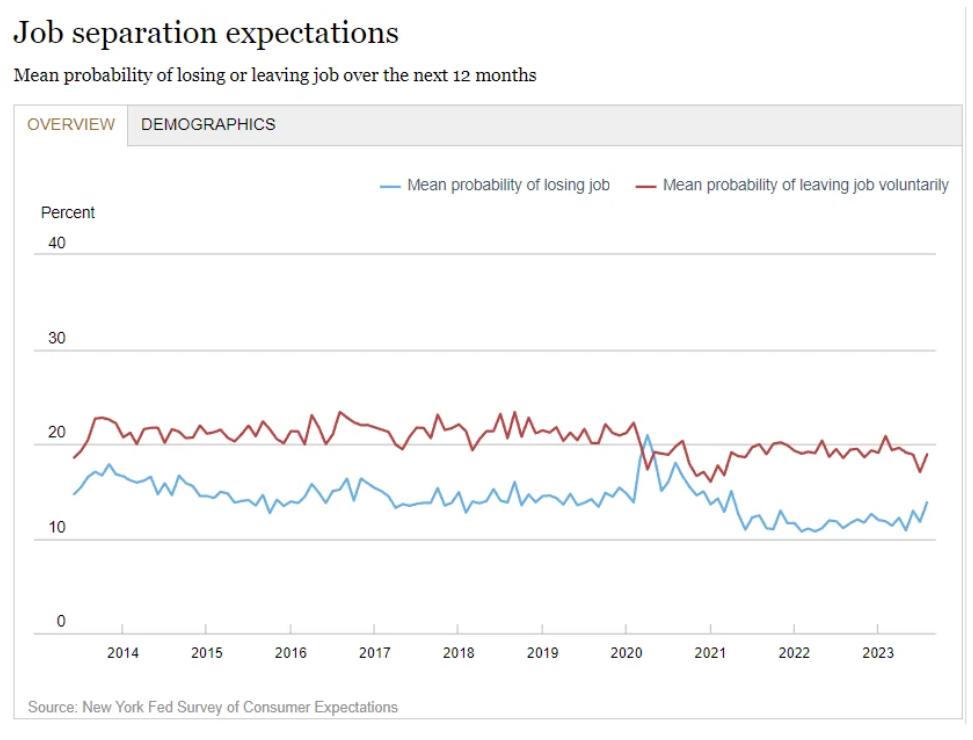

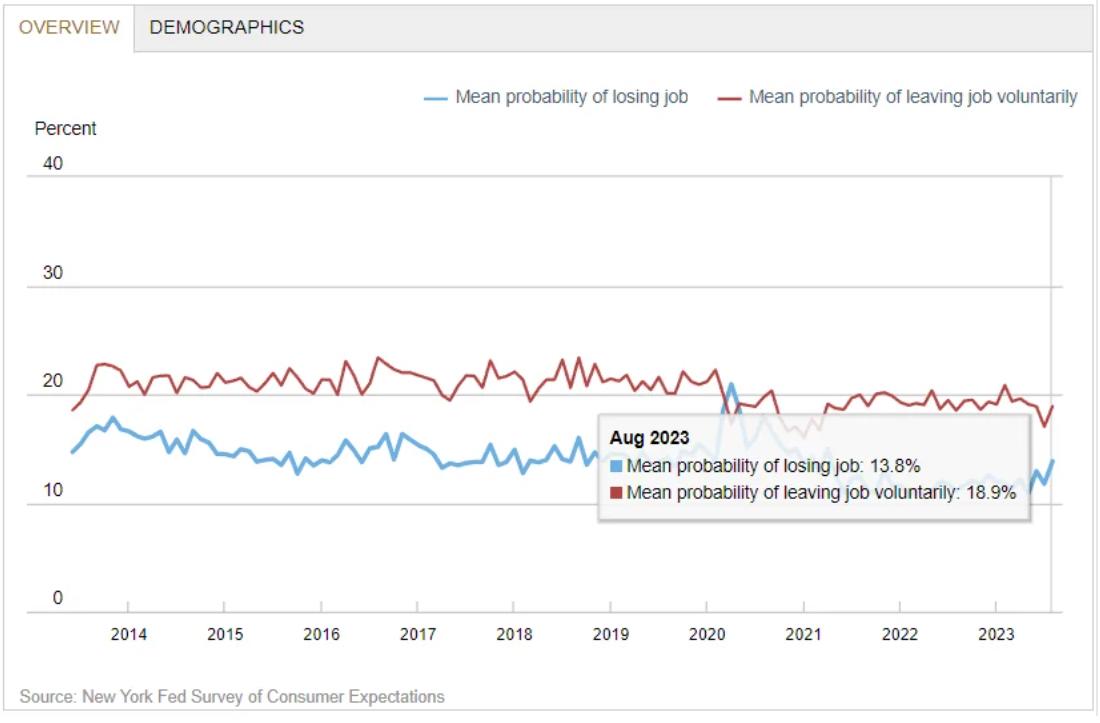

- The mean perceived probability of losing one’s job in the next 12 months rose by 2.0 percentage points to 13.8%, its highest reading since April 2021.

- The mean probability of leaving one’s job voluntarily in the next 12 months also increased by 1.9 percentage points to 18.9%. Both increases were most pronounced for respondents with a high school education or less and annual household income below $50k.

- The mean perceived probability of finding a job (if one’s current job was lost) decreased by 0.1 percentage point to 55.7%.

job loss expectations rose sharply to its highest level since April 2021

folks believe it is getting worse for everyone as well in the future.

Household:

- The median expected growth in household income fell by 0.3 percentage point to 2.9% in August, its lowest reading since July 2021. The decline was largest for respondents with a high-school education or less.

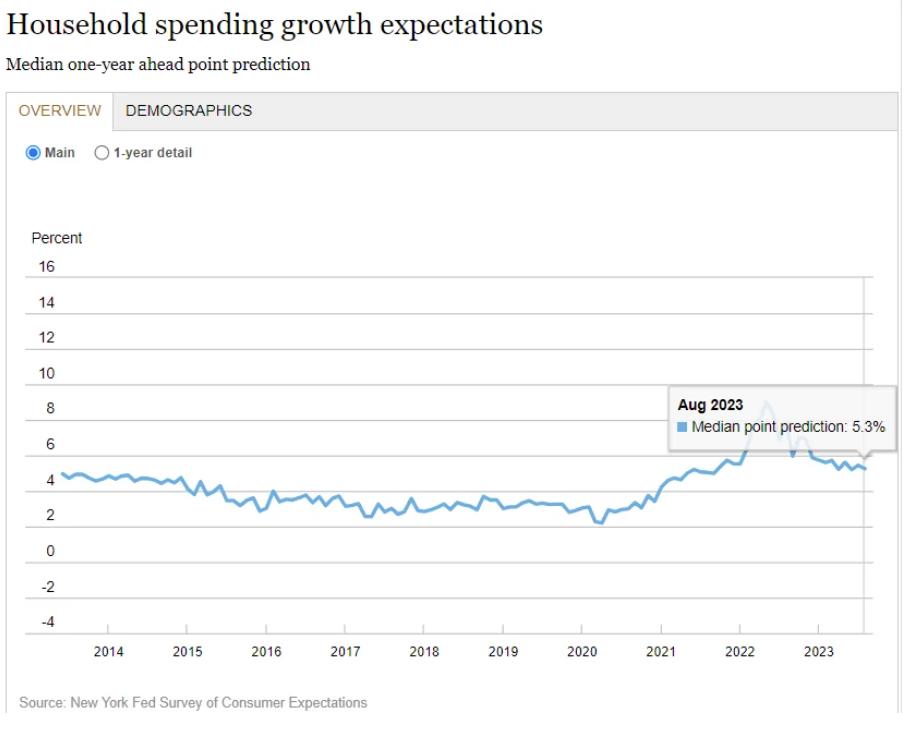

- Median household spending growth expectations fell by 0.1 percentage point to 5.3%.

- Perceptions of credit access compared to a year ago deteriorated in August, with the share of households reporting it is harder to obtain credit than one year ago hitting a new series high.

- Expectations for future credit availability also deteriorated in August, with the share of respondents expecting it will be harder to obtain credit in the year ahead increasing.

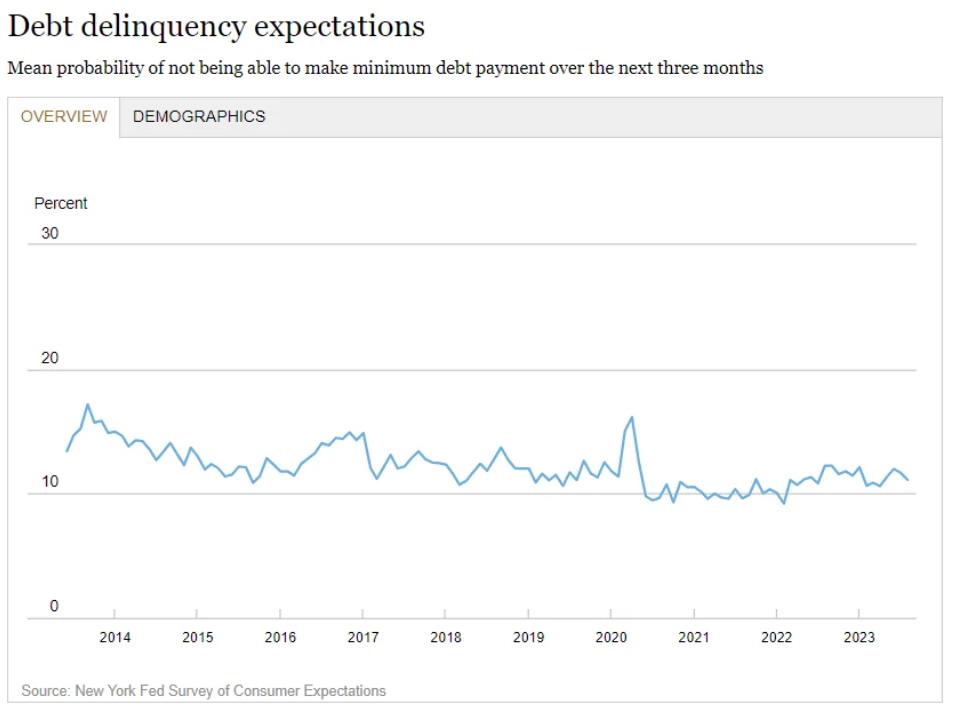

- The average perceived probability of missing a minimum debt payment over the next three months fell by 0.6 percentage point to 11.1%.

- Median year-ahead expected growth in government debt declined to 8.9%, its lowest reading since February 2020.

- The mean perceived probability that the average interest rate on saving accounts will be higher in 12 months decreased by 0.8 percentage point to 30.1%.

- Perceptions about households’ current financial situations compared to a year ago deteriorated slightly in August, with the share of households reporting a worse situation compared to a year ago rising.

- Similarly, year-ahead expectations about households’ financial situations deteriorated in August with the share of households expecting a worse financial situation in one year from now rising.

- The mean perceived probability that U.S. stock prices will be higher 12 months from now decreased by 1.9 percentage points to 35.2%.

households believe credit is going to become harder to access

11.1% of folks surveyed do not expect being able to make minimum debt payment over the next three months

expectations of being worse off a year from now also on the increase

Yikes, this spending is still DOUBLE what JPOW and the Fed want to see for inflation, consumers are still expecting to spend!

TLDRS:

Households right now:

- Income growth perceptions declined in August, and job loss expectations rose sharply to its highest level since April 2021.

- Perceptions about current credit conditions and expectations about future conditions both deteriorated.

- Households’ perceptions about their current financial situations and expectations for the future also deteriorated.

89 views