Will this lead to 2008 type of depression?

via NYP:

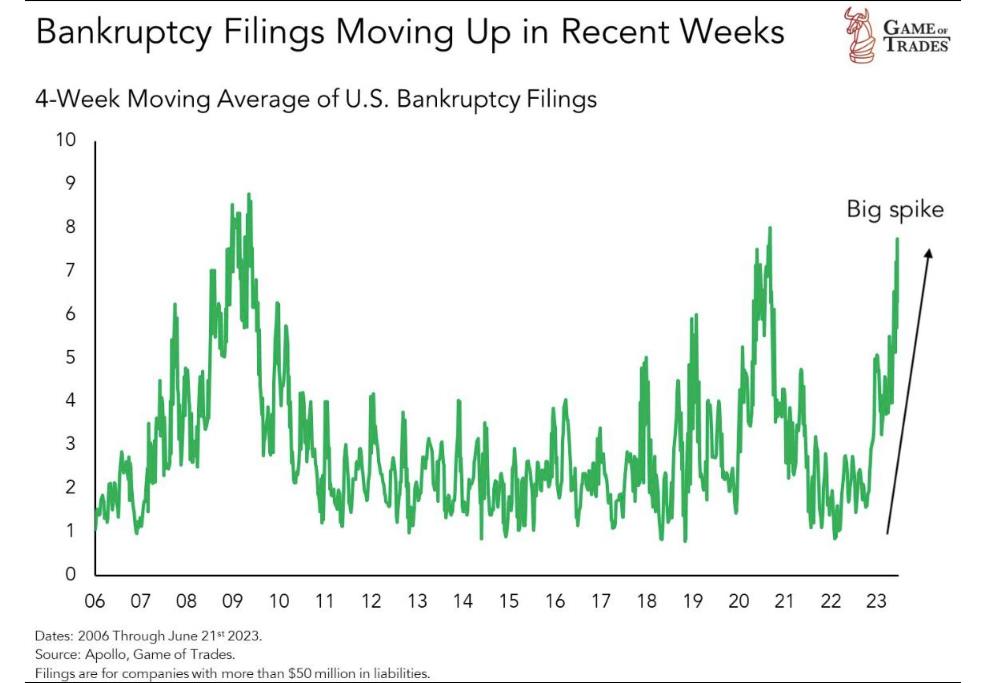

“Inflation-squeezed Americans are defaulting on their credit cards and auto loans at levels not seen since the financial crisis – and the struggle to pay their bills is poised to get worse as interest rates rise and the moratorium on student loans expires.

Low- and middle-income earners have been especially hit hard by soaring prices on everything from rent, groceries, and new and used cars despite the Federal Reserve’s attempts to tamp down stubbornly-high inflation.

This year, credit card delinquencies have hit 3.8%, while 3.6% have defaulted on their car loans, according to credit agency Equifax.

Both figures are the highest in more than 10 years.

“The increase in delinquencies and defaults is symptomatic of the tough decisions that these households are having to make right now — whether to pay their credit card bills, their rent or buy groceries,” Mark Zandi, chief economist at Moody’s Analytics, told the Washington Post.”

Wage growth has been strong and unemployment rates are low.

The US economy has added jobs for 31 consecutive months.

We have a historically strong labor market.

What happens when this is no longer the case?

Follow us @KobeissiLetter for real time analysis as this develops.

— The Kobeissi Letter (@KobeissiLetter) September 6, 2023