Source: www.fdic.gov/news/press-releases/2023/pr23071.html

Today, the Federal Deposit Insurance Corporation (FDIC) announced the start of a marketing process for the approximately $33 billion Commercial Real Estate (CRE) loan portfolio retained in receivership following the failure of Signature Bank, New York, New York.

The majority of the CRE loan portfolio being marketed is comprised of multifamily properties, primarily located in New York City. A large portion (approximately $15 billion) of the CRE loans secured by multifamily residences are rent stabilized or rent controlled. The FDIC has a statutory obligation, among other factors, to maximize the preservation of the availability and affordability of residential real property for low- and moderate-income individuals. To support this obligation, the FDIC will place the rent stabilized or rent controlled loans in one or more joint ventures (JV) with the FDIC retaining a majority equity interest in the JV. In addition, the JV operating agreement will provide certain requirements that facilitate the financial and physical preservation of these loans and underlying collateral.

While the FDIC will retain a majority equity interest in the JVs, the winning bidders, or partners, will act as the managing member of the joint venture and will be responsible for the management, servicing and ultimate disposition of the loans. The JV partner will be required to manage the portfolio in accordance with the JV operating agreement and be subject to stringent monitoring.

For this subset of the portfolio, the FDIC engaged with New York City and New York State housing authorities and government agencies, as well as community-based organizations, to obtain their input and provide information on the FDIC’s efforts as the FDIC developed its marketing and disposition strategy.

Marketing of the former Signature Bank’s CRE portfolio will take place over the next three months and the transactions are expected to be completed by year-end 2023. The FDIC has retained Newmark & Company Real Estate, Inc. (Newmark) as an advisor on this sale. During the marketing process, the FDIC and Newmark will conduct outreach to potential bidders on the qualification process. For general information about the FDIC’s asset sales program, visit the FDIC’s website.

This announcement is for information purposes only and does not constitute an offer to sell, or a solicitation of an offer to buy, any loans or securities or any interest therein.

Wut Mean?

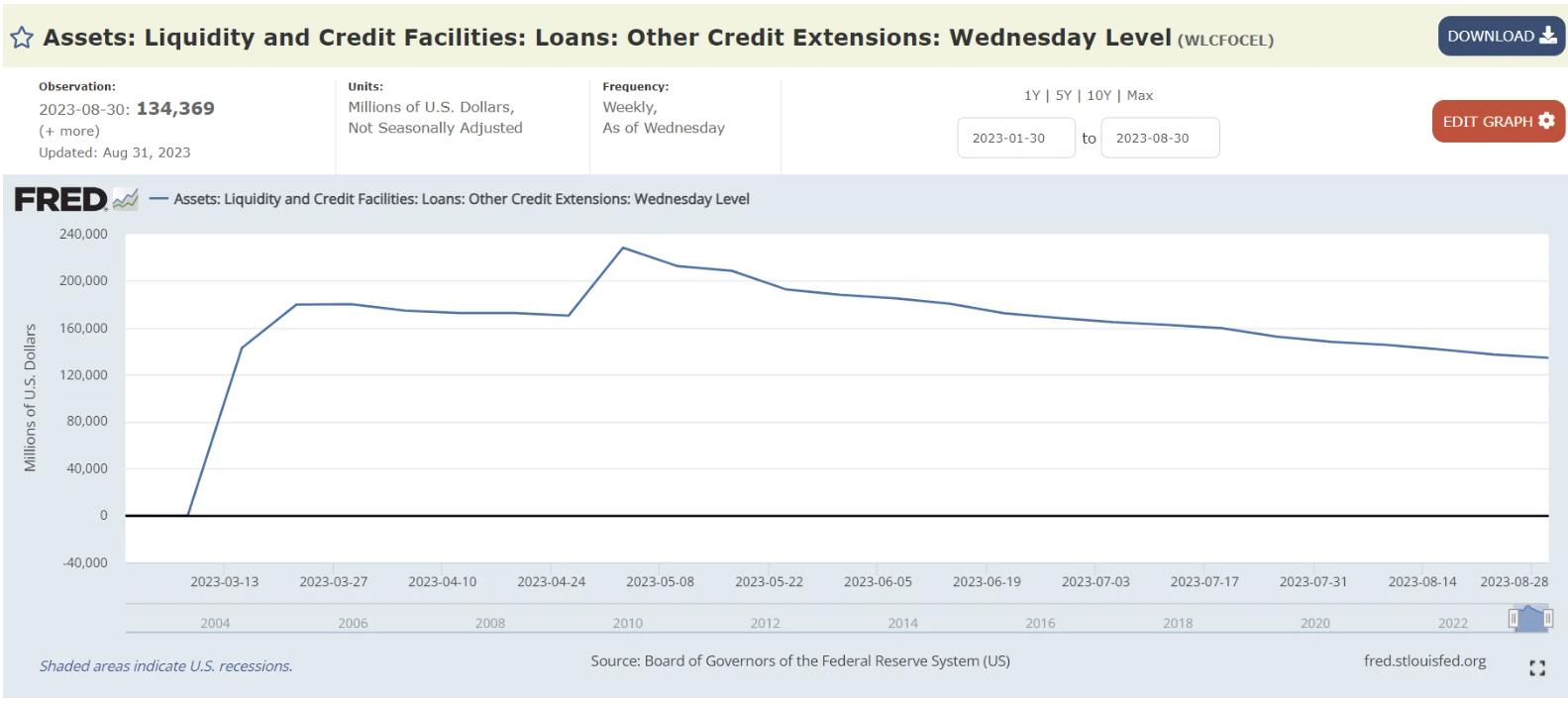

“Other credit extensions” should start to get smaller as the assets sold (I believe):

“Other credit extensions” includes loans that were extended to depository institutions established by the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve Banks’ loans to these depository institutions are secured by collateral and the FDIC provides repayment guarantees.

How I understand this works:

- The FDIC created temporary banks to support the operations of the ones they have taken over.

- The FDIC did not have the money to operate these banks.

- The Fed is providing that in the form of a loan via “Other credit extensions”.

- The FDIC is going to sell the taken over banks assets.

- Whatever the difference between the sale of the assets and the ultimate loan number is, will be the amount split up amongst all the remaining banks and applied as a special fee to make the Fed ‘whole’.

- It can be argued the consumer will ultimately end up paying for this as banks look to pass this cost on in some way.

There has been an update on this piece back in May:

Whatever the difference between the sale of the assets and the ultimate loan number is, will be the amount split up amongst all the remaining banks and applied as a special fee to make the Fed ‘whole’.

TLDRS:

- FDIC Announces Start of Marketing Process for $33 Billion Commercial Real Estate Loan Portfolio of Former Signature Bank, New York.

- Whatever the difference between the sale of the assets and the ultimate loan number is, will be the amount split up amongst all the remaining banks and applied as a special fee to make the Fed ‘whole’.

- It can be argued the consumer will ultimately end up paying for this as banks look to pass this cost on in some way.

Views: 25