Last week, I noted that the Bureau of Labor Statistics (BLS) and other government agencies have been engaging in a strange scheme.

That scheme?

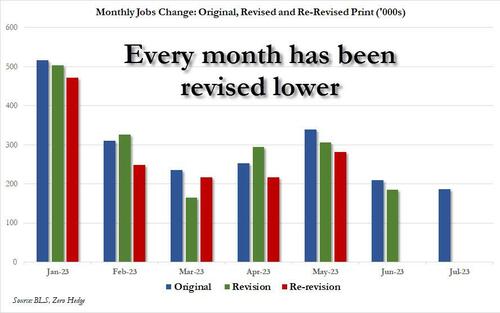

Releasing economic data that initially suggests the economy is booming, only for that same data to be revised downward multiple times in subsequent months.

Some people think the BLS is massaging the data the make Bidenomics look more successful that it really is. Others simply believe that the BLS is using faulty economic models (after all, how accurate is your model if it needs two or three revisions to be correct?).

Regardless of the reason, this issue continues to happen. And investors keep falling for it!

Case in point, last Friday, the BLS released the non farms payroll numbers for August 2023. And once again, you guessed it, the prior months (June and July) were revised lower. And not by a little: June’s NFP number was revised down by 80,000 jobs, while July’s was revised downward by 30,000 jobs.

Bear in mind, June’s initial NFP number of 209,000 had already been revised downward by 24,000 jobs in July. So with this second downward revision of 80,000 jobs, we now know that HALF of the jobs in the June NFP report were FAKE.

1st revision (24,000) + 2nd revision (80,000)=104,000 FAKE jobs.

104,000 Fake Jobs / 209,000 Jobs Claimed = 49.7% of the jobs were fake.

As I mentioned a moment ago, the August NFP report also revised July’s job numbers down by 30,000. So when we add this to the 104,000 fake jobs “created” in June, we’re now up to 134,000 FAKE jobs being created in the last two months.

As if that wasn’t bad enough, as Bill King noted in his King Report, seasonal adjustments were boosted to make August’s NFP numbers look better. In 2022, the BLS adjusted August’s NFP numbers upward by 47,000. But for some reason, this very same seasonal adjustment accounted for 117,000 jobs.

Put another way, we already know that 70,000 of the 187,000 jobs the BLS claims the economy generated in August were due to a seasonal adjustment, as opposed to being real jobs created in the economy.

Oh, and bear in mind, July’s numbers have only been revised down once thus far. They will likely be revised down again next month. And we can expect a similar thing to happen for August’s NFP numbers as well.

Indeed, as ZeroHedge recently pointed out, these downward revisions have occurred for every single month in 2023 thus far.

Why does all of this matter?

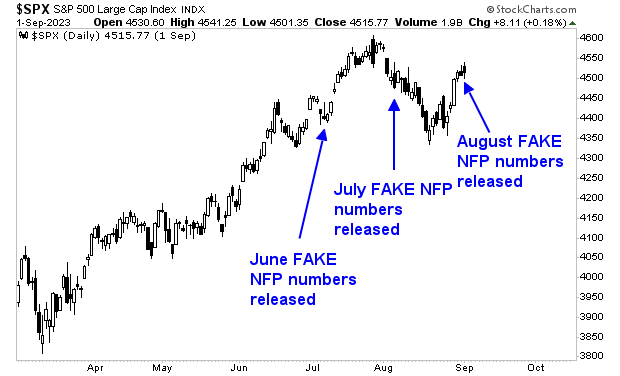

Because investors are pouring billions of dollars of capital into stocks based on those initial jobs numbers. Check out the below chart and you’ll see what I mean.

These folks are in for a RUDE awakening in the coming weeks. The signs are now clear that the economy is slowing. And this is happening at a time when investors are paying 19 times forward earnings for stocks!

The only time stocks were previously this richly valued was when A) the economy was expanding rapidly and B) the Fed was printing trillions of dollars in new month.

Today the economy is rolling over… and the Fed is DRAINING liquidity from the financial system. So again, investors are buying stocks based on a fantasy.