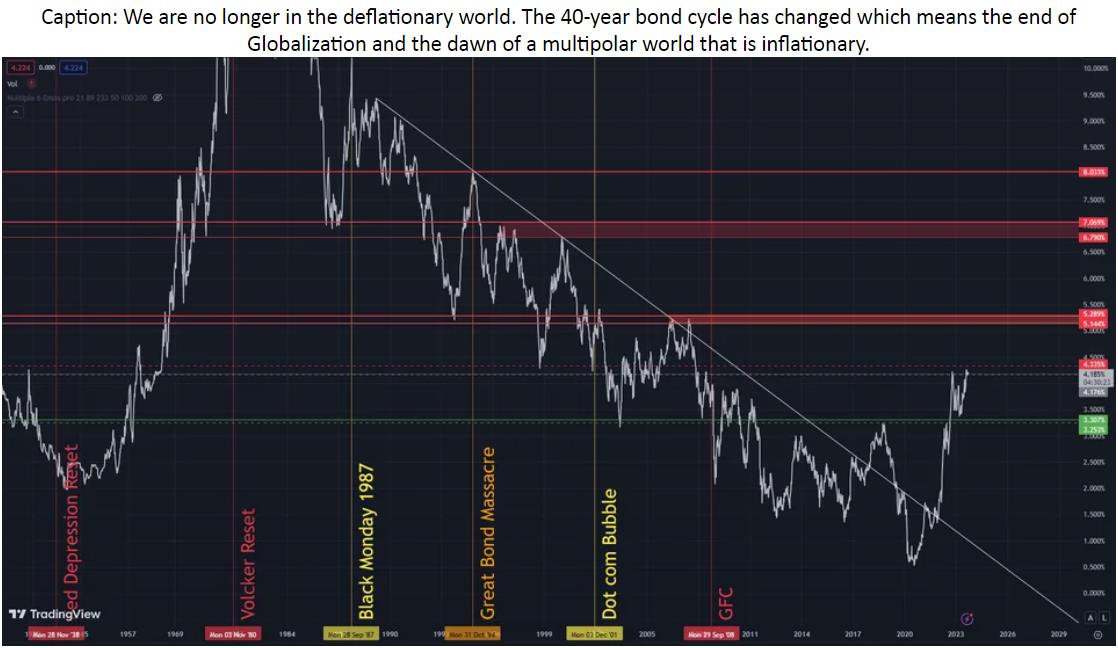

falling interest rates for 40 years (between 1980 and 2020) means that every year money got cheaper to borrow

when money gets cheaper to borrow, people and corporations borrow it and buy stuff with it, fueling bubbles in stocks and real estate

meanwhile, other sectors crucial to supporting human life like commodities get neglected because those aren’t sexy, high flying sectors with great PR and massive returns

so when the falling interest rate paradigm finally changes, as is shown in the technical analysis, it means a few things:

– money will get increasingly more expensive to borrow, and this will deflate the bubbles in real estate and stocks (unless the government artificially suppresses interest rates which will lead to epic amounts of inflation)

– money will rotate into sectors that are crucial for life like commodities as decades of mal-investment will lead to shortages