by BoatSurfer600

Source: sagar Singh LinkedIn

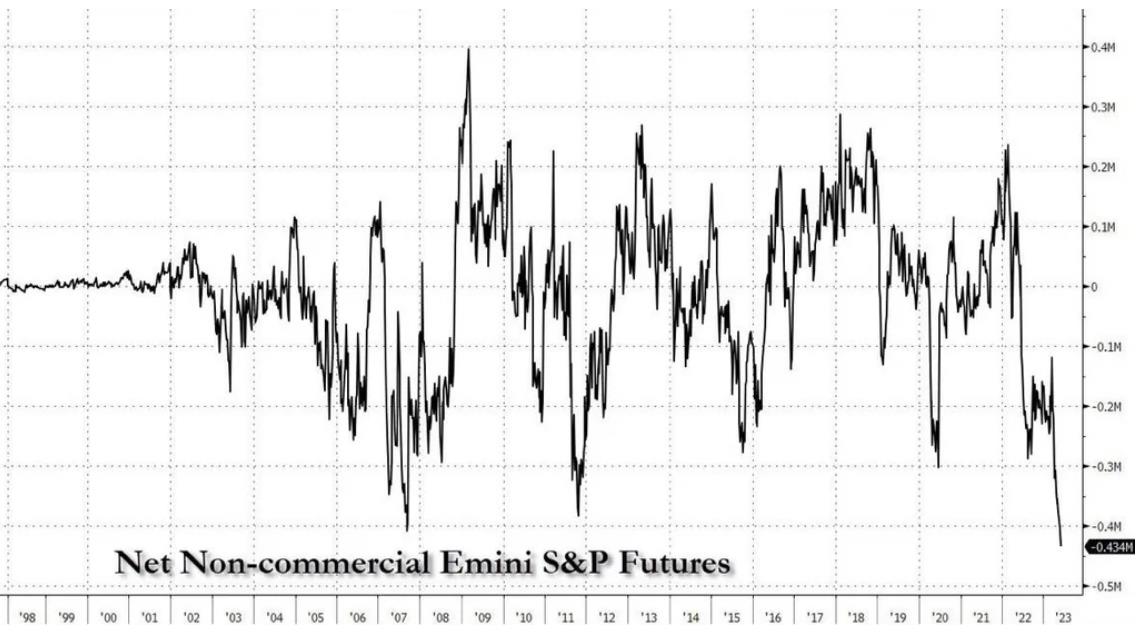

A new world record!

Bulls, your faith in policy-makers is totally unwarranted.

Short-covering in Regional banks has marked every turn in the market since the all time high. pic.twitter.com/HL7efgTOgN

— Mac10 (@SuburbanDrone) June 7, 2023

Lowest VIX since pre-pandemic.

Because what could go wrong. pic.twitter.com/163eH0nZrS

— Mac10 (@SuburbanDrone) June 6, 2023

There were ten "bull" markets in the 1930s ~one per year. None of them made a new high above 1929 nor anywhere close.

This is the first one. So, get used to bull shit.

Option skew highest since all time high. pic.twitter.com/ySFaG0ut8J

— Mac10 (@SuburbanDrone) June 6, 2023

An Economic Ticking Time Bomb Could Go Off In The Middle Of The 2024 Election.

They never saw it coming, because they’re mostly clowns with illusions of competence.

‘Commercial Real Estate Is Melting Down Fast’- Home Prices Will Be The Next To Crash

As a serial entrepreneur who co-founded Tesla Inc., revolutionized the electric car industry and is sending rockets into space, Elon Musk isn’t known for being a real estate guru. But lately, the billionaire has been sounding the alarm for the sector. “Commercial real estate is melting down fast,” Musk said in a recent tweet. “Home values next.”

Blackstone REIT Continues Trend Of Bad News For Real Estate Investors

Blackstone real estate investment trust (BREIT) is known as one of America’s largest and most dependable privately held REITs when it comes to delivering investor returns. However, 2023 has proven to be a difficult year for real estate investors, and Blackstone is not immune. As of May 1, 2023, Blackstone announced it is limiting investor withdrawals from its REIT, which is worth an estimated $70 billion. This move is not a new trend, as Blackstone has been limiting monthly investor withdrawals

JPMorgan: We Remain Cautious as a Looming Liquidity Contraction Is Added to Recession Concerns

Chart …broad liquidity in the US .. will contract by another $1.1tr from here .. the worst US broad liquidity contraction since .. after the Lehman crisis.”

Views: 265