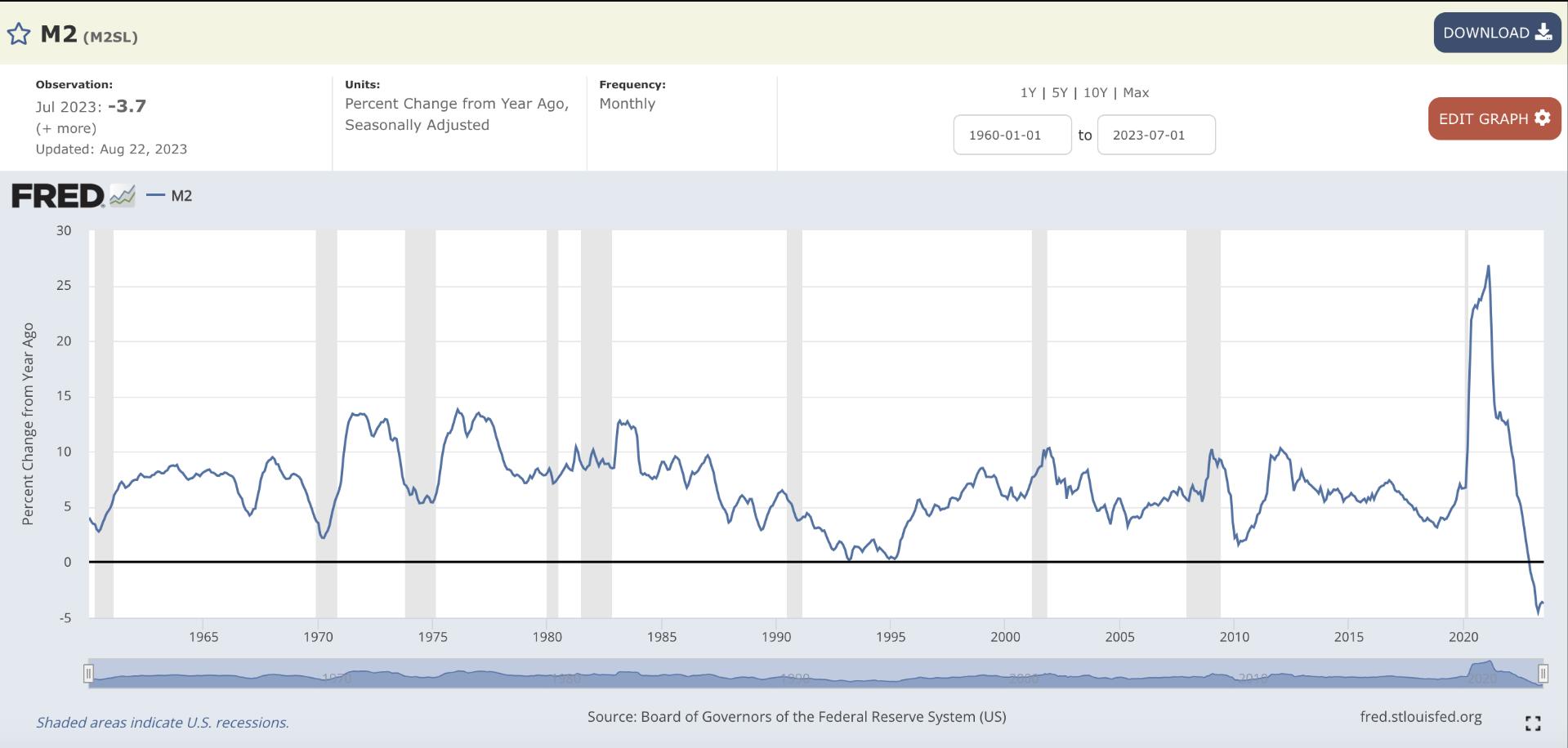

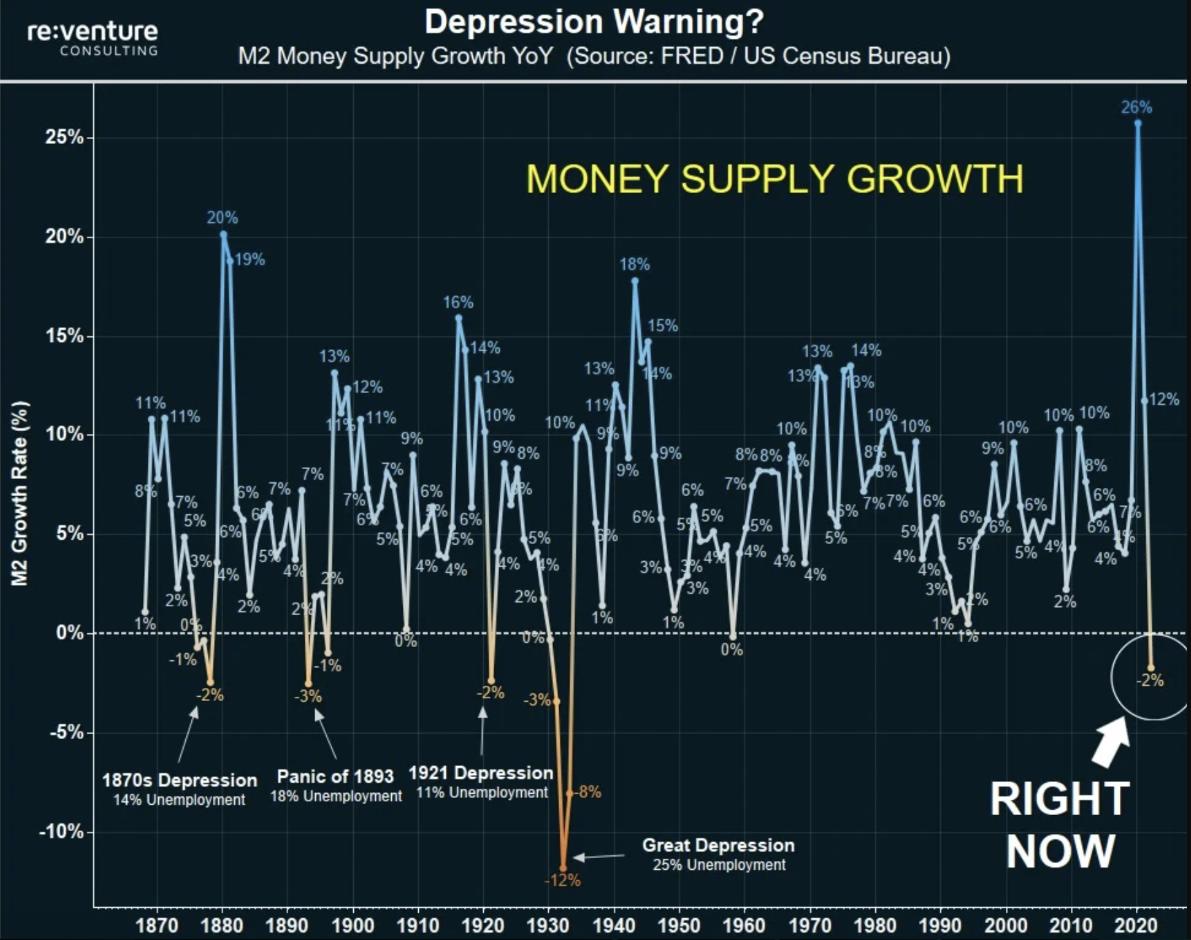

There won’t be a bull run, the money supply growth rate is negative right now

fred.stlouisfed.org/series/M2SL

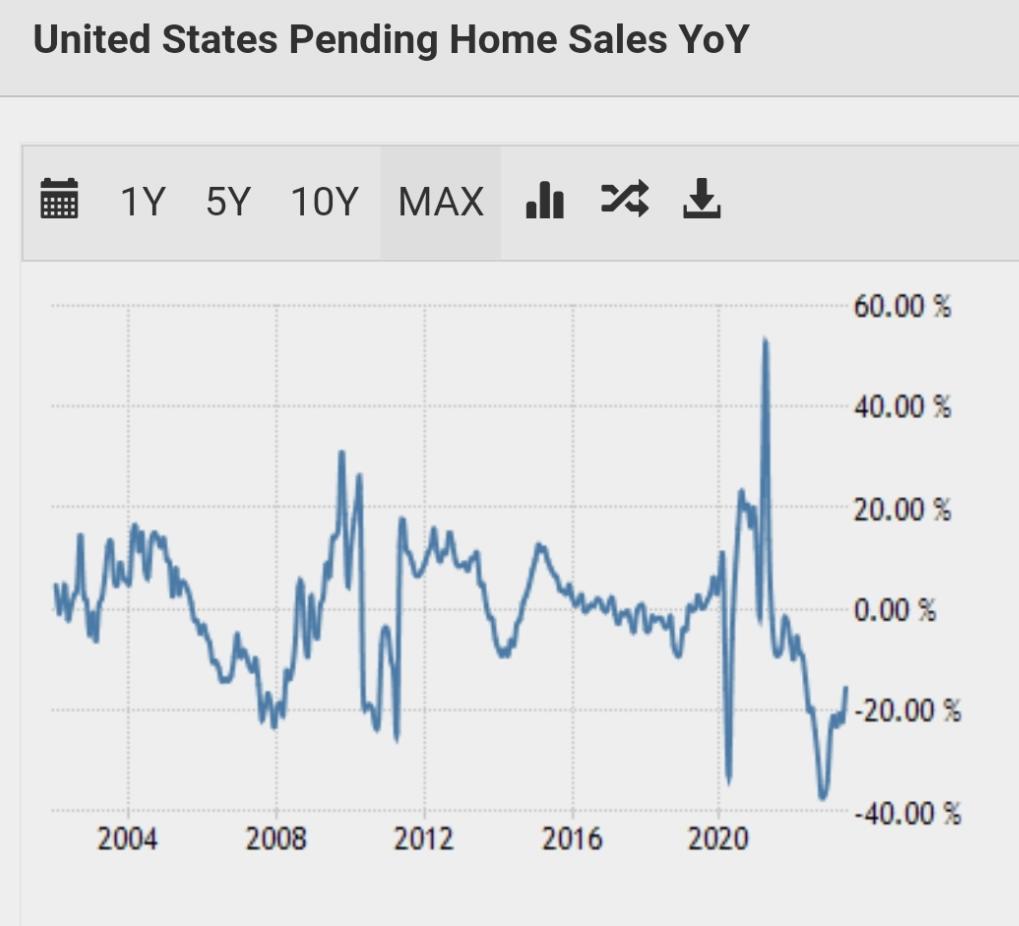

Where did that liquidity go to? Yes equities, real estate, bonds and consumer goods all around the world. What happens if the liquidity that got borrowed and is collaterized by bonds, real estate and equities gets less? Yes prices go down and some positions get liquidated. What does happen when those positions get liquidated? Yes, people and businesses lose capital they can’t use anymore to consume and invest, which of everything goes orderly leads to a recession or a small depression and if it goes too fast and unorderly and if unlucky deflation

h/t r9Ytugqq

Views: 241