by mark000

https://edition.cnn.com/markets/fear-and-greed

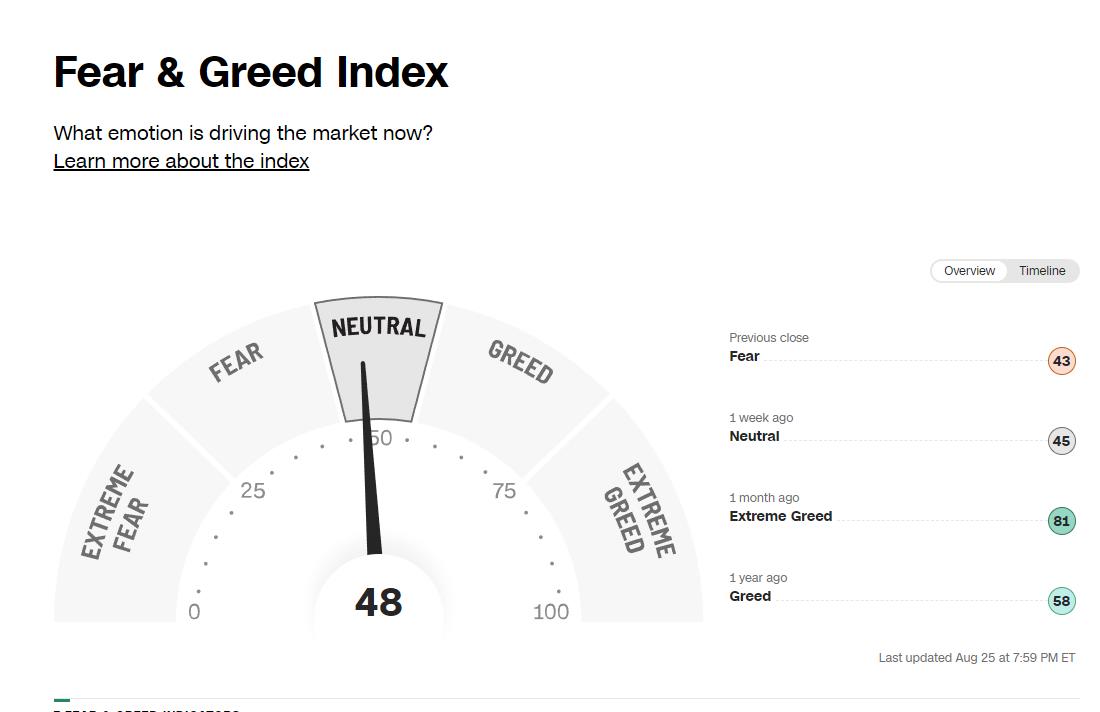

Has dropped from 83 five weeks ago to 44 today. Global: market crash + financial system crisis + economic depression approaching. Or worse……

Bulls, is this a good idea?

You can't always tell. pic.twitter.com/mPetdsVxxi

— Mac10 (@SuburbanDrone) August 25, 2023

He got away with it last time. pic.twitter.com/s4gHCrrUFw

— Mac10 (@SuburbanDrone) August 26, 2023

That's the week.

What we know is that very few people think this is a bad idea. pic.twitter.com/0BGKkj9ZVT

— Mac10 (@SuburbanDrone) August 25, 2023

Cost of Living Crisis Crushes Post-Covid Rebound – A Global Recession Looms

The global economy is teetering on the brink. The eurozone’s PMI is contracting for the third consecutive month, signalling deeper troubles ahead. Citi economists are raising alarms, stating the US may need to confront a severe recession to combat spiraling inflation. TS Lombard anticipates an imminent worldwide recession, with particular concerns about China and Europe, while the US seems on a collision course with an economic downturn due to escalating interest rates. Investment giants like Nomura forecast dire economic outcomes not just for the US and Japan, but also for major players like the UK and the eurozone. The sudden spike in interest rates worldwide threatens to destabilize an economy that has grown reliant on lower rates.

Navigating The Growing ‘Liquidity Hole’: Felder

The stock market experienced a surge in the first half of the year, driven in part by significant investments from foreign investors. As the saying goes, “foreigners are often the last to buy.” Additionally, the hype around artificial intelligence boosted the market, but what if its promise doesn’t deliver? A brief relief from an emerging “liquidity hole” further bolstered stocks, but this seems to be short-lived. Escalating long-term interest rates, due to increasing treasury demands, might destabilize asset prices. This situation could also corner the Fed. Eventually, investors might turn to a time-tested refuge amid financial chaos and rising inflation: gold.

A Boom That Awaits an Inevitable Bust With Bidenomics

Joe Biden claimed “Bidenomics” boosted real wages for low-income earners. However, after adjusting for inflation, wages seem to have declined. Following significant monetary growth in 2020–21 due to Fed policies, unexpected inflation emerged, contradicting the Fed’s “transitory” predictions. Ludwig von Mises’ concept of “forced saving” suggests inflation might compel lower earners to curtail consumption as prices rise faster than wages. Current data, however, shows wages lagging behind inflation, making Biden’s assertion questionable. In essence, the data, combined with Fed actions, challenges the notion that “Bidenomics” has benefited lower earners.

With $1.2 Trillion of Debt – Landlords Face Rising Default Risks

Offices present a significant financial challenge, contributing to over half of the $626 billion of vulnerable debt due by 2025. Since the Federal Reserve began increasing interest rates in March 2022, office values have plummeted by 31%. The decreasing property values and escalating refinancing costs due to higher interest rates are raising alarms about potential defaults. Prominent investors, including Blackstone Inc., Brookfield Corp., and Goldman Sachs Group Inc., have already defaulted or surrendered offices. Banks hold the majority of this at-risk debt, with $303 billion of these precarious loans set to mature by 2025.

165 views