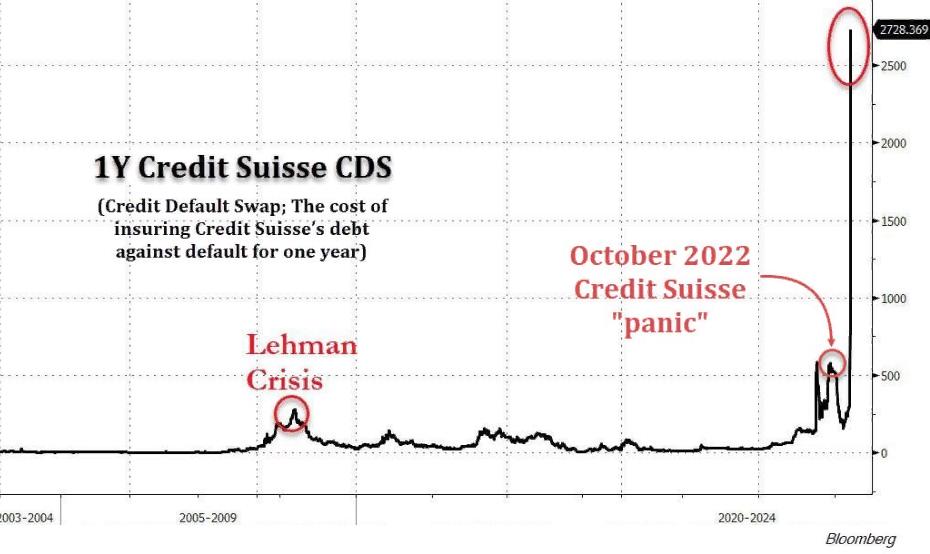

The panic from October about Credit Suisse’s default risk (via CDS, or the cost of insuring debt against default) is a blip compared to now.

The Fed’s multibillion dollar swap lines could only buy them time.

Should the markets’ worst fears on Credit Suisse come true (based on where CDS is trading, this means a bank failure), the Eurozone economy will fall off a cliff, upend the global financial system and bring global policy tightening by major central banks to a screaming halt.

Unlike Silicon Valley Bank and Signature Bank, the Swiss lender is classified as systemically important by the US Financial Stability Board (www.fsb.org/wp-content/uploads/P211122.pdf) — meaning it’s too big to fail as its collapse has the potential to trigger a financial crisis.

The straw that broke the bank stock’s ($CS) back were comments from Saudi National Bank — Credit Suisse’s top shareholder — that it had no intention of investing more into the Swiss lender, which is in the midst of a complex three-year restructuring in a bid to return to profitability (the restructuring which was brainstormed in October.

In the US, the Fed, Treasury and other regulators created a bank term-funding program (BTFP (www.federalreserve.gov/newsevents/pressreleases/monetary20230312a.htm)) that essentially allowed US banks — presumably those that may be in a predicament similar to SVB) amid the increase in interest rates dissolving the values of their Treasury holdings — to borrow against bonds (that lost value) at 100 cents on the dollar.

That quick backstop helped assuage some of the worst fears of depositors and investors.

It’s not exactly clear how Europe will deal with a larger and far more substantial bank crisis in its own domain.

Or whether they can.

What is at stake here, however, is an entity that has a far greater domino effect in its ability to damage sentiment than Silicon Valley Bank and Signature Bank combined.

Yesterday, Wall Street was talking about three things: Treasury market illiquidity, the solvency of certain G-SIB banks and the effect each of these will have on next Wednesday’s FOMC (www.federalreserve.gov/monetarypolicy/fomccalendars.htm) (interest rate decision).

Fed swaps and the CME FedWatch tool (www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html) each show a 50/50 chance of a 25bp rate hike next week.

Not a single New York bank is calling for a hike (Nomura is even predicting a CUT and halt to QT).

Another 25bps tacked onto the rate will do nothing more to tame inflation currently at (the adjusted 6% YoY), but it will do everything to pour gasoline on the Credit Suisse dumpster fire in a banking sector train wreck.

The Fed will pause here at 4.5% (but, to save face, will call it temporary).

Treasury dysfunction (which we’re already seeing the first signs of) will pick up in pace and culminate in a flash credit event or overnight liquidity crisis, much like the repo crisis in 2019, in or by this summer.

That is my prediction.

The new Fed put — under US Treasury bonds — is about to be born: the “baby” was already conceived in a CGFS report from the BIS last May, titled, “Market Dysfunction and Central Bank Tools (www.bis.org/publ/mc_insights.pdf).”

The BIS says that if government bond markets become dysfunctional, central banks should provide the final backstop.

It’s not a question of “if” the Fed will come back to intervene, but “when.”

Perhaps a better way to phrase this is, “under what conditions.”

As much as the Fed would prefer things to be different (so they say) the fact of the matter is that tightening cycles always end in trouble for money markets like repo (www.nationandstate.com/2019/09/17/todays-watershed-repo-calypse-is-one-of-the-worst-things-that-can-happen/) or FX swaps and/or the supremely-important Treasury market.

Today, the pace of tightening far exceeds any other time in history.

Here’s an interesting video predicting an imminent recession in the United States due to recent high interest rates creating conditions for massive layoffs in the construction sector, which is a key indicator for recession historically.

Views: 142